We need to verify your identity to meet money laundering regulations. These regulations stop criminals using financial products and services to launder money. They also protect you from criminals who might try to use your identity without you knowing.

These requirements are for personal banking accounts only. If you’re looking for business support, visit our business banking page

List 1 – Proof of name

Choose ONE document from this list:

Passport

- UK or Irish passport. Must be in date and signed

- Non-UK or Non-Irish passport with valid right to remain such as online visas, including those with settled or pre-settled status.

Driving licence

- Full or provisional UK photocard driving licence. Must be in date.

National ID card

- EU/EEA/Swiss National ID card or Citizen Photocard with valid right to remain such as online visas, including those with settled or pre-settled status.

How can I generate a sharecode for my online visa?

List 2 – Proof of address

Choose ONE document from this list:

Driving licence

- Full or provisional UK photocard driving licence. Must be in date.

- UK Paper driving licence. Must be in date

Bank or financial statements:

- Bank, building society, credit card or credit union or mortgage statement.

Must be the most recent and less than 3 months old, or an annual statement less than 12 months old

Utility bills

- Gas, electricity, water or landline telephone bill

Must be the most recent and less than 3 months old, or an annual statement less than 12 months old

Mobile phone bills and TV licences are not accepted

Government correspondence

- Council tax bill. Must be most recent and from the current tax year

- Notification of entitlement to UK state pension or government benefits. Must be most recent and less than 12 months old.

- HMRC correspondence including name, address and permanent NI number. Must be less than 12 months old.

If you can’t provide these documents we might be able to help, visit the alternative documents section below

Before you submit:

Please check your documents meet these requirements:

Exact match: Your name and address must match exactly on both your application and ID documents

Full name: Include all middle names in your application if they’re shown on your ID

One from each list: You can’t use the same document to prove both your name and address

Different sources: You can’t use two documents from the same source

Name changes: If you’ve changed your name since your ID was issued, provide supporting documents such as marriage certificate or deed poll

Non-UK documents: We can accept documents from non-UK countries for existing accounts. All must be in English

Please don’t send original documents by post. We’ll keep a digital copy of the ID you provide.

If we need to make extra checks we may ask you for other documents.

Proof of name:

- Birth certificate or adoption certificate.

Proof of address:

- Parent's proof of address from List 2. Address must match application. For children under 13, we need a long-form birth certificate, adoption certificate, or guardianship order to confirm family link or guardianship. For 13-17 year olds, this is only required where the surname doesn't match the parent or guardian's surname.

- Letter from school, college, educational or care institution, including letters from Youth Offence team. Must be most recent and less than 12 months old

Letter issued by a university, college or educational institution confirming UK study. Must include your name, course details and address. Must be less than 12 months old. Full address must match application.

If you can’t provide a standard document to prove your name, you can use one of the below:

- Notification of entitlement to UK state pension or government benefits. This must be the most recent, and less than 12 months old.

- HMRC correspondence including name, address and permanent NI number less than 12 months old.

- UK paper driving licence. Must be in date.

If you’re opening an account on behalf of a donor we need

- A copy of the POA document.

- One document from List 1 and one document from List 2 for the donor

Provide one document from List 1 and one document from List 2. Alternatively, if the donor has lost their mental capacity as stated in the POA document, you can provide one of the following :

- Court of Protection order.

- Court registered enduring Power of Attorney.

- Guardianship order (Scotland).

- Notification of entitlement to UK state pension or government benefits . Must be most recent, and less than 12 months old.

- HMRC correspondence less than 12 months old including name, address and permanent NI number.

- UK paper driving licence. Must be in date.

If you’re a solicitor authorised by the Solicitors Regulation Authority in England and Wales or the Law Society of Scotland or Northern Ireland, please provide your registration details or copies of your practice certificates. If you’re an accountant and a member of the Institute of Chartered Accountants, please provide your registration details or member’s certificate

Can’t provide any of these documents?

If you’re unable to provide documents from any of the lists, our branch teams might be able to help you. Please visit us in branch to discuss alternative options. You might need to book a follow up appointment.

Find your nearest branch

For full details on these alternative documents:

Already started your application and need to submit a document?

If you need to send us documents for an application you’ve already made, our document upload hub has advice and a guide on best practices

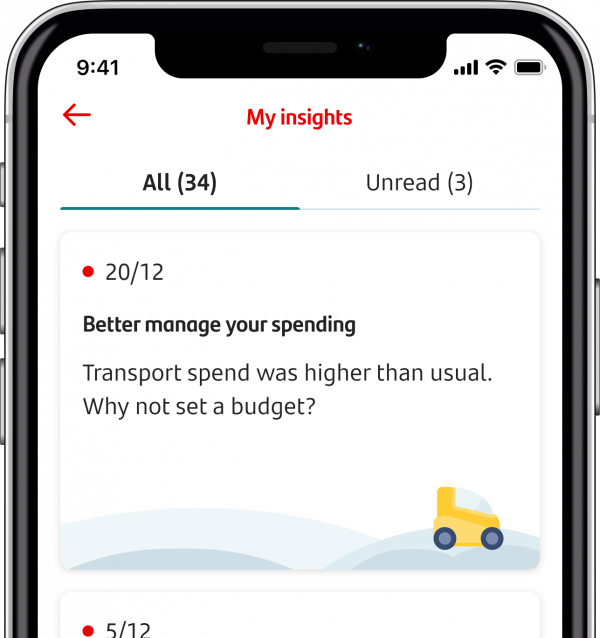

You can also apply through our mobile app

You'll need your passport or UK driving licence to apply, and we might need access to your NFC reader to read the chip in your passport. Get access to your account straight away if you're accepted. For help with your application, use our handy guide