Investing can be a good way to grow your money, but where do you begin? With so many ways to invest, it can seem far from simple to get started.

That’s why we keep it simple with a range of ready-made investments.

The benefits to ready-made investments

- Simplicity: Ready-made investments have different risk and reward levels to help you choose what's right for you.

- Managed for you: Experts create and manage these funds, so you don’t have to.

- Low cost: Our low fees help you grow your money.

- Start from £20: invest regularly from £20 per month or from a £100 lump sum, or do a bit of both.

Want to start investing, but not sure where to begin?

Our ready-made funds give you 4 options, whether you want steady growth or higher potential.

No guess work, no endless research and simple fees.

Just pick your risk level and let the experts handle the rest.

Once you have made your choice, you’re automatically invested in a mix of stocks, bonds and funds combined to deliver long term growth.

Fund box 1 - Low and slow, prefer to play it safe? This option prioritises stability over potentially higher returns.

Fund box 2 - Step up, a mix of bonds and shares, lower to medium risk with room to grow.

Fund box 3 - Moving on up, aiming for greater growth while managing the ups and downs.

Fund box 4 - Aiming higher, all about growth, a greater weight on shares, ideal if you can handle the ups and downs of market movements.

Think of them as a pre-packaged investment, expertly built, balanced and ready to perform.

Start small – even £20 a month can grow over time.

Check in anytime in online banking or through our app.

Pick a ready-made fund box, and off you go!

As with all investments your capital is at risk, and you may get back less than you invest. Investments should be held for the medium to long term, 5 years plus.

What are ready-made investments?

They are off the shelf selections of funds, managed by experts, making investing simple and hassle free. The easy choice if you don’t have a lot of time or are new to investing. Instead of choosing individual stocks or bonds yourself, you can pick the ready-made box you are most comfortable with.

Or you can pick and mix from hundreds of individual funds to make your own box.

As with all investments your capital is at risk and you may get back less than you invest. Investments should be held for the medium to long term (5+ years), unless there is a fixed term that applies.

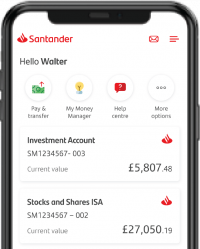

Stay on top of your investment with our app

If you already have the app, hit menu, product and offers, and then investments to get started.

Whether you want to check your investments online or through the app we have you covered.

- Watch how your money performs with your mobile, tablet, or laptop

- Make changes easily online or through the app

New to Santander? Download our app from the iOS App Store or the Google Play Store.

No, these boxes are designed and managed by the experts to keep you on track with the risk style.

Our team at Santander Asset Management. They have a wealth of investment experience, presence across multiple markets and billions invested. They are experts in what they do.

We charge an annual platform fee to provide a secure place to invest, transact, and manage your investments. Each fund manager also charges a fee for running the fund.