Current accounts

Earn cashback each month on your Santander Edge or Santander Edge Up current account.

Monthly fee, minimum funding and cashback exclusions apply.

Santander Edge credit card

Got a personal current account with us?

Earn up to £15 a month cashback on everyday spend with our new credit card.

Monthly fee applies. 29.8% APR Representative (variable). Credit is subject to status.

Personal loans

Use our online calculator to see how much you could borrow. Our eligibility checker will show you if you can get a loan and this won’t affect your credit file.

Credit is subject to status.

Support for Personal customers

Financial support

Products

Customer support

Independent service quality survey results

Personal current accounts (GB)

Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,000 customers of each of the 16 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Take a look at the latest published results

Personal current accounts (NI)

Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask approximately 500 customers of each of the 11 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Take a look at the latest published results

Authorised push payment (APP) fraud rankings in 2022

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster’s bank account.

These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in the UK in 2022.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

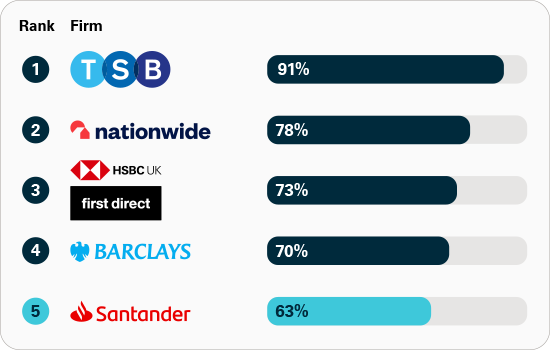

Share of APP fraud refunded

This data shows the proportion of total APP fraud losses that were reimbursed, out of 14 firms. Higher figure is better.

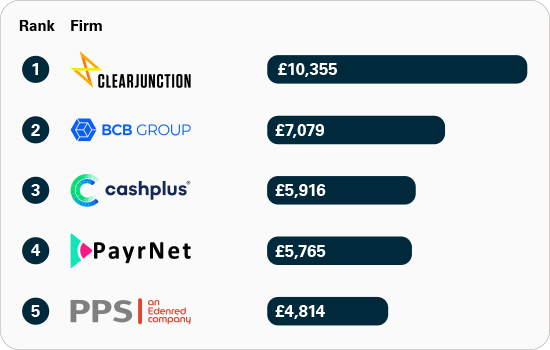

APP fraud received per £million transactions: smaller UK banks and payment firms

This data shows the amount of APP fraud received per million pounds of transactions, ranked out of 20 firms. Lower figure is better.

APP fraud sent per £million transactions

This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.

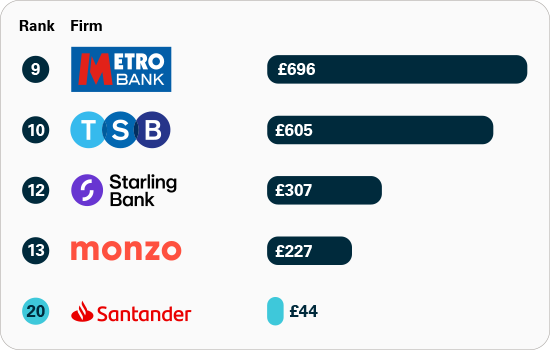

APP fraud received per £million transactions: major UK banks and building societies

This data shows the amount of APP fraud received per million pounds of transactions, ranked out of 20 firms. Lower figure is better.