Learn about how you spend your money with My Money Manager.

This tool:

- gives information about where your money goes

- shares personalised insights based on your spending habits.

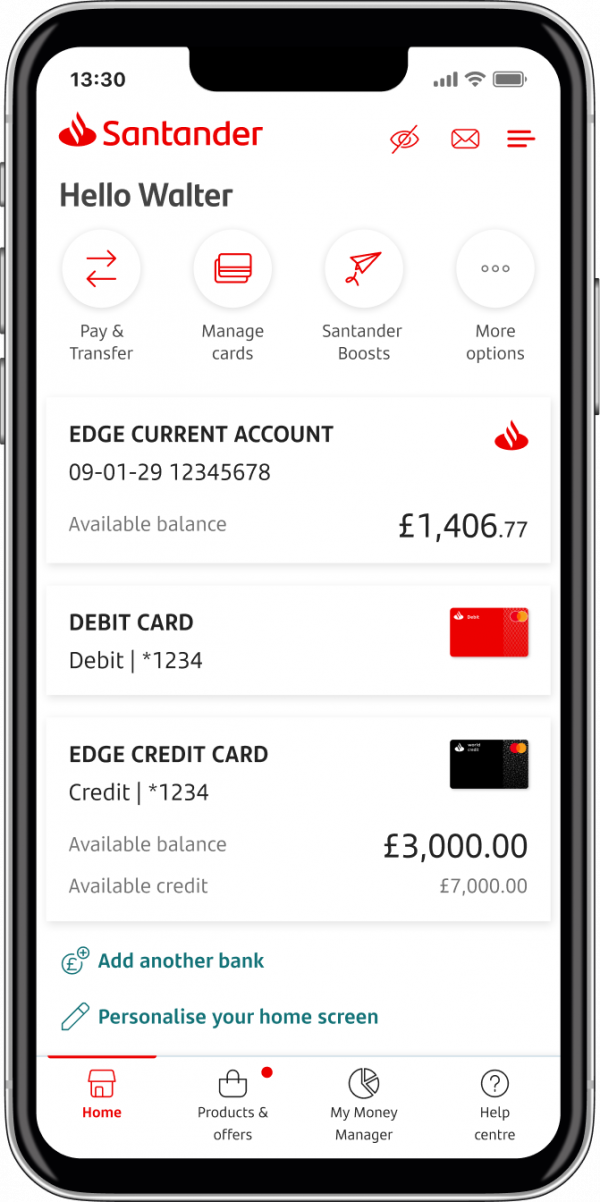

You’ll need the Santander Mobile Banking App. Log on and find My Money Manager by tapping the light bulb icon in the Mobile Banking app.

How do I get My Money Manager?

1.

Tap on the menu icon, and look for the lightbulb icon in the menu

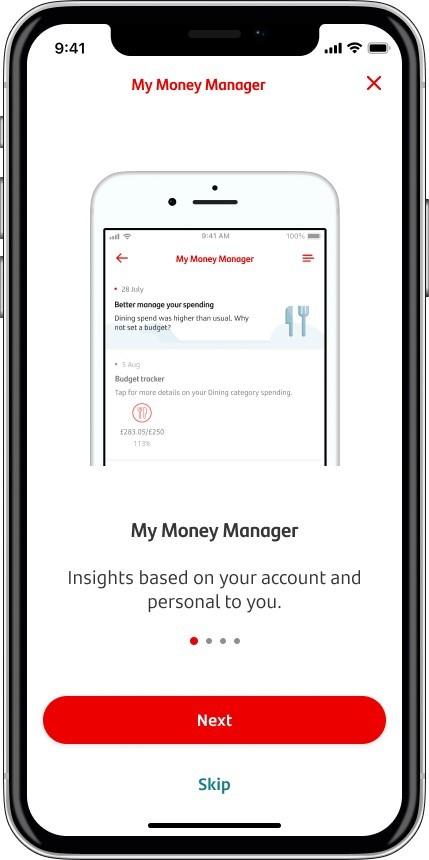

2.

