UK businesses go global in search of growth

Confidence among British businesses is proving resilient, but it’s firms with exposure to markets beyond the UK that feel most optimistic.

Our Spring 2023 Trade Barometer reveals UK businesses believe expansion overseas can help them defy the tough economic backdrop. The findings show businesses that already sell products or services in overseas markets, or have plans to do so, feel significantly more optimistic about the next 3 years than companies which operate solely in the UK.

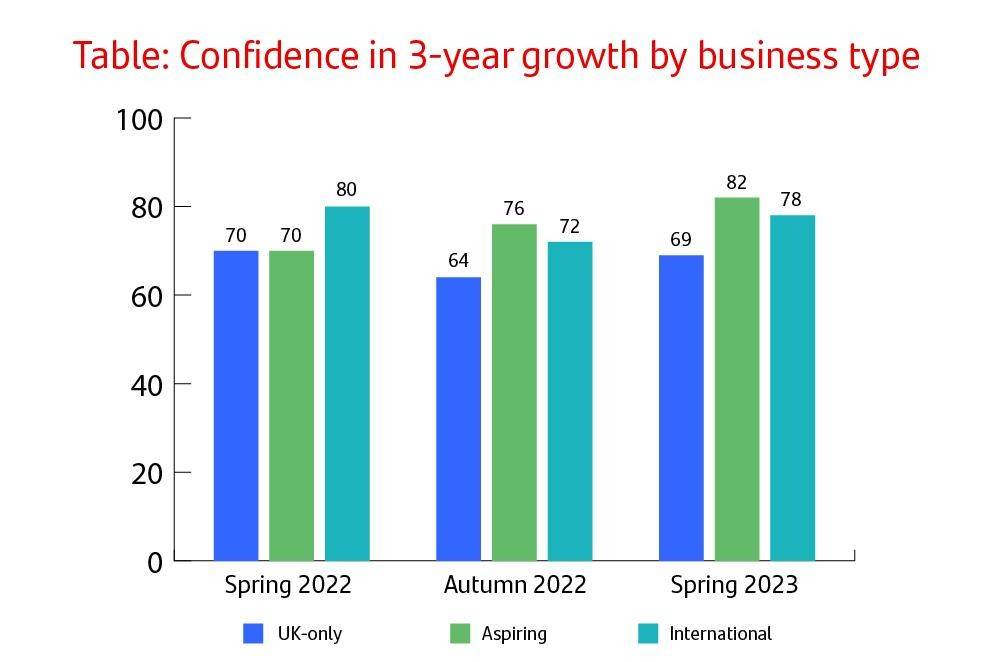

Our research, based on more than 1,000 businesses, suggests confidence is proving more resilient than might be expected given challenges such as rising inflation, slowing growth and market disruption. But while 69% of domestic-only businesses are confident they’ll grow over the next 3 years, this figure rises to 78% for those already selling overseas – and to 82% for those with plans to do so.

Reward outweighs risk

Our Spring 2023 Trade Barometer underlines the extent to which international expansion – sometimes perceived as a leap of faith for businesses currently focused only on the UK – can provide important risk-management benefits. While only 46% of domestic-only businesses in our research report that their performance has improved over the past 12 months, 59% of their international peers have seen better results

Our research suggests that overseas markets can generate significant diversification advantages for UK businesses exporting goods and services at a time when other economies are expected to outperform.

The International Monetary Fund’s latest World Economic Outlook predicts that the UK economy will shrink by 0.6% over the course of 2023, while the global economy as a whole expands by 2.9%. Developed markets such as the European Union (expected to grow by 0.7% in 2023) and the US (1.4%) could therefore provide crucial respite for UK businesses. Developing markets such as India (6.1%), China (5.2%) and the Middle East (3.2%) also offer valuable opportunities. (Source: IMF Blog– Global economy to slow further amid signs of resilience and China re-opening).

Many of the businesses in our research share that view. Some 57% point to the UK’s high rate of inflation as likely to have a negative impact on their business over the next year, with energy prices a particular concern. 54% are worried they may be adversely affected by a slowing British economy. By contrast, only 43% of businesses expect to suffer because of sluggish global growth.

Against this backdrop, overseas markets are widely regarded as offering UK businesses a way forward. More than a third of businesses (36%) say international markets have become more important as a result of current challenges. And 38% of businesses point to growth from overseas sales – in both new and existing international markets – as a potential driver of recovery over the year ahead. This is the biggest factor singled out.

Businesses focused on overseas sales say their determination to reduce their reliance on the UK economy and point to the greater potential of international markets. Many expect their products and services to sell better in target markets.

Overcoming the challenges

This is not to suggest that internationalisation is always straightforward. Many of the businesses in our research are concerned about a range of challenges that could stand in the way of their ambitions.

Skills shortages are a particular concern, highlighted by 33% of businesses as a potential threat to their international trade. One problem is that businesses are struggling to recruit and retain staff as they scale up. But there’s also concern that they lack the skills required for trading overseas, from dealing with new partners and customers to navigating bureaucracy and tariffs.

High transport costs are also worrying many businesses with international operations. While the cost of shipping freight has fallen dramatically since the all-time highs seen during the Covid-19 pandemic, costs remain high by historical standards (Source: Freightos Data). And the disruption isn’t over. In our Spring 2023 Trade Barometer, 38% of businesses say transport costs are a key challenge when selling overseas. 69% worry about the potential for shipping delays.

Nevertheless, businesses are determined to explore the potential of overseas markets, seeking assistance from third-party advisers where necessary. And the opportunities are global. 46% of businesses expect to see growth for their business in the European Union over the next 12 months, despite ongoing frustration with Brexit-related problems. Significant numbers also predict growth in countries including the US (35%), Australia (20%), the United Arab Emirates (16%) and India (16%).

How we can help

We've made it easier than ever to grow your business internationally with Santander Navigator.

With our Santander Navigator platform, you'll have access to the knowledge and insights you need to determine where your next international market is. You’ll also be able to connect with key intermediaries and buyers and distributors there too. And if there are any challenges you might face when commercialising your target market e.g. completing customs documentation, shipping your goods or finding people with the necessary skillsets, we can help you overcome them too.

Santander Navigator is a one stop shop for all your international needs. This means saving time and money as you grow internationally by having everything at your fingertips without having to commission research yourself, visit multiple websites or call different companies, organisations or distributors.

Subscription fees may apply for some packages. For more information about Santander Navigator visit www.santandernavigator.co.uk or contact santandernavigator@santander.co.uk