Stay in control of your card repayments to avoid paying interest charges.

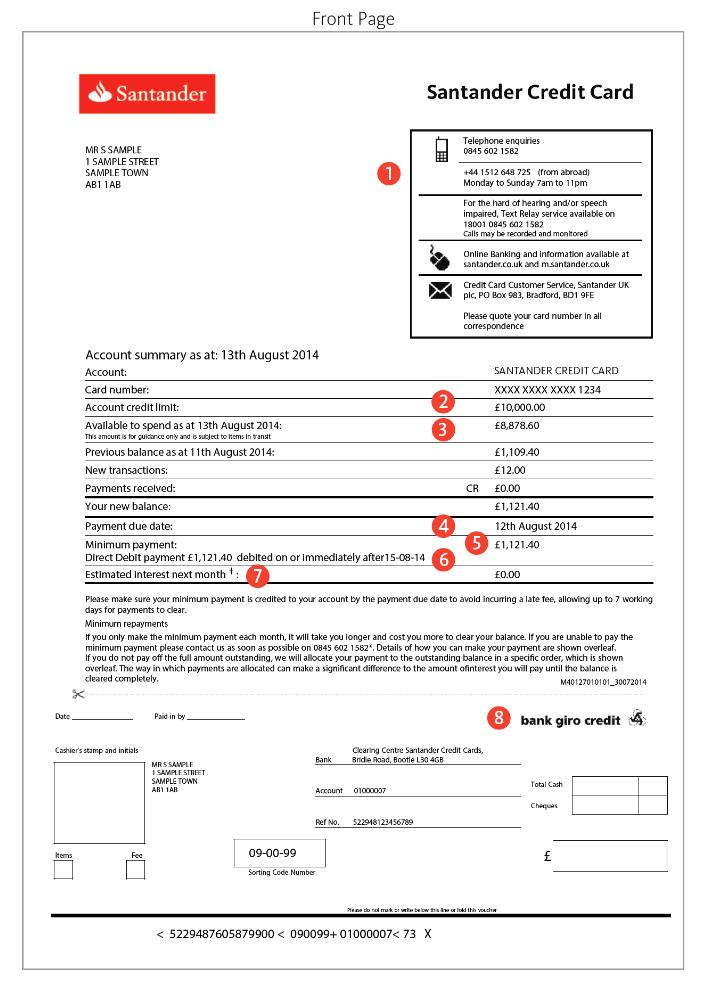

Each month, we'll give you a statement showing the minimum payment you'll need to pay for that month. It will cost you more if you only make your minimum payments. It will cost you less if you pay off the full balance quickly. You can use our credit card repayment calculator to see how increasing your monthly payments will help.

You can pay automatically by setting up a Direct Debt but remember you can also make payments to your credit card account at anytime. Find out more below.

Making extra one-off payments when you have the money can help you clear your credit card debt more quickly. The easiest way to do it is by using Online or Mobile Banking, where you can pay from your Santander current account. If you don’t have a Santander current account, you can set up a bill payment from any other UK bank.

You’ll need these details:

Sort code: 09-00-99

Account number: 01000007

Reference: your 16 digit Santander credit card number (essential to make sure payment reaches your account)

To get the maximum impact from a one-off payment, we recommend you make it up to 5 working days before the Direct Debit is taken (you’ll find your Direct Debit claim date on the ‘Account Summary’ page of your statement). This way, the one-off payment will be taken as well as your Direct Debit.

Alternatively, if you make the one-off payment outside the above timings the amount will reduce down your Direct Debit amount and won’t be on top of your usual payment.

Mobile Banking

An easy way for you to make payments to your Santander credit card is with Mobile Banking.

You can make payments to your Santander credit card from your non-Santander account.

This is called ‘Pay with another bank’.

For step-by-step instructions on how to make payments to your credit card within Mobile Banking, take a look at our mobile guide

Contact us

Still having trouble? Contact us

Online from a current account:

You can pay your Santander credit card using your current account by setting up a ‘new payment’ in Online Banking

You’ll need the following details:

- Sort code: 09-00-99

- Account number: 01000007

Reference: your 16-digit Santander credit card number (essential to make sure payment reaches your account).