You’ll be given a short intro

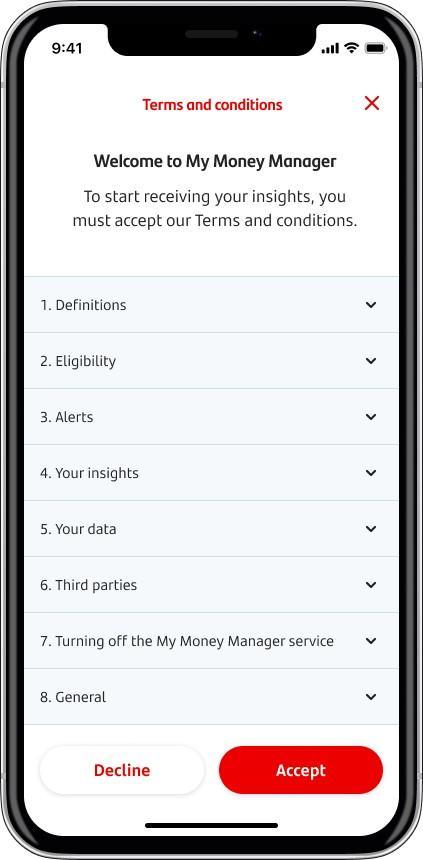

3.

Read and accept the T&Cs and you're in

If you need more detailed step-by-step instructions on how to use My Money Manager, take a look at our mobile demo

Smart Budgets

You can set smart budgets for different categories that you spend in. Track your budget for dining, travel, utilities, and food shopping.

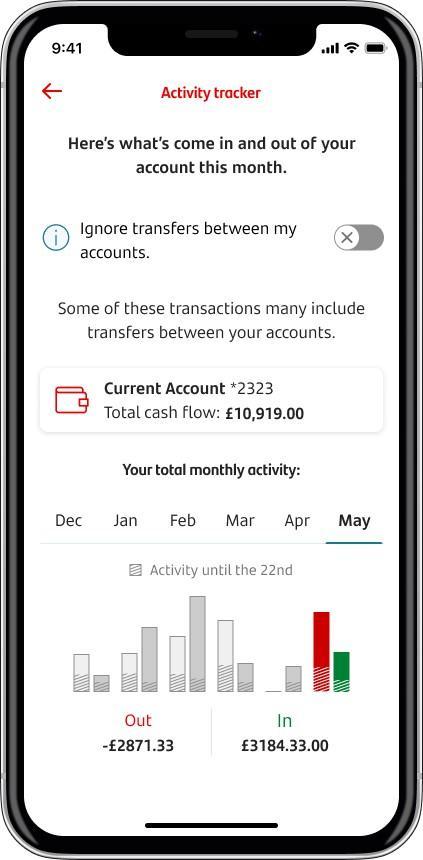

Check your monthly spend

You can track your monthly income and outgoings to keep track of your cashflow.

