Mortgages

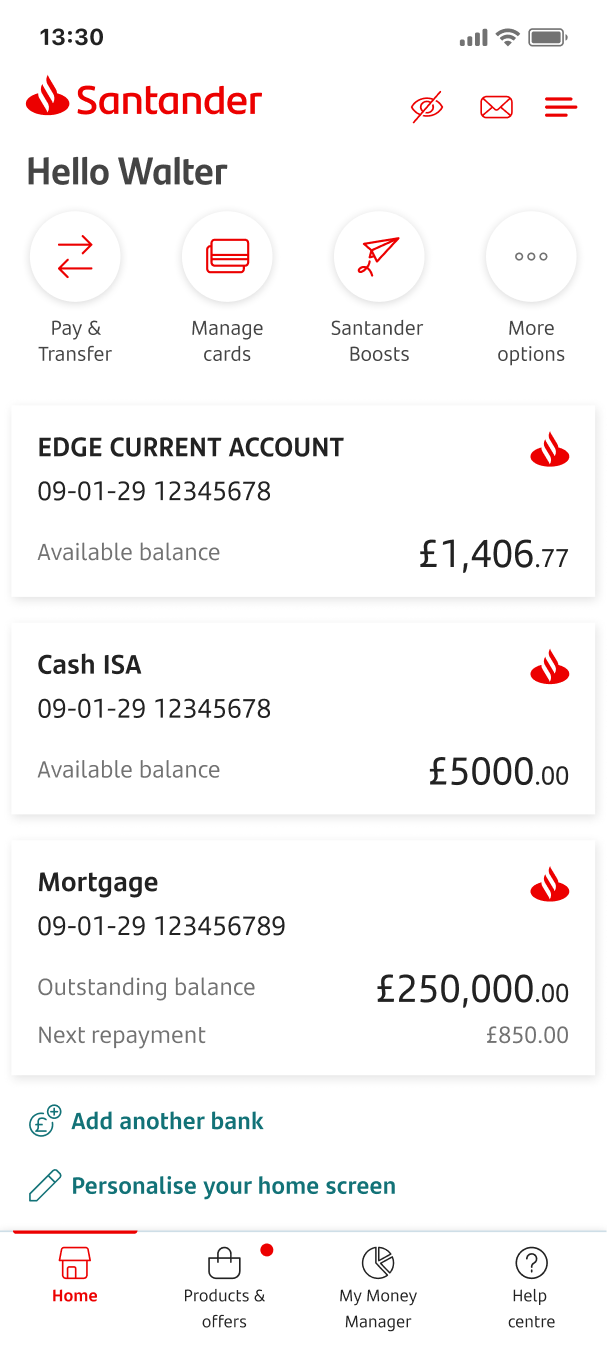

If you have a Santander mortgage, you can find out more information about it by tapping on your mortgage product on the home screen.

This guide will cover:

- How to view your mortgage details in the app

- The Manage my mortgage menu

- How to make a single or regular overpayment

- How to change your Direct Debit

- How to get a settlement figure

- Paying off your mortgage in the app

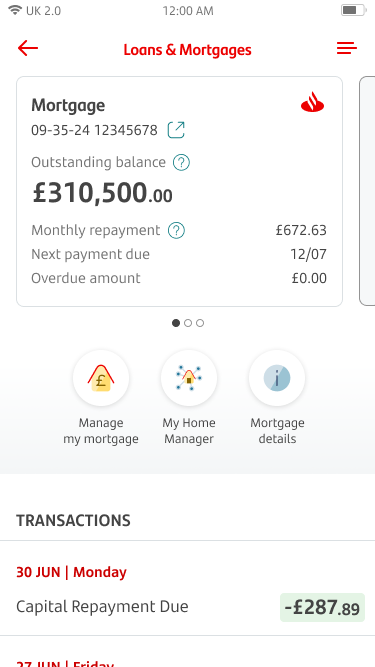

By tapping on your mortgage, you'll be able to see your:

- outstanding balance

- contractual monthly repayment

- next payment date and

- list of transactions.

You can get more information about your mortgage by tapping 'Mortgage details’. You can also see additional features by tapping the ‘Manage my mortgage’ or ‘My Home Manager’ options.