Online using your debit card:

As an Online Banking customer, you can make Direct Debit payments to your credit card. You can also make one-off payments by logging on to Online Banking, choosing ‘Pay Santander Credit Card’ and entering your debit card details.

Don’t have a debit card? Don’t worry, you can still register for Online Banking with your credit card.

Setting up a Direct Debit is the hassle-free way to pay your credit card bill. It will take a few minutes to do in Online Banking and will then happen every month without you having to do anything further.

You can set your Direct Debit to pay in one of 3 ways.

- Full payment: which pays off the entire balance each month.

- Minimum payment: a percentage of your balance which we require you to pay each month. It’s shown on your statement.

- Fixed payment: an amount that you decide to pay each month.

If you do already have a Direct Debit set up to pay your credit card balance, you could increase the amount you pay each month to pay off the balance more quickly. This will also reduce the total amount of interest you pay.

You can see the amount you’re currently paying on your statement. See the ‘your statement explained’ section for guidance on where to find this information.

How to set up or change a Direct Debit:

- Log on to Online Banking

- Click on the Credit cards tab in the top menu

- Click set up/amend Direct Debit - on the left hand side

- Choose the amount you want to repay each month (full payment, minimum payment or fixed payment)

- Type the sort code and account number of the current account you want to make the payments from - this can be non-Santander account

How long will a Direct Debit take to set up?

It takes about a month to set up a Direct Debit so if you need to make a payment to your credit card in the meantime, you'll need to pay your credit card using another method which you can find on the back of your statement.

You can also contact us to set up or change a Direct Debit.

