Stay one step ahead of fraudsters

Fraudsters stole £629 million through fraud in the first half of 2025. By understanding how you can keep yourself protected, you can help make sure they don’t get hold of your money.

Mind your OTPs

- Never share an OTP with anyone

- Double check the details before verifying an online card payment.

- Always read the full message. If it doesn’t match what you’re trying to do, stop.

Check before moving money

- Check the person you’re speaking with is genuine.

- Use a known or trusted number or ideally speak to them in person.

- If you’re buying something online, take time to double check the item exists and is of the quality expected.

Police and bank ‘investigations’

- If anyone asks you to move your money to keep it safe, it will be a scam.

- Your bank or the police will never ask you to buy items or move money to help with an investigation.

- Double check, call 101 to be connected to the police, or call 159 to speak to your bank.

Fraudsters will tell you different stories to get what they want, which is access to your money and information. You can learn more on our spotting fraud and scams page.

How to keep your money safe if you lose your phone

Mobile phone thefts are on the rise. But the people who steal them want access to your finances and personal data too.

You can help protect your money with some simple steps:

- Enable biometrics (this is fingerprint or facial recognition). Do this on both your phone AND on your banking apps. Make sure you don’t use the same PIN for both.

- Use remote tracking apps. This means you can locate your device if it’s lost. It might also give you access to additional features to keep you protected.

- Use your phone’s extra security protections. There are different options depending on your device type. These can help prevent changes being made if it gets stolen.

You can find more information here about protecting your device.

And if you’re unfortunate enough to have your phone stolen, it’s important to take action quickly. We can help protect your money, so give us a call straight away.

Make sure you confirm payment details in person or over the phone using a known and trusted number. Learn more on our spotting fraud and scams page.

Criminals use DocuSign to send documents for payment redirection scams, or to download malware to your device. The email address they’re sending from looks like the real DocuSign one, but the document inside is fake.

DocuSign have tips on spotting these messages. For example, you can check for the security access code found at the bottom of each message. For more tips on how to stay safe visit DocuSign's website.

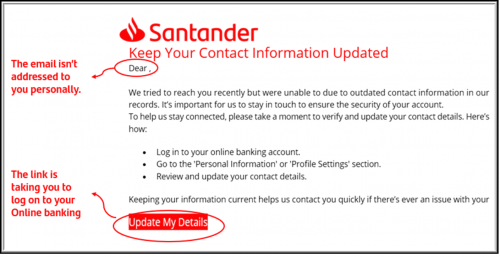

Criminals are impersonating Santander. They’re sending emails to our customers asking them to update their contact details, via a link.

The link takes you to a fake Santander website. Here you’ll enter your Personal ID and Security number. You’ll believe you’re logging on to our real site. In the background, the criminal is taking your details. And then using them to logon themselves. They change the details on your real account. And a One Time Passcode (OTP) is sent to you to authorise it.

Keep you and your account safe by following some simple steps:

- We’ll never send you a link to log into your Online or Mobile banking. To access your accounts, always visit www.santander.co.uk directly or use our mobile app.

- Make sure the email’s really from us. We’ll always:

- Address it to you personally

- Include the last 4 digits of your account or card number. Or the last 3 characters of your postcode

- Think twice before entering an OTP. Always review the full OTP message, checking it accurately describes your transaction. If it doesn't, stop and give us a call.

If you think criminals have contacted you, stop. Call us now to speak to one of our expert team.

Learn more about how you can protect yourself. Visit the spotting fraud and scams page on our website. Or you can visit Take Five. A national campaign offering impartial straight-forward advice.

Finding friendships or romance online is becoming the new normal. Lots of people use the internet to make new connections. Unfortunately, criminals exploit this and use this as an opportunity to build fake relationships to steal someone’s money.

These relationships can be built up over days, months or years. The criminal wants to make that person trust them.

When they feel like it’s the right time, they’ll start asking for help with money. It normally starts off as smaller amounts that they promise to pay back. Eventually they borrow more and more until the money runs out.

They prey on your emotions and willingness to help. Sometimes you don’t even recognise this is happening. It can be difficult to face reality and accept what is happening, especially when there are feelings involved.