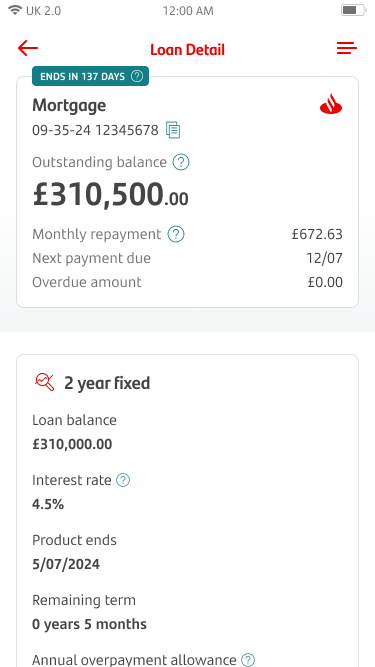

By tapping on 'Mortgage details', you'll be able to see the detail for each of your loans, including:

- interest rate

- current product and end date

- remaining term

- early repayment charge and overpayment allowance (if applicable) and

- the variable rate your loan will change to when your current product ends.

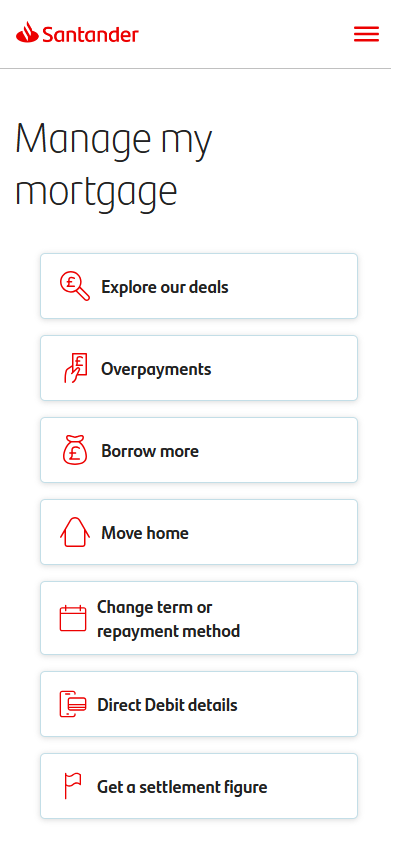

When tapping on the ‘Manage my mortgage’ option, you can:

- explore deals available to you

- make overpayments

- borrow more money

- move home

- change your mortgage term or repayment method

- view and change Direct Debit details and

- get a settlement figure.

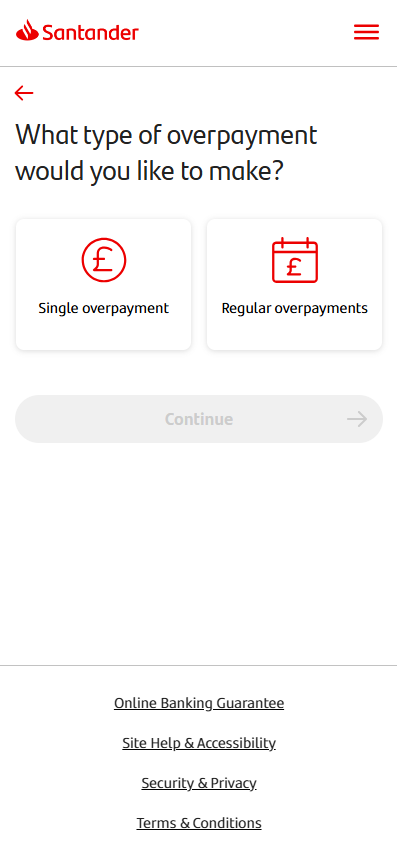

Let’s take a look at overpayments. If you tap ‘Overpayments’ in the Manage my mortgage menu, you’ll be able to choose which type you’d like to make.

You can make a single overpayment, or set up a regular overpayment.