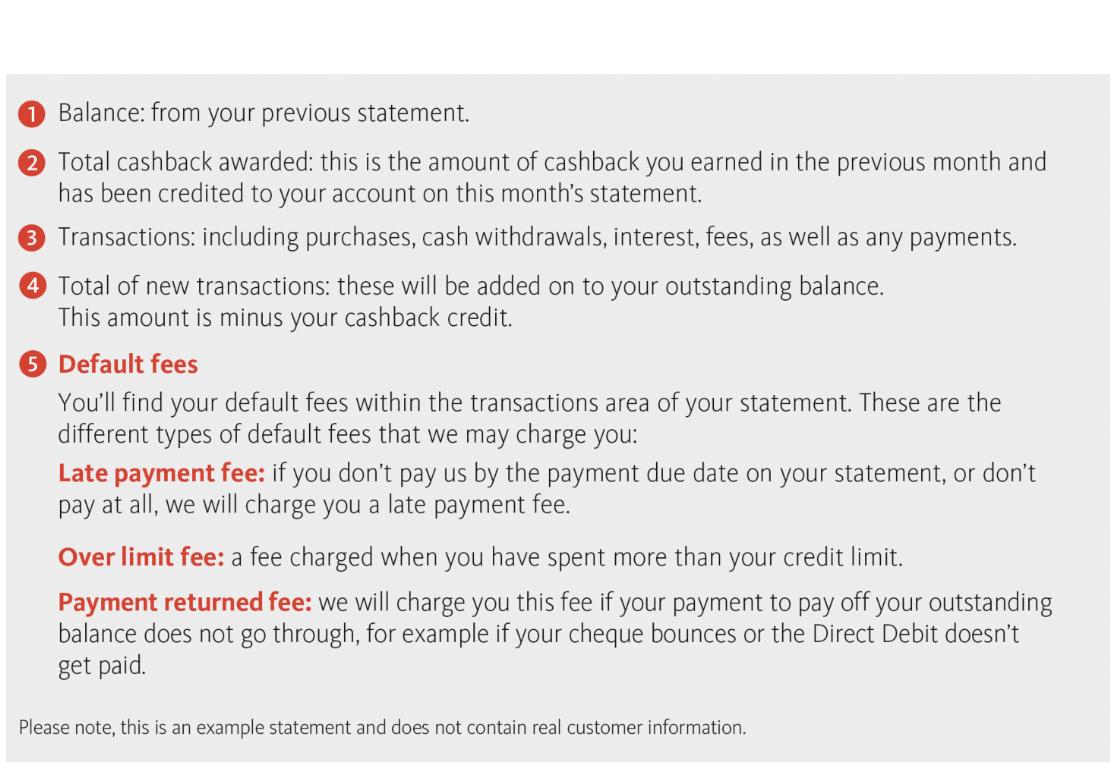

These are the general fees and charges for your credit card. You can find the specific fees and charges for your card on the back of your statement.

Fees

Late payment fee

If you don’t pay us by the payment due date on your statement, or don’t pay at all, we’ll charge you a £12 late payment fee.

Over limit fee

If you're over your credit limit on your statement date we’ll charge you a £12 fee.

Other credit card interest rates and charges

Cash transactions

Cash transactions include withdrawing money from a cash machine and buying foreign currency. Sometimes we call these ‘quasi-cash transactions’.

Interest is charged from the date the cash transaction is added to your account – there’s no interest-free period on cash transactions. So even if you pay your balance in full on your statement date, you’ll still be charged interest on any cash transactions.

A fee may also be charged for cash transactions.

Balance transfers

If you transferred a balance during a 0% offer, you’ll be charged interest at your standard rate on any balance remaining after the 0% interest offer ends.

If you transfer a balance at any other time, you’ll pay a balance transfer fee and interest will be charged at the standard purchase rate.

Your standard interest rate is printed on your monthly statement. This is the interest that you’ll be charged if you’re not in a 0% interest offer period.

Purchases

If you have a 0% offer, you’ll be charged interest at your standard rate on any purchase balance remaining after the 0% interest offer ends.

If you use your card for new purchases after the 0% offer period ends, you’ll get up to 56 days interest free if you pay your full balance on time and in full each month.

If you don’t pay your balance in full, you’ll be charged interest on new purchases, as well as any remaining purchase balance.

Your standard interest rate is printed on your monthly statement. This is the interest that you’ll be charged if you’re not in a 0% offer period.

Monthly or annual fees

Some credit cards will have a monthly or annual fee. You’ll be told about this when you open your account and you can always check the ‘fees and charges’ section for the credit card you have on our website:

Santander Edge credit card

All in One Credit Card

Everyday Long Term Balance Transfer Credit Card

Everyday No Balance Transfer Fee Credit Card

Santander World Elite™ Mastercard®

Foreign transaction charges

When you use your card abroad you may be charged additional fees and interest for making non-sterling transactions. There may also be fees to withdrawing cash abroad. Find out more in our travelling guide.

How payments are applied to your account

We'll use any payment you make to pay off items that are already on your statement before paying off any more recent transactions

We'll apply your payment to amounts on your statement that we charge the highest interest rate on. We’ll do this before we apply your payment to amounts charged at lower rates or zero interest. For example, a cash withdrawal will be paid off before an introductory 0% interest offer because it has a higher interest rate. But this only happens once the transaction has been applied to your statement. See your terms and conditions for more details.

Your credit card statement is available in Online and Mobile Banking. If you’re not yet paper-free, we’ll also send you a paper statement each month showing all your recent transactions, including your minimum payment and the date its due.

You can switch to paper-free anytime within Online Banking.

If you’d like to change your payment due date and the date we send you your statement, please contact us

To help you get the best from your statement, we’ve designed a simple guide.