We’ve teamed up with ‘Traitors’ contestant Paul Gorton to help you recognise the red flags. We want to help you protect yourself, and the people you care about. Take a look at Paul in our romance scams video

What can you do to stay safe?

- Don’t believe everything you see online. Pictures can be edited, and fake profiles can easily be made. It’s important to check if the person you’re talking to is who they say they are. You can do this by doing a reverse image search to see if a person's picture has been stolen from somewhere else.

- Try to remove emotion from your decision-making. Be really careful if you're lending or giving someone money. No matter how urgent their reason might seem, its important you think it through. And we'd always suggest talking it through first with someone you trust.

- Be honest with us. If we ask you questions about a payment you’re making, always tell us the truth. We do this to protect you and make sure its genuine.

Check out our spotting fraud and scams page to learn more about how you can keep yourself safe.

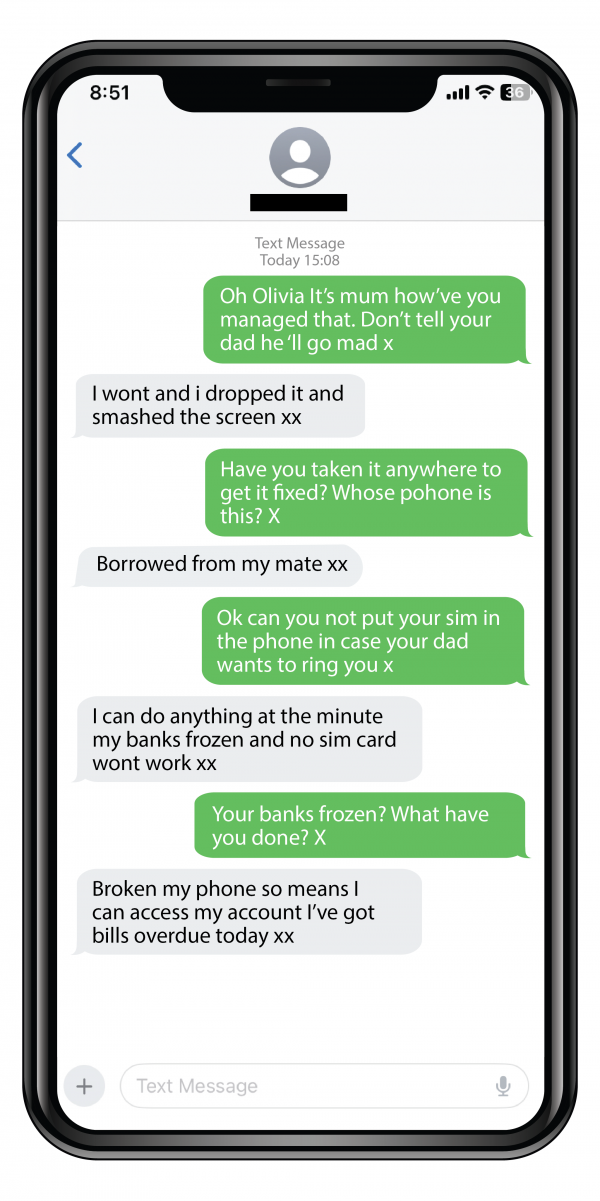

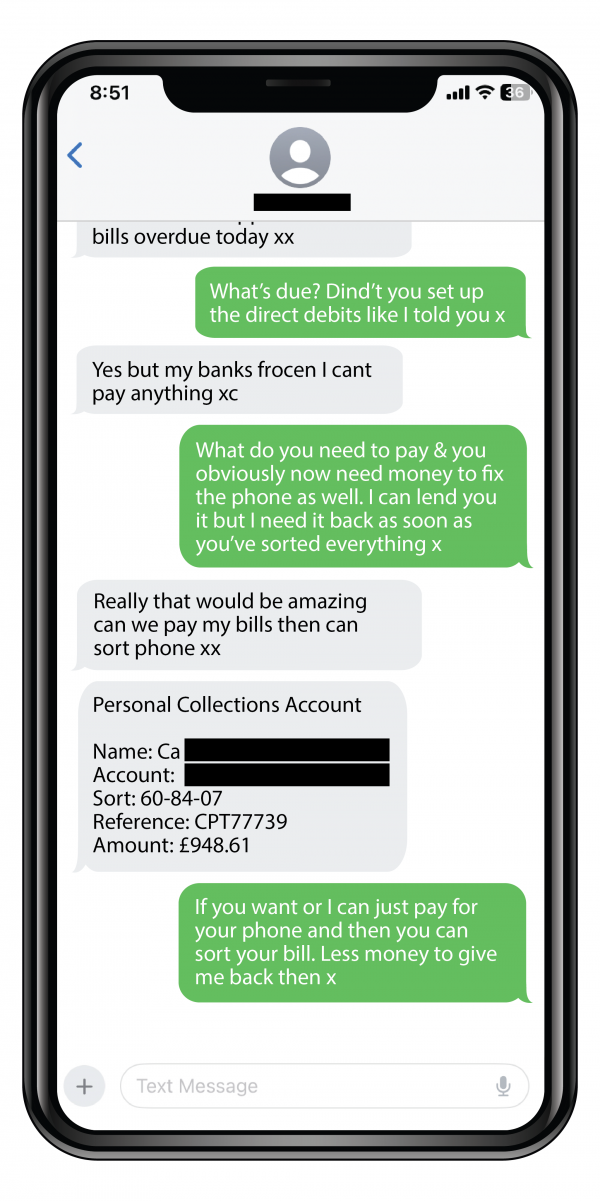

Criminals pretend to be your family and friends asking for help with money. They send you a WhatsApp or SMS message from a new number. They may ask to borrow money or for you to help pay their bills.

Here's an example of what these text conversations could look like.

Following some simple advice can help you keep your money safe.

- Don't take anything at face value. Criminals pretend to be people you trust. Make sure you know who you’re talking to first.