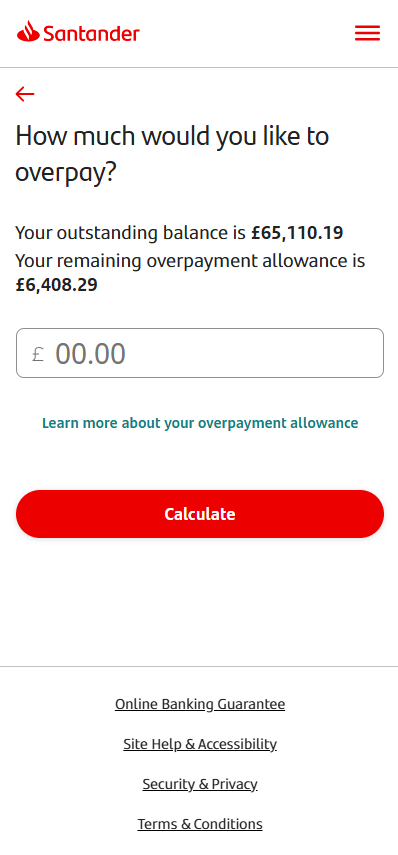

If you choose ‘single overpayment’, you’ll enter the amount you want to overpay.

If your mortgage has an early repayment charge, we’ll show your remaining overpayment allowance here. We’ll give you an option to tap ‘learn more about your overpayment allowance.’

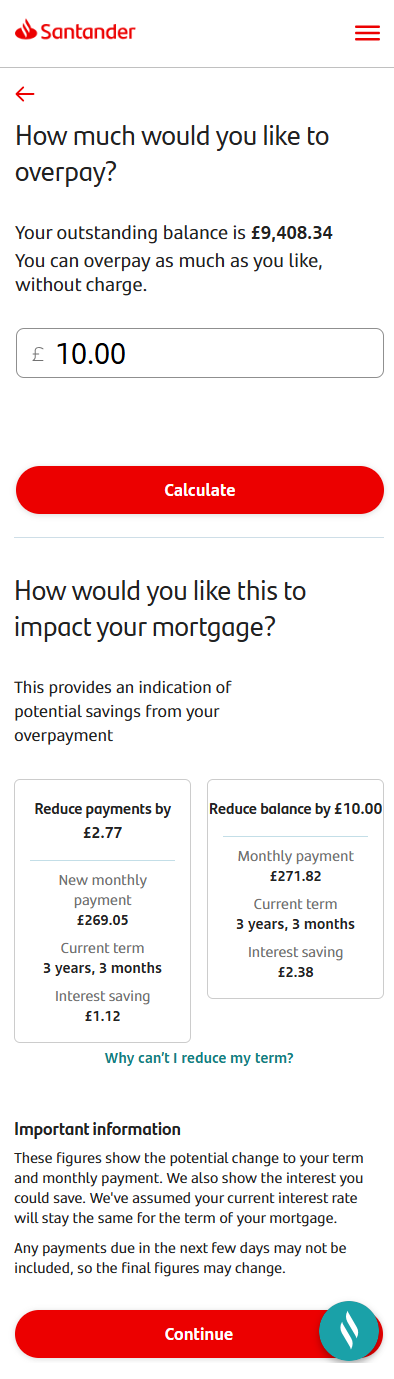

Once you enter an overpayment amount, we'll show your options with the potential savings for each.

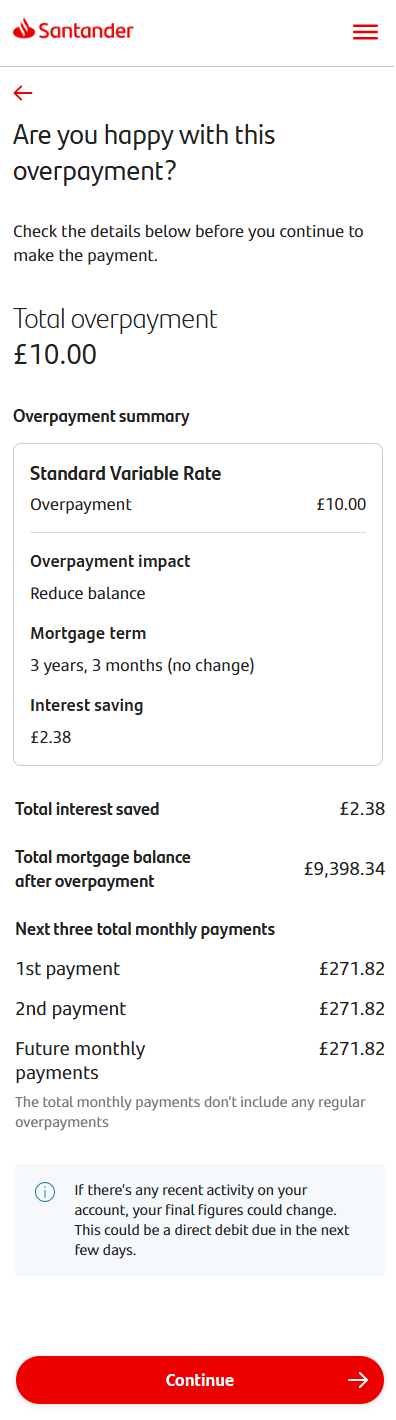

We’ll show you the details of your overpayment. You can review this and check you’re happy. Then tap ‘Continue’.