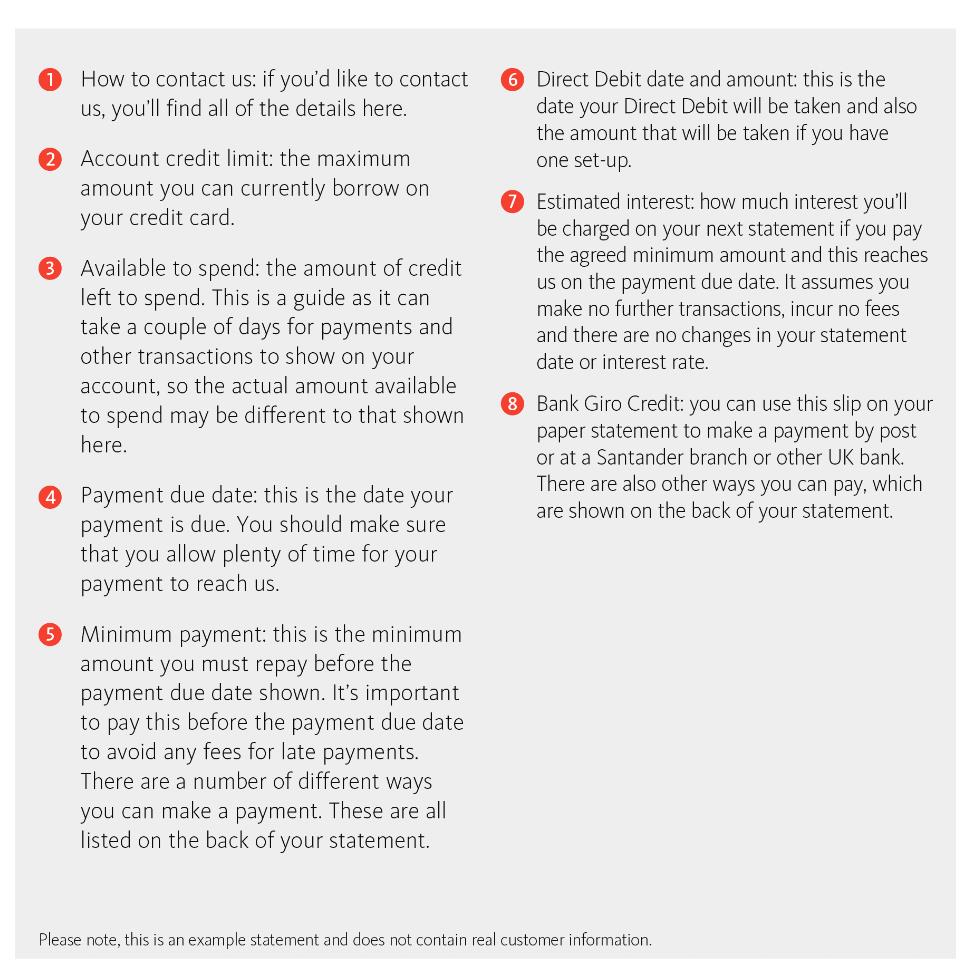

Front page of your printed statement:

