Santander Global Connect Automated Sweeping

Santander Global Connect Automated Sweeping is an additional service which is available through Santander Global Connect. Automated Sweeping allows you to control the movement of funds between ‘child’ accounts and a centralised Santander ‘master’ account. This is achieved by setting target balances to be maintained in child accounts, sweeping into or from a Santander master account.

To use Automated Sweeping, you’ll need to register for it. To register, you’ll need to complete an Automated Sweeping Service Set Up Form. You’ll use this form to provide your sweep instructions to us.

This will include:

- the accounts you want to sweep funds to or from

- the target balance you want to maintain; and

- the date, time and frequency of the sweeps you want to carry out

This page provides guidance on how to set up Automated Sweeping and how to make the most of the service.

If you’d like to register, please speak to your Relationship Team for more information.

For technical support, including servicing or onboarding support, please contact our dedicated support team. You’ll find their contact details on the Automated Sweeping Service Set Up Form.

Account structures

To use Automated Sweeping, you'll need to tell us your ‘account structures’.

An account structure needs to contain a ‘master’ account and your ‘child’ accounts.

The master account must be a bank account held with Santander. It will be used as the main account that funds are centralised in to optimise liquidity across your organisation.

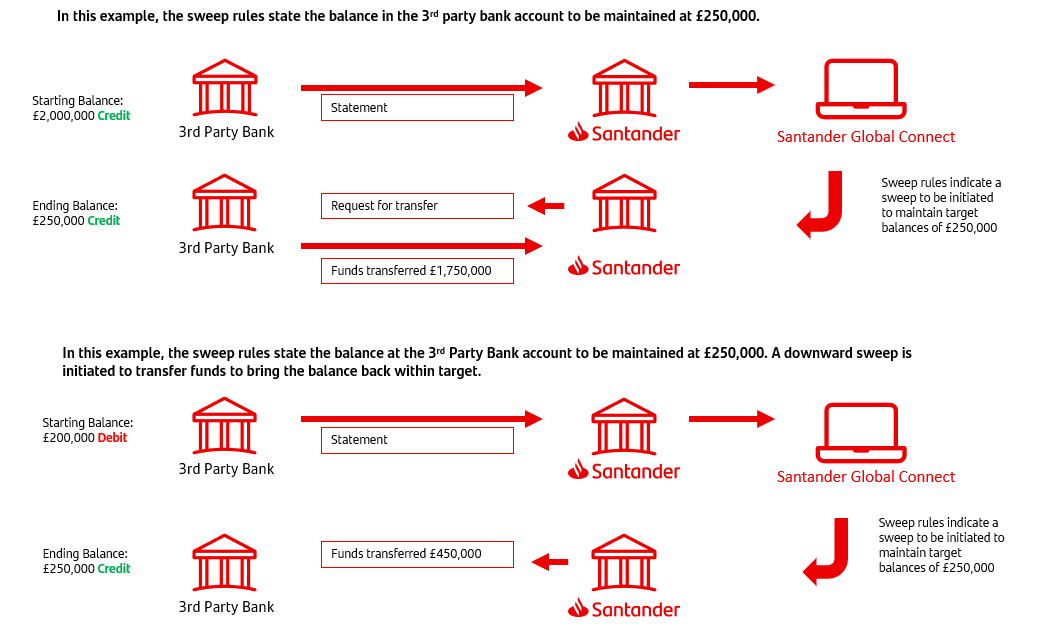

A child account can be another bank account you hold with Santander or a bank account you hold with a 3rd party bank. You’ll need to set a target balance that you want to maintain on this account which will be used to determine whether to carry out a sweep. All sweeps will be carried out in the currency of this account.

If the balance on the child account is above the target balance, funds will be transferred from the child account to the master account. If the balance on the child account falls below the target balance, funds will be transferred from the master account to the child account.

You can choose if you want the sweeps to go in either direction, or both.

Account structures

To use Automated Sweeping, you‘ll need to tell us your ‘account structures’.

An account structure needs to contains a ‘master’ account and your ‘child’ accounts.

The master account must be a bank account held with Santander. It will be used as the main account that funds are centralised in to optimise liquidity across your organisation.

A child account can be another bank account you hold with Santander or a bank account you hold with a 3rd party bank. You’ll need to set a target balance that you want to maintain on this account which will be used to determine whether to carry out a sweep. All sweeps will be carried out in the currency of this account.

If the balance on the child account is above the target balance, funds will be transferred from the child account to the master account. If the balance on the child account falls below the target balance, funds will be transferred from the master account to the child account.

You can choose if you want the sweeps to go in either direction, or both.

Setting up a bank account held by an affiliate with Santander as a child account

To register a bank account that is held by an affiliate with Santander as a child account, you’ll need to provide us with a mandate from your affiliate that confirms that as the account holder of the child account, they have authorised you to register their account for the Automated Sweeping service and that you are authorised to provide sweep instructions on their behalf. We’ll need this to confirm that we can act on your instructions. Your Relationship Team will provide you with the mandate that needs to be completed.

