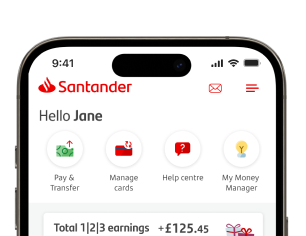

Banking on the go just got good

With our mobile app, you can bank on the go with confidence. It's a simple, quick, and secure way to do your banking from anywhere, at any time.

Ready to get started?

Register for Digital Banking

You're going to need 1 of the following.

- Debit or credit card number

- Banking or savings account sort code and account number

- Mortgage account number

Download our app

Start using the app

Enter your log on details, and start

making the most of our app today

Handy features at your fingertips

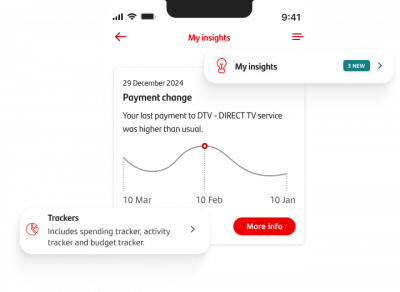

Your card, your way

Get a 360 view of your credit card in our app. See what you owe, track pending payments and be the first to hear about new cards.

Think it's lost or stolen? No need to panic, freeze or block your card in just 3 taps.

The smart features don't end there...

- Chat – 24/7 help, because life isn’t 9-5.

- My Home Manager – find out how to run your home for less and give it the TLC it needs.

- Santander Boosts – cashback, offers and prize draws from your favourite brands.

- Open Banking – a streamlined view of your balances in one place.

Want to know more?

We have a host of online guides to help answer your burning questions.

A helping hand when you need it

- Financial support if you're struggling.

- Take our quiz to get a check up on your financial health

- Get a clearer view of where your money's going with our budget calculator

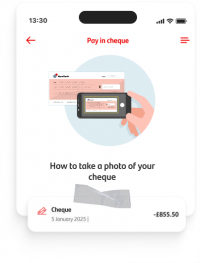

Money admin sorted, minus the paperwork

- Save yourself a branch trip and pay in cheques using your phone.

- View and cancel Direct Debits in just a few clicks.

- View and download your statements.