You can now view a selection of external financial accounts in one place in our mobile banking app.

By linking your accounts in Mobile Banking, you can easily manage your money with us and other providers. You can choose which accounts you want to link, and you can unlink them at any time.

What is Open Banking?

Open Banking allows you to link certain accounts from multiple financial organisations and see them all in one place so you can manage your money more easily.

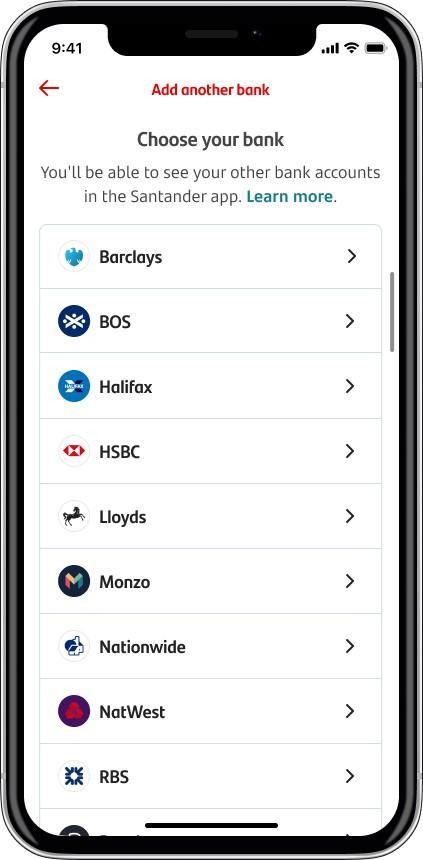

With Open Banking, you can share your data with authorised third-party providers to link accounts you hold with other financial organisations (so long as you give them your permission). An example of an authorised third-party provider could be another bank, building society, or regulated financial institution, such as Barclays, Lloyds, or HSBC that is registered on the Open Banking Directory. You can link your:

- current accounts

- savings accounts

- and credit cards.

You can also share your data with authorised third-party providers offering budgeting apps.

This means you can manage your money more easily as you can access all your accounts in one place.

For more information, you can:

- take a look at our FAQs below

- visit our page on Open Banking Third Party Providers

- or visit the independent Open Banking website

How do I get started?

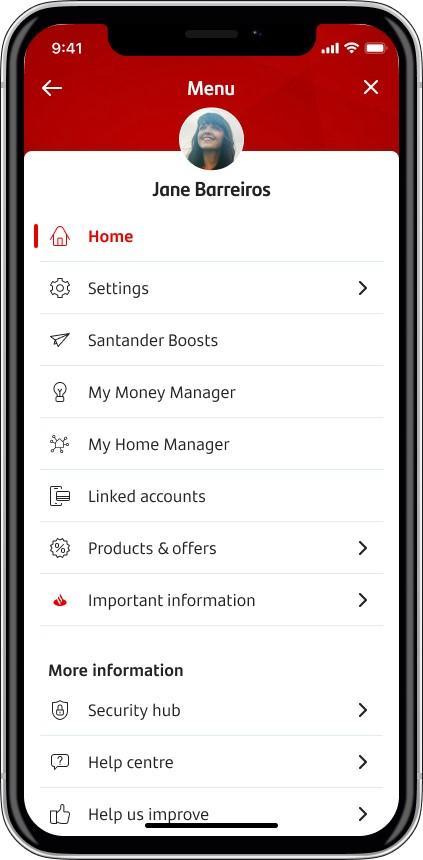

You can link your accounts in our mobile banking app. Simply log onto your account and tap ‘More’.

1.

After tapping 'Menu' in the top-right corner, click 'Linked accounts'

2.

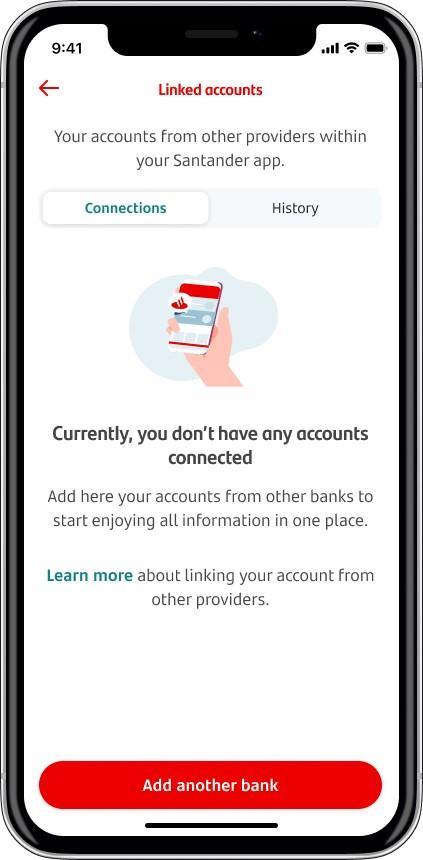

Choose ‘Add another bank’

3.

Tap the provider of the account(s) you want to link

If you see that a provider is greyed out, this means that you're temporarily unable to link your account to that provider. However, you should be able to try again soon.

Once you've chosen the account you want to link, you'll be asked:

- to read some important information about linking your accounts

- and to confirm your consent.

Consent can be removed at any time, but if you continue to use the linked account, you'll need to renew your consent for it every 90 days.

You’ll then be redirected to the other provider’s online banking service or app. You'll be asked to log on to your chosen provider's account, where you'll be able to see the account(s) you hold with them. Once you've chosen the one you want to link, you'll be taken back to the Santander app. Next, you’ll see a message letting you know your account has been successfully linked. Your account will now be available to view.

You can now view your account details, balances and historic transactions all in one place in Mobile Banking app.

Do I need to bank online to use Open Banking?

Yes, Open Banking is only available through digital banking. Our customers can access Open Banking by logging on to Mobile Banking

Is Open Banking safe to use?

Yes, Open Banking is designed to be very secure. This is thanks to the strict rules around how it works and how your data is kept safe with rigorously tested software and security systems. You’re also protected by data protection laws and the Financial Ombudsman Service.

Any apps and websites that want to take part are registered on the Open Banking Directory. They're also regulated by the Financial Conduct Authority (FCA) or European equivalent.

Your information will only be shared if you give permission to an authorised provider. You'll also never be asked to share your password or log on details with anyone other than your own bank or building society.

How do I check if a provider is authorised?

You can check they are listed on the Open Banking Directory and make sure they are registered on the FCA Register

What if I don’t want to use Open Banking?

It’s up to you whether you want to use Open Banking or not. There’s no legal requirement for you to use it, and it can only be switched on with your permission. If you do use it but later change your mind, you can switch it off at any time.

My consent expired, how do I renew it?

Consent will automatically expire after 90 days. By looking at your linked account(s) in the app, you can see if the consent is active or expired and when your consent for this link expires.

For step-by-step instructions on how to renew or remove your consent in the mobile banking app, take a look at our mobile demo

I’m having trouble linking my accounts

If you were unable to successfully link your accounts the first time, try again. It may take more than one attempt to go through successfully if there’s a technical error. You’ll know you’ve successfully linked your accounts when you receive a message to say that your accounts have been linked and you can see them in the ‘Linked accounts’ menu. If you’re still having problems, please contact us