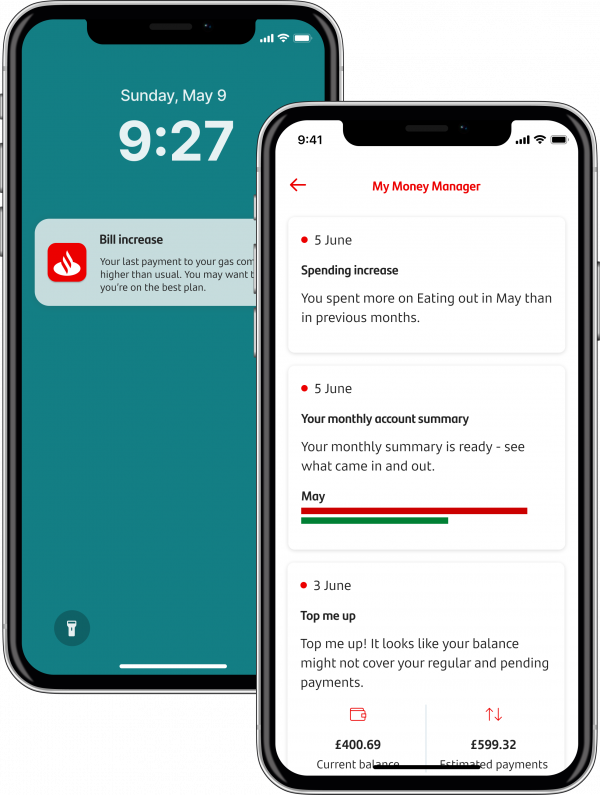

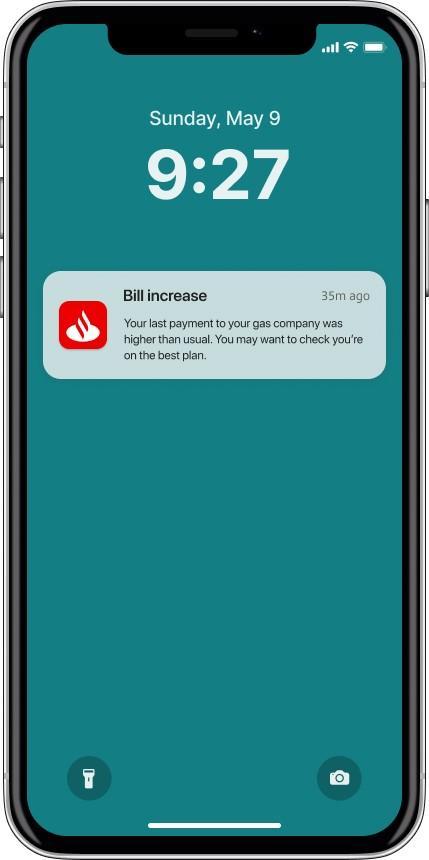

Know where you're at with your bills

We'll let you know if your bills are higher than normal, or if you spent more on shopping than usual.

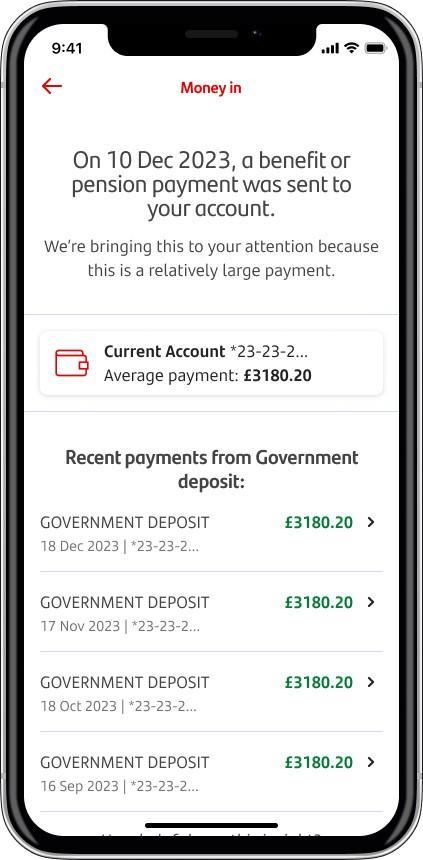

See when money comes in

Track when your salary, benefits or pension arrive in your account. We'll also let you know when a refund is in your account.

You can download our app on your smartphone or device from the iOS App Store or the Google Play Store. Just click on one of the logos below to get started. We don’t ever recommend downloading apps from other third-party sites.

If you haven’t signed up for Online and Mobile Banking yet, you can get started today.

Can’t log on to your account? Visit our trouble logging on page for help and tips.

Your information is protected

As My Money Manager sits in your Mobile Banking app it’s just as secure.

If you need help

Use Sandi by clicking ‘Chat with Sandi’ on any of our web pages.

The app uses data from Santander accounts to provide insights based on how you spend. Therefore, these insights are personal to you, and you might not get all these insights shown above. You can rate insights to show whether you like them, and we’ll send you more of what you like. We send your insights as messages from Mobile Banking, then you can go into your My Money Manager inbox to see more.

- Anyone who has a current account, credit card account or savings account

- Those who are signed up to Online and Mobile Banking and has the most up-to-date version of the mobile app installed.

- You must be aged 16 or over.