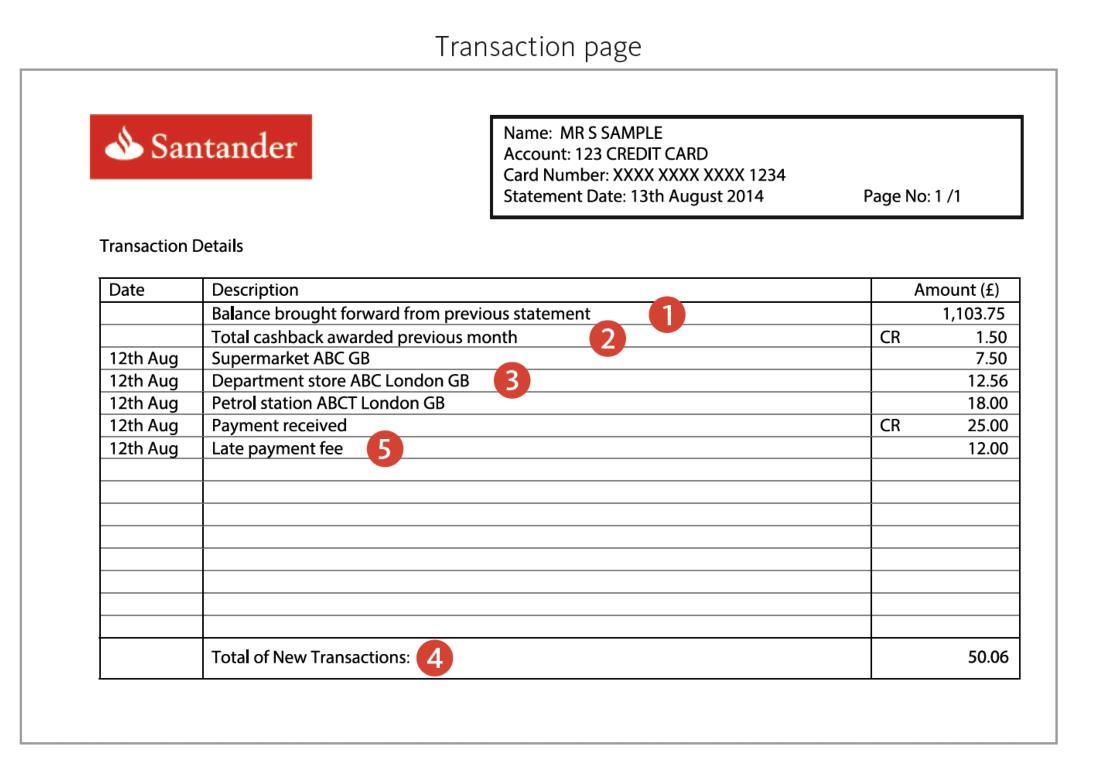

Transaction page of your printed statement:

Set up account alerts to help avoid fees and charges

We’ll send you alerts when you’re near your credit limit to help you avoid fees and to make you aware of certain activity on your account. You can manage your alert settings through Online Banking, or by contacting us.

Find out more about account alerts

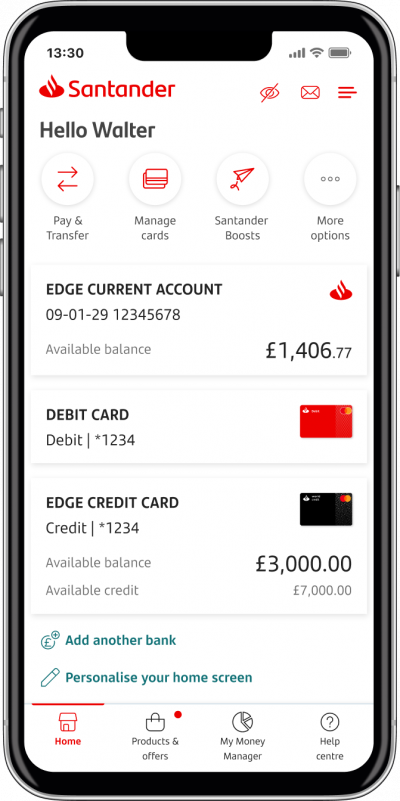

Stay up-to-date on the go with Mobile Banking

Check your credit card balance, make payments to your card, view your credit limit and more with our mobile banking app.

Stay within your credit limit

Your credit limit can be found on your monthly statement and in Online or Mobile Banking. If you spend over your limit you’ll be charged an over limit fee. You can manage your credit limit preferences in Online Banking

Avoid using your credit card for cash withdrawals

If you use your credit card to take out cash from cash machines, you’ll be charged interest from the day you withdraw the money. This differs from interest on purchases, as you have 56 days before that is applied. To avoid any interest charges from a cash withdrawal, you need to pay off the entire existing balance and any outstanding interest as soon as the cash withdrawal is made. If you don’t, you’ll be paying interest on the amount of cash you took out until your balance is cleared.

Change your payment date to suit you

You can choose a convenient date to have your credit card Direct Debit payment taken. Contact us to change your payment date.

Check your rates and fees

Take a look at the ‘understanding fees and charges’ section. Keeping in mind what you’ll be charged may help you spend less. You can also find useful information on the relevant product page on our website, and also in our credit cards guide (PDF - 126 KB)

If you’re worried about your finances, please visit our money worries page for further support.

There are also a number of organisations detailed below that can give you free impartial debt advice.

