At Santander, all your investments are held and managed on our Investment Hub.

Log on to your Investment Hub – the place to manage your investments.

Here’s some videos to help you get started

How to use the Investment Hub

[On screen message: Remember, the value of any investment can fall, as well as rise, so you may get back less than you invest. Tax rules can also change, and any benefits will depend on your individual circumstances.]

Once you’re invested, how can you use the Investment Hub to keep track of your money?

At the top of your screen, you'll always see your investments account showing how much they have increased or decreased over time.

Below this, you can see options to transfer or open new accounts.

Tapping or clicking on each of these will show you the value, performance, and details of the portfolio of funds you're investing in.

Want to make changes?

Just open the menu at the top of these screens. Here you can see all your transactions, manage your payments in and out and invest in new funds or buy more of the funds you already have.

Back on your main dashboard, you can also choose to browse funds, and choose how you want to pay your platform fees.

You can also quickly see any messages or notifications, change your settings, or get in contact with us.

We hope you enjoy investing in your future.

How to become an investor

[On screen message: Remember, the value of any investment can fall, as well as rise, so you may get back less than you invest. Tax rules can also change, and any benefits will depend on your individual circumstances.]

Once you've joined the hub. Your next step is to become an investor.

First, browse through our fund list to choose your investment to match your chosen risk appetite. You can keep it simple by choosing one of our ready-made investments or take full control to pick your own selection of investment funds.

And if you’re starting a personal pension, you may want to simply choose our core fund.

Once you have decided on your investment, you can choose which account is right for you.

ISAs are a tax-efficient choice and perfect when you want to invest up to your ISA allowance each tax year.

The Investment Account can act as an overflow when you want to invest more than our ISA or want to invest jointly.

And choose the Personal Pension for a tax efficient way of saving for retirement

As you open your account, you can add money as a lump sum, or you can set up a Direct Debit to automatically add money each month.

Then you can add your chosen funds to your basket.

Once you are happy with your choices, you’ll need to download the costs and charges. And have one last check of the key features of the funds you have chosen.

Finally, confirm to buy the funds, and we will do the rest. We’ll let you know once the investments have been made.

And don’t forget to add a bank account, so you can add more money in the future and it’s a good way to pay for the platform fees.

We hope you enjoy investing in your future.

Where can I find the Investment Hub, and how do I access it?

