Helping you manage currency risk

Foreign exchange movements can impact your margins, cash flow and balance sheets. Our regionally based specialist teams can help you identify, review and manage foreign currency risk.

Simple solutions for trade finance

Access a range of tailored financing options from working capital and term loans through to supplier finance. Our team will work with you to understand your trading risk profile, how risks can be mitigated and will deliver the most appropriate product mix.

Helping your multinational business

We’re a global bank, which means we can help you worldwide, as well as in your local area. We provide personalised guidance and a full suite of financial products, advanced global technology platforms, deep market expertise and an extensive network. All of this is designed to streamline your international expansion.

Export globally - faster, simpler, smarter

Your fast track to global growth

Already trading or just starting out? Navigator Global by Santander helps give you the edge. Get faster access to new markets and cut costs – all in one place.

Access step-by-step guidance, real-time intelligence, and – with Premium membership – verified providers and in-market experts, helping you grow with confidence.

Tailored coaching tools

Unlock your potential with coaching tools designed just for you. It’ll make things clearer, help to set goals, and help to grow your business.

Exclusive intelligence

Stay ahead with powerful insights from trade news and local expertise. Plus, access exclusive content. It can help your business growth and allow you to explore new markets.

Expert connections

Connect to over 250 verified providers and in-market experts who can help drive your business forward. Premium membership only.

Standard membership is free. Fees apply for Premium membership. Speak to your local Santander contact about how you can get a discount for Premium membership. If you don't already bank with us, get in touch today. Navigator Global replaces Santander Navigator and is more personalised, intuitive and mobile enabled. Navigator Global is a non-regulated entity.

New to global trading?

We’ll help you discover new opportunities in global markets.

- Identify market opportunities.

- Get to know the basics of trade and shipping logistics.

- Explore markets.

- Get to know the local laws and regulations.

- Understand what financial support is available. Subject to meeting minimum criteria.

- Get ready to trade.

Already trading overseas?

Use tools and services that help your business grow and run smoothly in the market.

- Explore new markets.

- Conduct checks on overseas partners (Premium membership).

- Grow bigger and work more efficiently.

- Find new verified service providers (Premium membership).

Already established abroad?

Get guidance and connections that help optimise your existing global business.

- Optimise existing operations.

- Stay compliant across the globe.

- Grow your business in a smart and smooth way.

Helping businesses reach new markets

G&I Spirits had their sights set on international expansion. Through our connections, they’ve successfully broken through into markets they never thought they’d be in.

Supporting business success overseas

With export ambitions for Poland, see how we helped connect Zabou with the experts they need to get up and running in Poland. Gary Neville and our Poland country specialist, Magda Crosa, talk through the key considerations, learnings and watchouts.

Connecting businesses to new markets

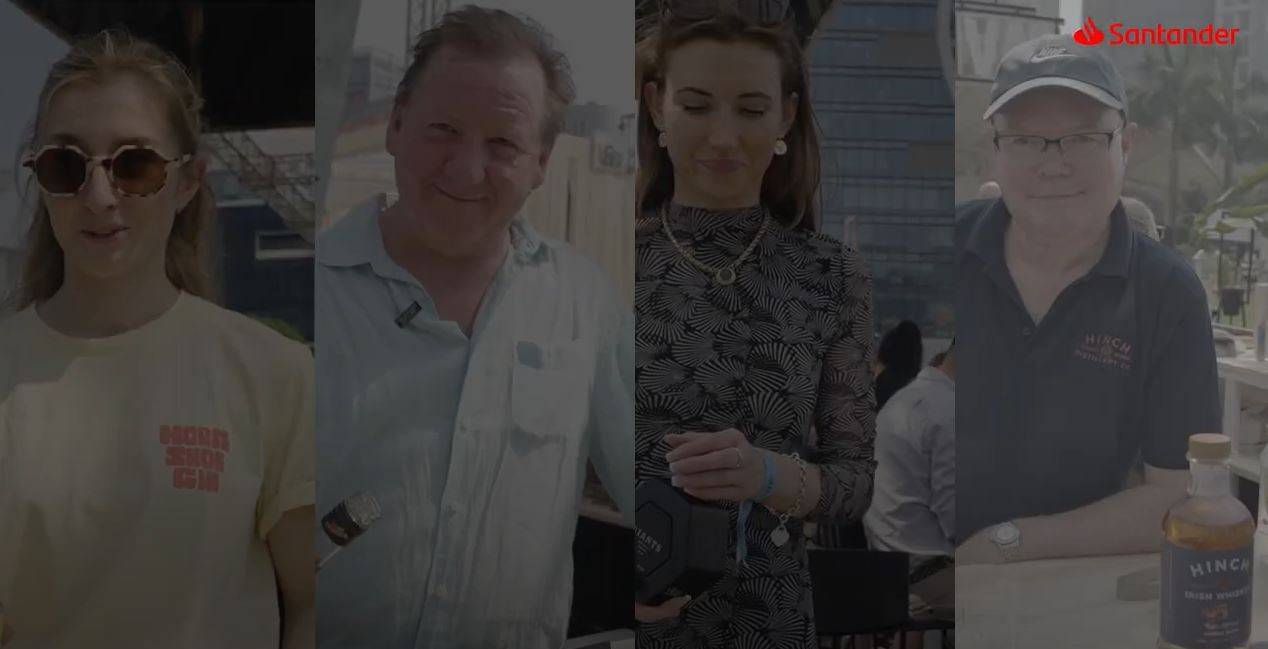

Our trade missions are a great way to build the connections you need to grow. We took 14 gin and whiskey businesses to India to meet the people who could help them expand into this market. Watch our video to see how we could support your business expand into new markets.

Insights and solutions for international growth

Trade Barometer Autumn 2025

We asked businesses what they see as their biggest prospects and challenges when it comes to growing overseas. Our key findings are below.

- Businesses thinking about expanding overseas has reached an all-time high.

- The greatest growth opportunities are expected to come from the US, Germany and France.

- Over half of businesses have or are thinking about bringing their supply chains closer to home.

- The greatest barriers to trade is the risk of tariffs and regulation.

- AI, staff training and upskilling are the key areas for investment.