Additional functionality

We also have these features available to you:

- Reverse sweeps – this returns the funds to the account they came from at the start of the following business day.

- You can set minimum and maximum sweep values to prevent very large and very low value sweeps.

- You can set cumulative maximum sweep limits for a specified period.

- Sweep start and end dates.

- Times of sweep calculation and initiation.

To use these features, you’ll need to complete the relevant sections of your Automated Sweeping Service Set Up Form.

Initial Setup

You will need to instruct your 3rd party banks to send us intra day or end of day statements in line with your sweep instructions and the relevant cut-off times (see below).

Sweeps will only be executed after we start receiving these statements. Sweep instructions cannot be setup and executed on the same day. Please contact the Corporate Digital team if you need any additional guidance.

Cut-off times

There are two types of cut-off times that you need to be aware of when using Automated Sweeping.

Automated Sweeping service cut-off times

The automated sweeping service is only available on business days in the UK (Monday to Friday, excluding bank holidays).

The cut-off times for the purposes of the automated sweeping service are:

| Day | Start time | End time |

|---|---|---|

| Monday - Friday (excluding bank holidays) | 01:00am | 11:45pm |

Payment processing cut-off times

All banks have cut-off times for when payment instructions need to be received for them to be deemed to be received the same day. When you instruct us to carry out a sweep, you need to consider the relevant cut-off times for the account that will be debited as part of the sweep. This includes both if the account is held with Santander and if it is held with a 3rd party bank.

- Any sweep from a Santander account must be set prior to the cut off time for the relevant payment type (e.g. online, CHAPS or SWIFT payments). These are published on our website which can be accessed using the following link: Payment cut-off times | Santander Corporate and Commercial Banking. You should tell us which payment method you want us to use when setting up your sweep instruction. Different payment methods may have different cut-off times.

For example, the cut-off time for sending a same day Euro payment from a sterling Santander account is 14:50 so your sweep instruction must be scheduled prior to this if the child account is in Euros.

- Any sweep from a 3rd party bank account will be subject to the relevant cut-off times set by the 3rd party bank. You should consult your 3rd party bank to understand the payment method they will use to execute the payment and the relevant cut-off time. As the decision to initiate a sweep from a 3rd party bank account will be dependent on the intra-day or end of day statement sent to us by your 3rd party bank, we recommend that you set your sweep for at least 30 minutes after the intra-day or end of day statement is due to be sent to us.

For example, if you want to send a same day sterling CHAPS payment from a child account in the UK to your Santander master account, your 3rd party bank may have a cut-off time of 17:00. This means you should arrange for us to receive the intra-day statement no later than 16:30. If you want to send a same day USD payment from a child account to your master account, your 3rd party bank may have a 10:00 cut-off time which means you should arrange for us to receive the intra-day statement from them by no later than 9:30.

Reverse sweeps

- Should you request a reverse sweep, we’ll return funds or send over a request for transfer to your 3rd party bank at the start of the following business day.

Payment settlement times and time zones

- When you set up your sweep instructions, you need to consider the time it will take for the payment to settle. Different types of payments (particularly international payments) may have different payment settlement times. You also need to consider whether the sweep will involve more than one time zone. If it does, it may take longer for the sweep to be completed. These are particularly important factors to consider if you want to set up sweeps on a daily basis or want to initiate reverse sweeps.

You can contact your implementation manager for further help and guidance when setting up your sweep instructions.

Automated sweeping

Sweep success reports

The Automated Sweeping service provides you with a sweep success report for each structure.

This is how we will notify you if a sweep has failed. We’ll tell you the reason why the sweep has failed using the report.

The report can be accessed using the main Santander Connect banking service under the ‘Statements & Documents’ section.

These reports are generated daily and show the previous day’s activity. They will be available from 9:00 each day.

To access your report:

- On left hand menu, click ‘3rd Party Bank Account via SWIFT Reports’.

- In the ‘Master account ID’ dropdown, choose the structure you want the report for.

- In the ‘Report type’ drop down, select ‘Sweep success report’.

- Select the date range in the ‘from date’ and ‘to date’ selections.

- Click ‘Confirm’.

- A report for each day within the date range selected will be loaded in the lower part of the screen.

- To view a report, click on ‘Download’.

To access these reports, a user needs to have the relevant access permission within Santander Connect.

This permission is called “3rd party account sweep success reports”.

If a user does not have this access permission, a Santander Connect Authorised Administrator will need to grant them access. They can do this by following the below steps:

- Log on to Santander Connect. Please refer to Connect Help Centre on how to log on to Santander Connect.

- Click on ‘Administration’ then ‘Manage users’.

- Choose the profile of the user you want to update and click ‘Edit user’.

- Click ‘Edit roles’.

- Assign the role of ‘3rd party account sweep success reports’ and/or ‘3rd Party Account Sweep ICL Reports’ to the user.

- Click ‘Continue’ and ‘Confirm’.