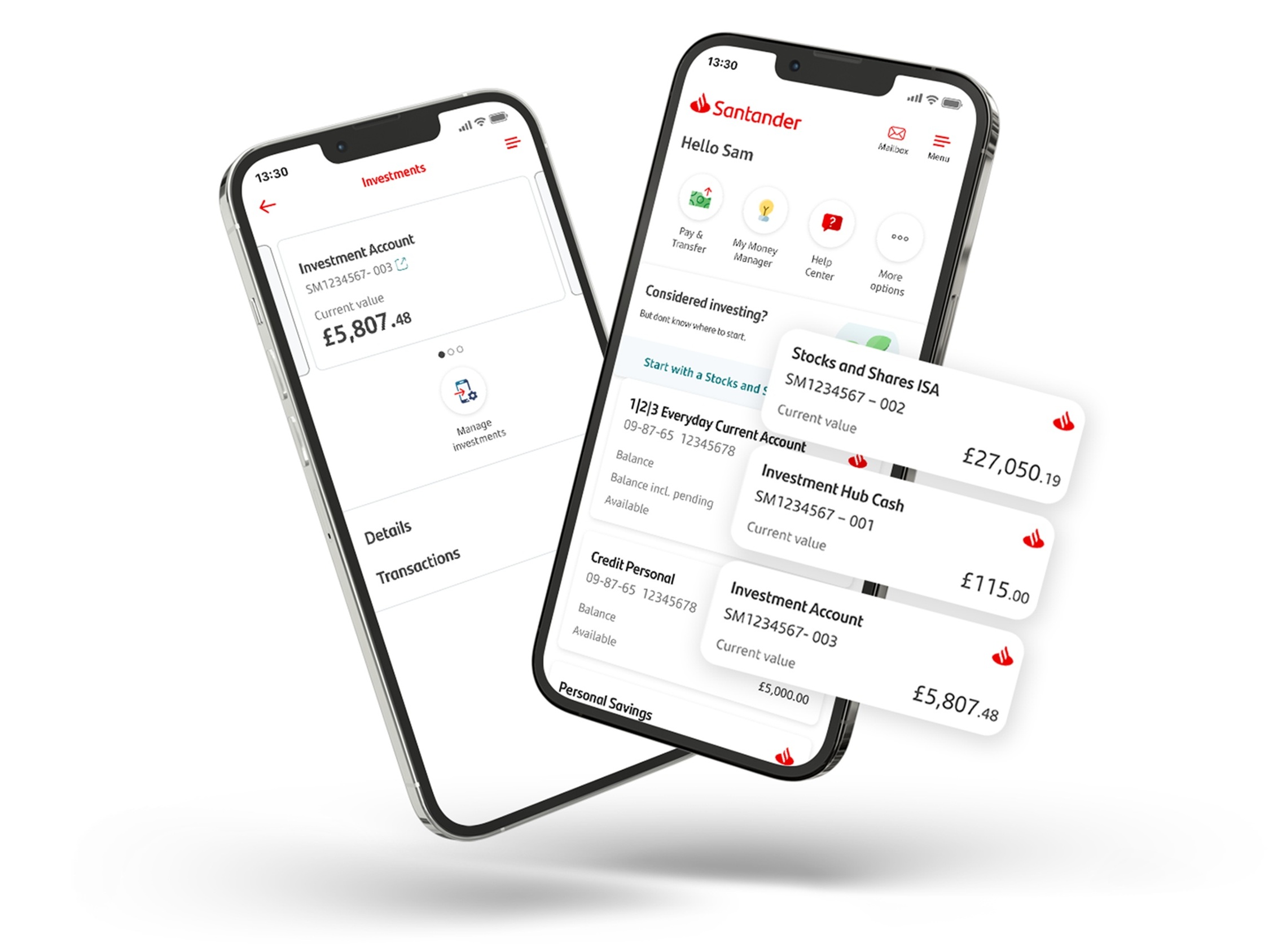

You can find the Investment Hub in your Online Banking or within the App.

In the app you will see each of your investment accounts, with real time balances. Clicking on the account will show you more details, like the funds held and your transaction history. Clicking on the ‘manage investments’ icon will take you to your Investment Hub so you can manage your investments further.

In Online Banking, you’ll see ‘Investment Hub’ in your list of accounts. Just click on it, and it will open a new window. From there, you’ll be able to see and manage all your investments.

New to Santander? Find out how to download the Santander App.

Existing Investment Hub customer? Find out more below.

Setting up

You can access the Investment Hub through the Santander app or your Online Banking.

Once you've logged in Online Banking click ‘Investment Hub’. Or through the app, tapping on your account and clicking the ‘manage investments’ icon.

Forget your Online Banking details? No problem. You can reset these on our website.

If you can't access your Investment Hub, please call us on 0800 328 1328 and choose option 2, and we will help you.

When you apply for the Investment Hub, we verify electronically that the information you provided on your application is correct. This is normally done within 48 hours, but can at times take longer. If we can’t check any information electronically we’ll send you a letter asking that you confirm your details and provide any ID and/or proof of address we need. When we’ve checked your info, we’ll open your account and the message will disappear.

Keeping your personal details up to date is important. You can let us know if you’ve moved, have a new phone number or want to add or change your email address, by simply logging into your Online Banking, and clicking ‘My details & settings’.

Once in your Investment Hub click on ‘Inbox’ and ‘documents’ and choosing the document library, you’ll have access to copies of all your important Investment Hub documents, including contract notes and regular quarterly statements.

You can read or download these whenever you want to and if you’ve given us an email address, we’ll always send you a message to let you know when a new document is available for you to read.

Investment (Stocks and Shares) ISA

Log on to the Investment Hub scroll down to ’Our accounts’, find ‘Stocks and Shares ISA’ and click ‘Apply’. Then follow the screens to set it up.

If you haven’t opened an Investment Hub, register here.

Log on to the Investment Hub scroll down to ’Our accounts’, find ‘Stocks and Shares ISA’ and click ‘Transfer’. Then fill in the information about the ISA you want to transfer, and we’ll do the rest.

If you haven’t opened an Investment Hub, register here.

Personal Pension

Log on to the Investment Hub scroll down to ’Our accounts’ on the home screen and find Personal Pension and click ‘Apply’. Then follow the screens to set it up.

You can register for the Investment Hub if you haven’t ready done so. Once you’re set up, choose ‘Open a Santander Personal Pension’ and follow the next steps.

Log on to the Investment Hub scroll down to ’Our accounts’ on the home screen find Personal Pension and click ‘Transfer’. Then fill in the information about the pension you want to transfer, and we’ll sort out the rest.

Register for an Investment Hub account, if you don't have one already. Register for an Investment Hub account

Like with any personal pension, you can access your Santander Personal Pension once you turn 55.

However, the age will rise to 57 from 6 April 2028.

Adding money and buying funds

It’s a good investment strategy to add to your investments little and often and a Direct Debit is a great way to do this.

They are simple to set up, click on the account you want to add money to. Then click ‘Account options’ and select ‘Manage payments‘ then ‘Set up regular payment’.

Fill in the amount, date, and how often you want the payment to be, and choose which account you want to make it from. Once you've done that, click ‘Continue'.