- Double-check all payment requests before sending your money. It’s best if you can check in person. But if not, use a known and trusted number. Don’t use the contact details within the payment request.

If you think criminals have contacted you, stop. Call us now to speak to one of our expert team.

Learn more about how you can protect yourself. Visit the spotting fraud and scams page on our website. Or you can visit Take Five. A national campaign offering impartial straight-forward advice.

Criminals pretend they’re us to steal your money. They'll say anything to convince you they're for real. And they’ll coach you on what to say to your bank. Here are some things they tell customers:

- “We’re going to generate a new safe account to send your money to whilst we secure your account”.

- “It’s important you act really quickly otherwise even more money will leave your account”.

- “If you speak to someone in the bank and they ask you if you’ve been asked to lie to them, you must say no”.

- “There will be a lot of pressure because of safeguarding. You must make it clear to them that it’s your account and your money, and you know what you’re doing”.

- “Let’s practice what you’re going to tell the bank when you speak to them”.

To keep your money safe, remember:

- We’ll never ask you to move your money to keep it safe. If anyone does, it’ll be a scam.

- Criminals will tell you to lie to us. If you’ve been told what to say, stop and tell us now so we can help.

If you think criminals have contacted you, stop. Call us now to speak to one of our expert team.

You can also see how to spot frauds and scams. Or, for impartial, straight-forward advice, go to Take Five.