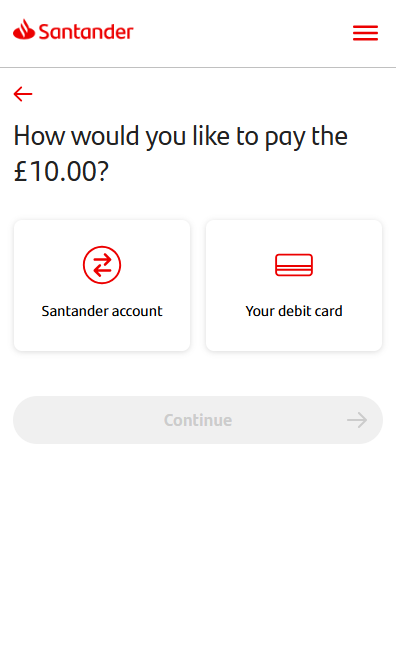

If you have a Santander account, we’ll give you the choice to pay from your account or using your debit card. If you don’t, we’ll take you straight to the pay by debit card screen.

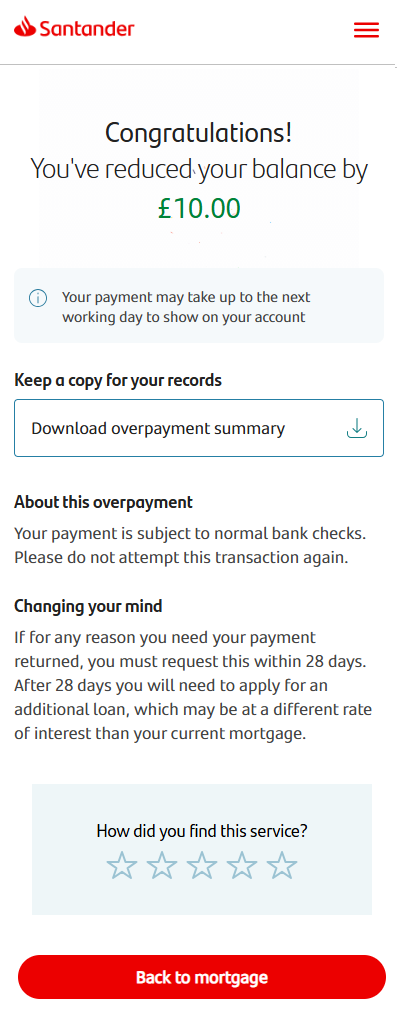

Once you’ve made the overpayment, you’ll see a confirmation screen with more information. You’ll have the option to download an overpayment summary here.

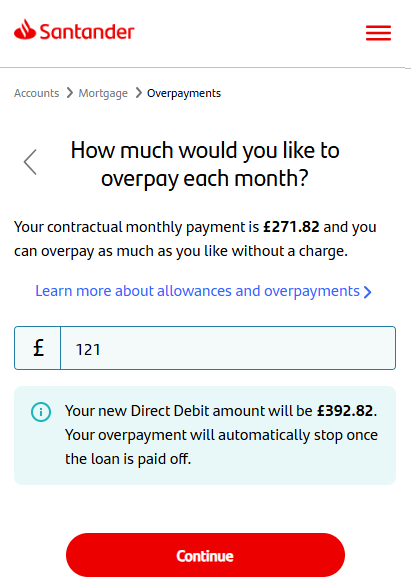

If you chose ‘regular overpayment, you’ll be asked to enter the amount you want to overpay each month.

If your mortgage has an early repayment charge, we’ll give you information about this here.