These organisations aren’t linked with Santander and they can help you manage your creditors and debt problems. Please note that some of these organisations may charge for their services.

Business Debtline

bdl.org.uk

Cardcosts from UK Finance

cardcosts.org.uk

Citizen’s Advice Bureau

adviceguide.org.uk

Money Advice Service

moneyadviceservice.org.uk

National Debtline

nationaldebtline.org.uk

Payplan

payplan.com

StepChange Debt Charity

stepchange.org

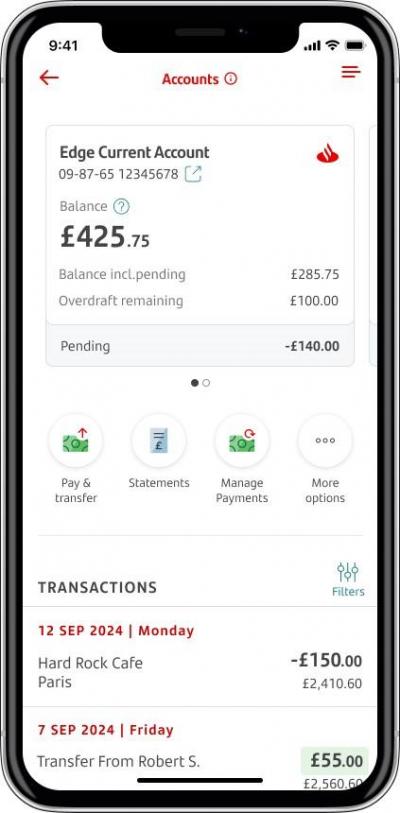

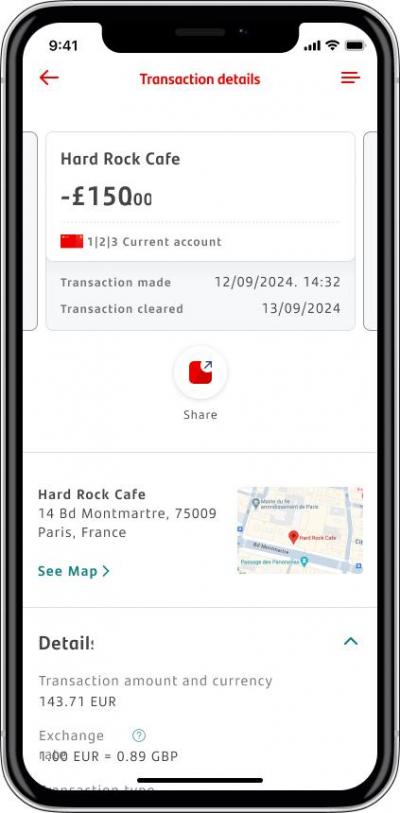

If you don't recognise a transaction on your credit card, you can find out more about it in our mobile banking app

In the app, you can see:

- when the payment was made (date and time)

- the location, which will be shown as a map or text (if there's enough information available)

- fees incurred (such as exchange fees, transaction fees, cash machine fees).

Follow the steps below to learn how to find the details of a credit card transaction in Mobile Banking.

1.

On the homepage, pick the credit card you’d like to find out more about

2.

Tap on a transaction for more information

3.

You’ll see the details about your transaction

If you're already using Online Banking, download our mobile banking app for your phone or device. Then you can log on with the same details you use for Online Banking and you're ready to go.

If you haven't signed up for Online Banking yet, you can get started today.

We've added some new features in Mobile Banking to help you stay on top of your credit card’s payments and transfers.

- You can see the status of a payment in the 'Payment cleared' section. It'll say 'Pending' until the payment's cleared and later tell you the settled date.

- For international transactions in a currency other than (£), the exchange rate will be shown.

- The location of a transaction will be shown to help you find where it came from. If there's enough information, we’ll also show you a map or address.

A credit card isn’t ideal for long-term borrowing, but a personal loan could help you consolidate your debts into one monthly repayment at a fixed rate. Find out more about other borrowing options