Whether you’re new to investing, or have investing experience, we have a range of investment options to help you reach your goals.

- Join over 270,000 customers who have invested with us

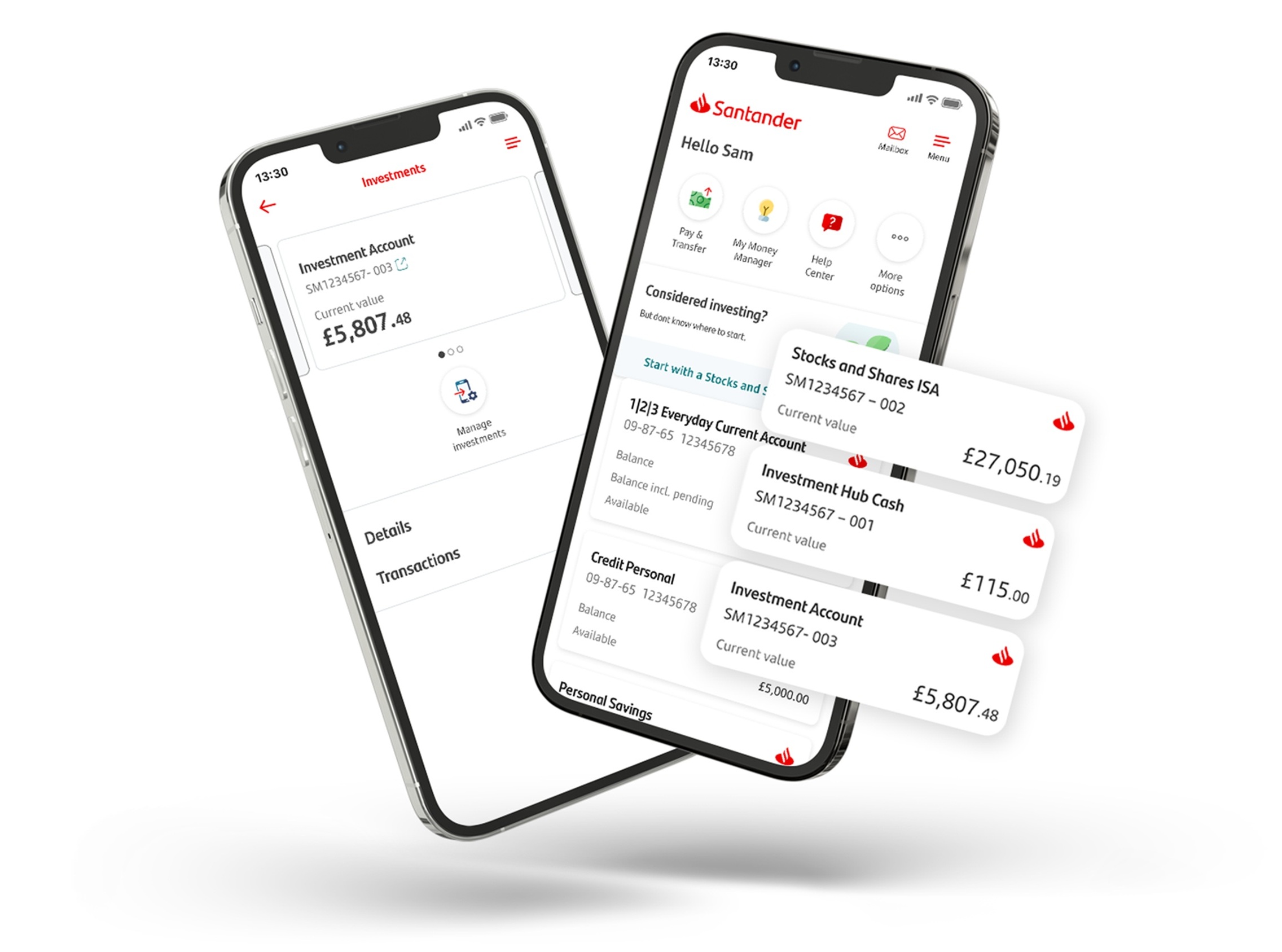

- All investments are held and easily managed in our investment hub

Investment (Stocks and Shares) ISA

Invest up to £20,000 this tax year.

A tax efficient way to invest.

Personal pension

Feel confident knowing that you’re in control of your tomorrow with our Personal pension.

Ready-made investments

To make investing simple, we have 4 ready-made funds, created by our financial experts. Simply choose which best suits your investments needs.

If ready-made investing isn’t for you, then you can choose to invest from a wider range of other funds across the market.

Save for soon, invest for later

Give investing a go yourself

Buy, sell and manage your investments that you choose

Investing made simple

We keep it easy with 4 ready-made investments – or pick your own from hundreds of funds

Stay on top of your investment with our app

If you already have the app, hit menu, product and offers, and then investments to get started.

Whether you want to check your investments online or through the app we have you covered.

- Watch how your money performs with your mobile, tablet, or laptop

- Make changes easily online or through the app

New to Santander? Download our app from the iOS App Store or the Google Play Store.

Learn more about investing, from how to get started to different ways of investing

Simple investment tool

Compare what you could earn with savings and investments.