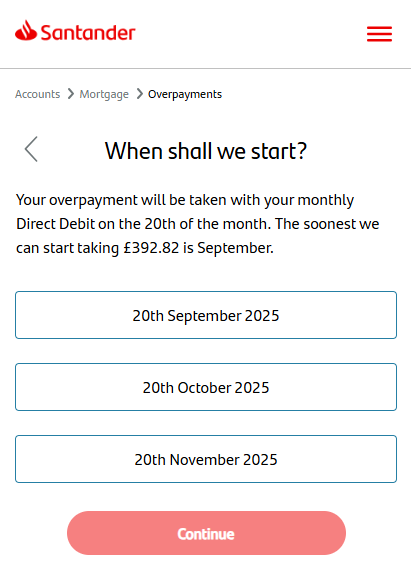

You’ll be able to choose a date when you’d like the change to take place. We’ll ask you how long you want to overpay for on the following screen. You can choose ‘until further notice’ or ‘choose a month’.

Once you've picked your dates, you'll be shown the details of your overpayment and new Direct Debit amount to review. When you’re happy you can tap ‘confirm set up’ to finish setting this up.

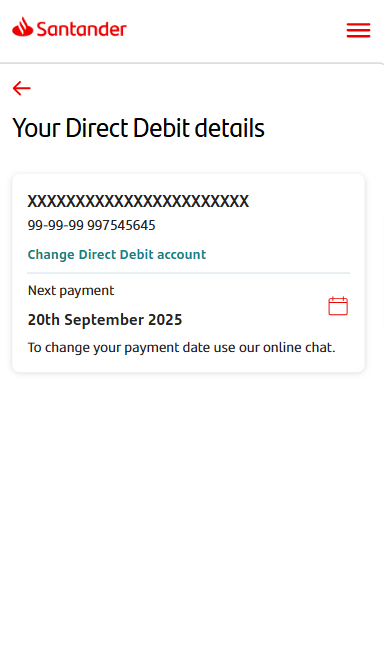

When you’re in the ‘Manage my mortgage’ screen you can tap on ‘Direct Debit details’ to view and change your Direct Debit. You’ll see the details of your current Direct Debit. To change the account you pay from tap ‘Change Direct Debit account.’

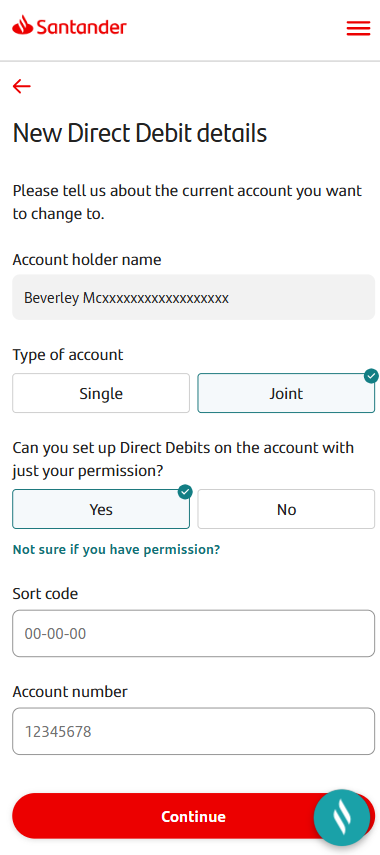

If you have any eligible Santander bank accounts, you'll be able to either pick from a list, or you can click the link to enter details manually.

You can then provide the details of the account you want the Direct Debit to come from.

Once this is complete, we’ll show you a screen where you can review the details. If you’re happy, tap ‘submit’ and you’ll see a screen saying your Direct Debit change is all done.

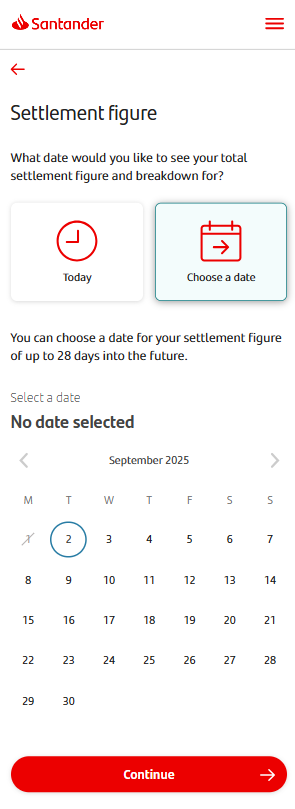

If you tap ‘Get a Settlement Figure’ on the ‘Manage my mortgage’ screen, you can choose a date for your settlement figure. This can either be for today or a date up to 28 days in the future.

