Join the Investment Hub with no commitment to invest

Buy, sell and manage your investments easily.

The Investment Hub gives you a clear way to view and manage your money when investing.

- You can keep it simple and pick from our 4 ready-made investment funds.

- Or, you can choose from a wide range of other funds from across the market.

Join the Investment Hub, with no commitment to add any money or invest until you’re ready. Once in the hub you can choose to open a Stocks and Shares ISA or Investment Account, decide how much to invest and research the funds available

Invest with as little as £20 a month or a £100 lump sum.

Simple dashboards to help you monitor your investments.

Easily buy, switch or sell your investments.

Ability to transfer in stocks and shares ISAs and investments you hold elsewhere so that everything can be viewed and managed in one place.

Access to your investments with your mobile, tablet or laptop.

All with a clear charging structure

0.35% p.a. maximum platform service fee

View our fees, charges and key documents

Advice is to hand

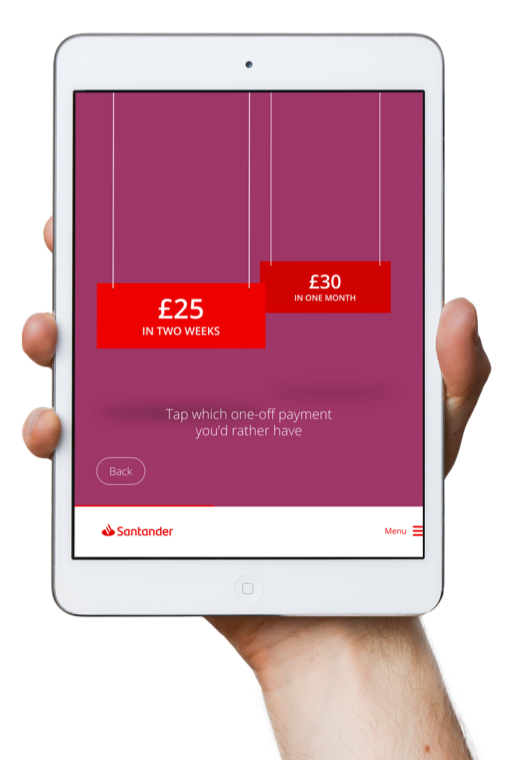

By joining the Investment Hub, you’ll get access to online advice through the Digital Investment Adviser.

This will let you see how much you could gain from investing, evaluate the downside, and contemplate the emotional aspects of investing by answering some easy questions.

Get online advice Read more about online advice

Investing using our mobile app

Stay on top of your investment on our app

- Sign in securely using Touch ID, Face ID, or Fingerprint.

- See your other Santander accounts alongside your investments.

- View the investment you hold and their current values.

Continue into your Investment Hub

- Monitor your investments performance wherever you are.

- Buy, switch, sell or top up your investment anytime.

- Transfer in stocks and shares ISAs or other investments you hold elsewhere so that everything can be viewed and managed in one place.

Why invest with Santander?

Source: Santander UK plc as at October 2024