The next screen lets you choose the fund you want to pay into. Click the + symbol to the right of the fund and type the amount you want to set up as your Direct Debit. You can repeat this step as necessary to pay into multiple funds. When you’re done click ’Continue‘ to go to the review screen and double check all the information.

You’ll see two documents in red, a Key Information Document (KID) or Key Investor Information Document (KIID) and summary of the full cost and charges. To go ahead, you have to open and read these documents, so you learn about the funds and any costs associated with investing. When you’ve read them, the red links will turn green and if you’re still happy to continue, tick the box to confirm and click ‘submit’.

To invest more money in the funds you already hold, log into your Investment Hub and click on the account you want to add the new investment fund to. Then click ‘Account options’ and select ‘top up existing fund’. You’ll see a list of the funds you currently hold.

Next to each fund is a drop-down box. Use that to select ‘Buy’ and follow the rest of the on-screen instructions to complete adding more money to the fund you hold.

You can add money to your Investment Hub by using your debit card or by Direct Debit.

If you use your debit card, the money will appear immediately.

When using a Direct Debit, the money will appear in your Investment Hub in 3 working days if it’s already been set up on your bank account, or 10 working days if you’ve recently nominated your bank account for Direct Debits.

The exact date the Direct Debit will be taken can be found on the ‘Direct Debit Advance Notice’ letter, which you can see in your document library on the Investment Hub.

Buying a new investment fund in a few simple steps.

1. Once in hub click on the account you want to add the new investment fund to. Then click ‘Account options’ and select ‘Buy new fund’. You’ll then be asked how you want to add money to your investment, either a debit card or from cash you already have available on the Investment Hub.

2. Next you’ll then be asked which fund you want to invest in. Choose the fund and click the + sign under add to basket and type in the amount you want to invest. Choose ‘Continue’ at the bottom of the page, and you’ll see a review page where you can double-check all of the information is correct.

3. To go ahead, you have to download the key documents so that you learn about the funds and any costs associated with investing. When you’ve downloaded and read them, the button will turn green. If you’re still happy to continue, tick the box to confirm and click ‘Submit’.

You should now see a page telling you the transaction has been successful. If you chose to pay with a debit card, you’ll now need to enter your card details.

Accessing your money

Yes, the app will show all your investment accounts with Santander. The balances are in real time. You can click on each account you hold you will be able to find further information. And you can tap on the icon and you will go directly to your Investment Hub. For more information see our guide

On your Santander app you will find the latest value of your investments. Click on your Stocks and Shares ISA or Investment Account to see more detail about the funds you hold.

Or log to your Investment Hub online. Where you can find more details about the funds you hold and how they're performing by clicking into the Stocks and Shares ISA and Investment Account they are held in and clicking the ‘Full performance details and transaction’ button.

In the investment Hub selling an investment couldn’t be simpler.

Click on the account you want to sell from. Then click ‘Account options’ and select ‘Sell a fund’. You’ll first be asked where you want the money to go to. Once you’ve chosen, press ‘Continue’.

You’ll then be asked how much you want to sell from your investments. You can choose the full amount or put a value in the box and then ‘Continue’.

This will take you to a review screen where you can double-check all of the information is correct. Tick the box if you want to go ahead, and press ‘Submit'.

You can withdraw your money anytime, but to keep your money safe we’ll only make payments out of your Investment Hub account to a bank account in your name.

To link your bank account, choose ‘Settings’ at the top of the Investment Hub home screen. Then tap ‘Banking details’ and follow the instructions.

If you need access to your money, how quickly you’ll get your money will depend on how your money is being invested.

- If you’re withdrawing cash from the Investment Hub it will take 1 working day to arrive in a verified bank account.

- If the money is from an investment fund they have to be sold first, and the money from these fund(s) has to clear into your Investment Hub account. So the money can take up to 6 working days to arrive into your verified bank account.

When you first open the Investment Hub, we send you a ‘Confirmation of Registration Request’ letter, asking you to sign and return it to us to allow you full access to the Investment Hub.

If you don’t have the option to ‘withdraw cash’ on the ‘My Options’ drop down, then we’ve not yet received this letter back from you. If you don’t have the letter to return to us, call us on 0800 328 1328 (option 2) and we’ll send you another copy.

Paying fees

We collect your Platform Service Fee twice a year. You can easily set up a variable, one-off or regular Direct Debit online to pay your fees.

You can set up a Direct Debit from your Investment Hub by going to 'Settings' then 'Banking Details' and following the instructions.

If you don't set up a Direct Debit or add sufficient cash to your Cash Only Account we’ll need to take your fees from any cash held in your Investment Hub account. If there isn’t enough cash in your account, we’ll need to sell some of your investments to cover the fees due.

Why invest with Santander?

Source: Santander UK plc as at October 2024