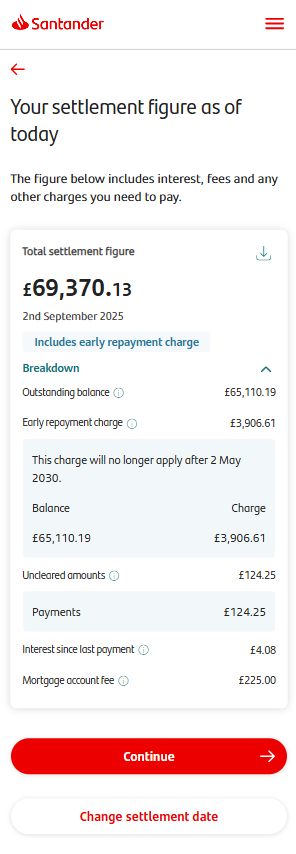

Tapping continue will show you your settlement figure. You can tap ‘Breakdown’ to see more details. You can change the settlement date or continue.

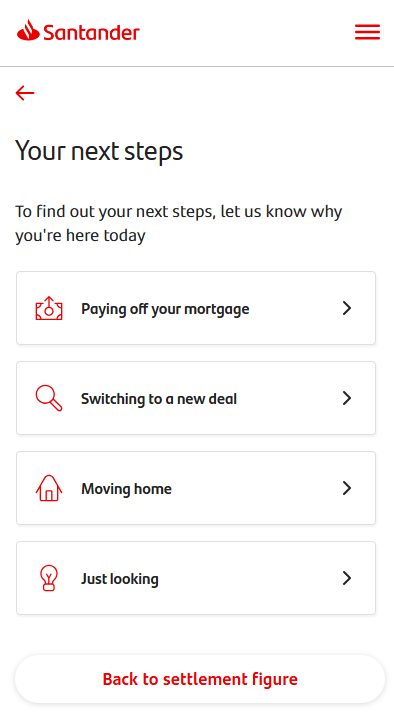

You’ll see a menu for next steps. You can go back to the settlement figure from here.

If you want to pay off your mortgage, tap ‘Paying off your mortgage’. If you’re eligible to pay off your mortgage online, we’ll help you with that in the app. Otherwise, we’ll explain to you what you’ll need to do next.

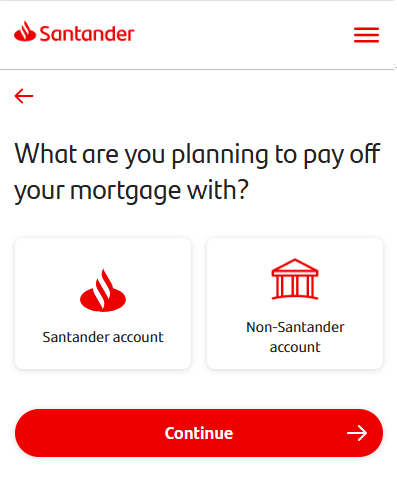

If you’ve selected a settlement date of ‘today’ and you’re eligible to pay your mortgage off online, you’ll see this screen next. This is where you can choose if you’re paying from a Santander account or an account with another bank.

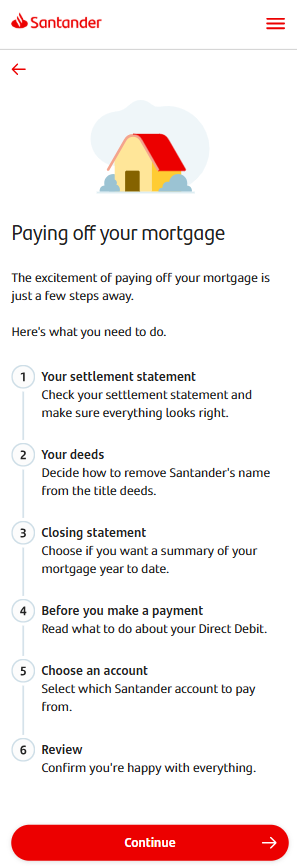

You’ll see a screen which breaks down all the steps you need to go through to pay off your mortgage. The app will guide you through all these steps.

- Check your settlement statement

- Decide how to remove Santander’s name from the title deeds

- Choose if you want a summary of your mortgage year to date

- Read what to do about your Direct Debit

- Choose which account to pay from

- Check all the details and confirm.

Once you've gone through these steps in the app, you'll see a confirmation screen letting you know what happens next.