Investing made simple

Investing can be a good way to grow your money, but where do you begin?

With so many ways to invest, from shares, bonds, cryptocurrency, to even vintage wine, it can seem far from simple to get started.

That’s why we keep it simple with a range of investment funds.

What is an investment fund?

You may be familiar with buying individual shares, maybe through an employee scheme or buying shares in the likes of BT or Royal Mail when they were privatised.

When you buy shares you own a small part of that company. If it does well, your investment grows, if it doesn’t, your investment falls.

So, investing in individual shares can be risky as you’re relying on a single company’s performance to get a return. You may also find it time consuming, expensive and hard to get the right mix of shares or other assets to diversify your investment risk.

This is why investing in funds can be a good idea.

Funds pool money from lots of investors to buy shares and/or other asset types such as bonds. This lets you invest in a range of investments run by professional fund managers. Funds are invested across different asset types, spreading your risk and keeping the impact of transaction costs relatively low.

When it comes to choosing how to invest, we keep it simple

You can choose one of our ready-made funds or pick your own

Ready-made funds

To make investing simple, we have 4 ready-made investments funds created by our financial experts. Simply choose which best suits your investments needs.

Pick your own funds

Choose from hundreds of other investments, managed by asset mangers from across the market.

It's a good idea to regularly review the funds you're invested in to make sure that they’re meeting your needs. If you want to make a change then it's easy to switch your money from one fund to another or to withdraw your money if investing is no longer right for you.

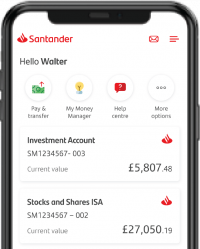

Start investing on our mobile app

Keep you in control

Whether you want to check your investments online or through the app we have you covered.

- Watch how your money performs with your mobile, tablet, or laptop

- Make changes easily online or through the all

New to Santander? Download our app on the app store or Google Play.

If you already have the app, hit menu, product and offer, and then investments to get started.

Join the Investment Hub with no commitment. Take a look around, check out the funds, and see where you could invest some savings.

Need help deciding which investment fund to choose?

Get specialist advice from our qualified Financial Planning Managers.

Explore getting advice

As with all investments your capital is at risk and you may get back less than you invest. Investments should be held for the medium to long term (5+ years), unless there is a fixed term that applies.