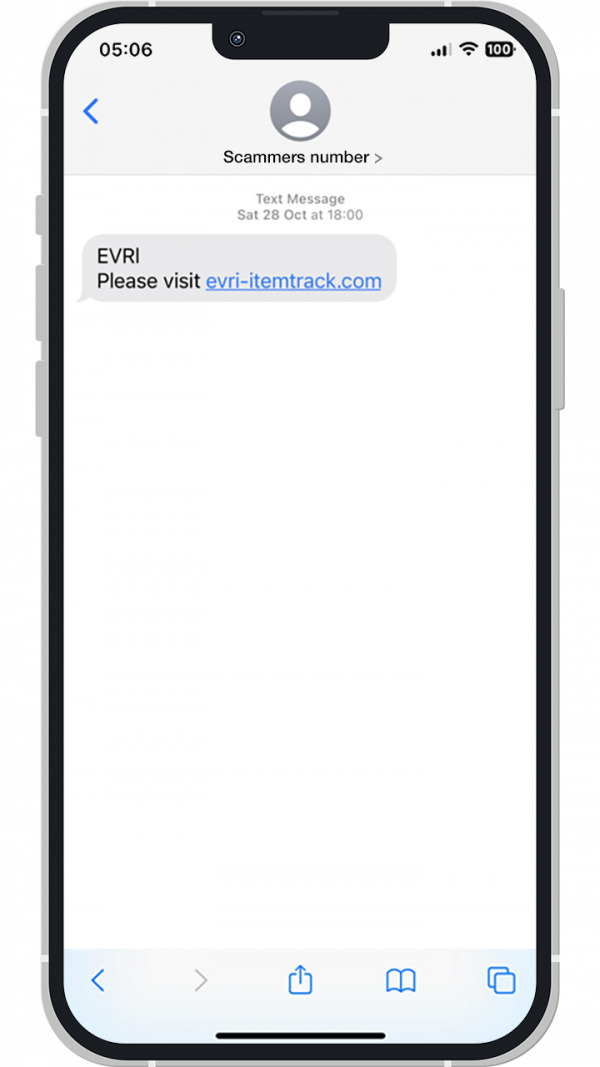

Lots of people receive deliveries at home, and criminals use this as a way to steal your money. They will send fake messages and emails pretending to be delivery companies.

They’ll say you’ve missed a delivery and need to reschedule. The message will have a link and will ask for information such as your name, address, and card details to pay a small fee.

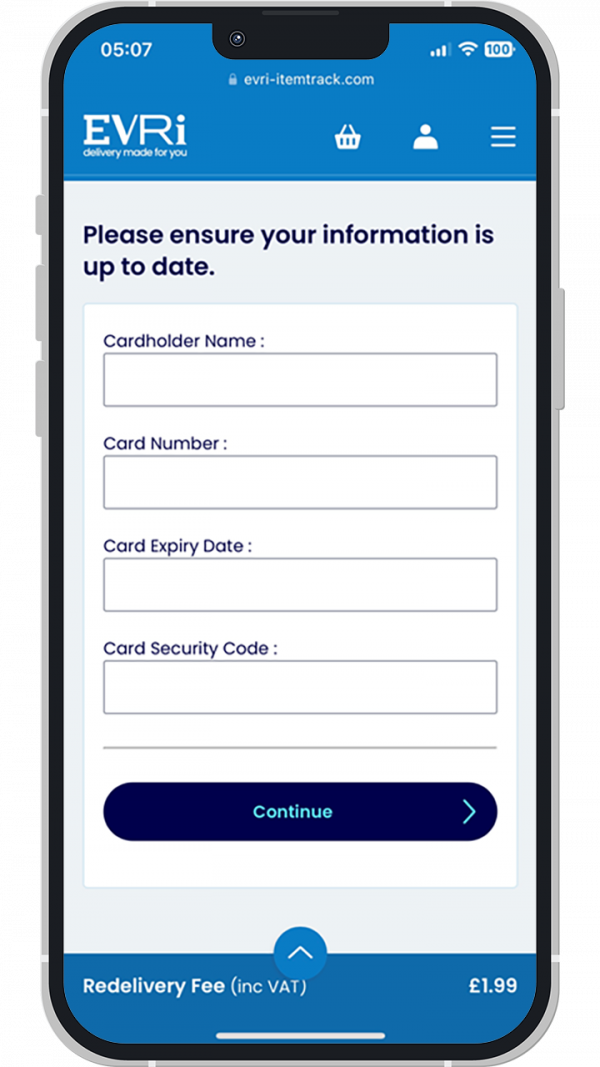

Here’s an example that shows what information they ask for.

These scams usually start with a text message from an unrecognised number posing as a courier company. This text usually includes a link to a fake website.

In this text, the scammers are pretending to be from Evri and want you to click on a link.

This link will take you to a fake website. The scammers want to make you think that you need to pay a fee before the parcel can be delivered or rescheduled.

In this example, the fake Evri webpage wants you to rearrange a missed delivery.

The scammers will then try to trick you into giving them your personal details like your card number.

Here, the fake Evri webpage asks you to add your card details so you can pay for a delivery fee.

Keep yourself safe

- Don’t click on a link in a text or email and enter any of your personal information.

- Never take things at face value. Criminals pretend to be people you trust. Always make sure you really know who you’re talking to.

- A genuine organisation will never rush you in to taking action. Always take time to double-check what you're being asked to do. Use a publicly available phone number or online chats through the company's app/ website to get in touch.

If you think this has happened to you contact your bank straight away. Criminals can use the information you've shared for other scams. They may call and impersonate your bank or other genuine companies.

Beware of ‘follow-on’ scams

Over 17,000 people a year fall victim to a second fraud or scam after the first one.

Criminals use the information shared through previous scams – like name, address and card details. They do this to make you believe they’re real.

We're aware that there's been a spate of these linked to purchases made through fake Wilko social media adverts, but information can come from other sources.

Criminals may pretend to be a bank or the police. There are a few different things they might ask you to do.

This includes:

- Asking you to move your money to keep it safe.

- Asking you to withdraw cash or buy goods. Then hand these over to someone to assist with an investigation.

- Telling you they can help you get back money lost to fraud.

Criminals can make their calls, emails or texts look like they are from someone else, like your bank.

They can make a fake text appear next to other genuine texts. Call back using a phone number you know is genuine, like one on their website.

Keep yourself safe

- Never move money out of your account for security reasons. Criminals may say that your account is at risk and to keep your money safe you need to move it to a new account. If this happens, it’s always a scam.

- A genuine organisation won’t rush you in to taking action. Take time to double-check what you're being asked to do before moving your money. You can use a publicly available phone number.

- Always be honest with the reason for your payment. This is so we can help protect you.

For more information visit spotting fraud and scams on our website. Or visit Take Five, a national campaign offering impartial straight-forward advice.

Last year, people in the UK lost £31.3m in romance scams. Criminals target people through dating sites and social media. They build up a relationship or friendship over time. Then, once they have a connection with you, they'll ask you to send money to them. And they'll always have a good-sounding reason. These are phrases we've seen used by criminals in actual scams:

"My account's frozen, and I can't access my money"

"I'm working overseas"

"I'm working on an oil rig“

"I've been arrested"

"My *family member* is sick"

"I’m struggling with medical bills“

New research from Santander shows almost a third (31%) of Brits have been targeted by a romance scammer. More than four in five Brits (83%) who fell victim to a romance scam said it was either the clever language the criminals use, the way they were spoken to, or the intimate conversations they had with the scammer.

Take a look at our new campaign 'Love Hurts'. We’ve teamed up with dating expert and Celebs Go Dating star Anna Williamson. The new campaign takes commonly used phases by scammers and puts them on Love Hurts sweets to help improve public awareness of key warning signs.

There's a rise in the number of fake HMRC emails going around.

These fake emails will try to grab your attention with urgent language or 'too good to be true' offers. The hooks criminals use will vary, but here are some of the common ones:

- tax credit renewals deadline: 31/07/23.

- update your records

- a £460 discount offer under the Energy Bill Support Scheme, but you need to add your card details.

Each email will ask you to click on a link and fill in your personal and financial details. The scammers will use time sensitive scenarios in their emails to make you enter your personal details without thinking.

Just remember:

- HMRC will never send emails about rebates or refunds

- Never click on a link in an unexpected email and enter your details

- You should always contact HMRC to verify any payment request using the number on the gov.uk website or through your online tax account.

Use the FCA’s Firm Checker. It’s designed to confirm if a firm is authorised and has the correct permissions to provide services.

It's always a good idea to take the time and carry out extra checks on a company before investing. For example, check that the telephone numbers you’ve been given match those registered to the company so you can contact them directly using the genuine number.

Take a look at our spotting fraud and scams page for more information and our tips to protect yourself.

As we feel the effects of higher energy bills, there's also been a rise in cost-of-living scams. Criminals are looking to exploit people by pretending to be energy companies and other trusted organisations.

Criminals are sending customers a link and asking them to sign up for the government's Energy Bills Support Scheme. However, you don't need to apply for the scheme. For more details, visit the Energy Bills Support Scheme page.

Always think about what you’re being asked to do and carry out any checks you need to satisfy yourself that it’s legitimate. If you’re not sure or feel uncomfortable, stop.

Take a look at our spotting fraud and scam page for more information and our top tips to protect yourself.