Rising to the Covid-19 challenge

This is the first weekly update from our Aerospace, Advanced Manufacturing & Rail team on how the Covid-19 pandemic is affecting our clients and the sector as a whole.

Many of the UK’s advanced manufacturers are now focused on how to confront the Covid-19 pandemic head on. For example, one consortium has been working with medical appliance manufacturers exploring how to increase production of ventilators, and to develop new models, with units due to start to be delivered to the NHS early this month. Several of our clients are involved in this initiative and we were able to introduce one of our customers to the consortium with the offer of an air cargo service to help get ventilators distributed as quickly as possible.

These projects underline just how quickly the industry is having to respond to a rapidly changing situation. The impact of Covid-19 is now being felt across most sub-sectors of aerospace, advanced manufacturing and rail, but in different and specific ways. In rail and air travel, the biggest problem is slumping demand; in industries such as electronics, which depend on components from China, supply chain issues are to the fore.

Moreover, the nature of the problem is constantly evolving. For example, a few weeks ago, China’s factories were shut, leaving them unable to supply the industry with key components. Now, many of those factories are open, but distribution is a key problem, with freight unavailable or unusually expensive. These challenges may take several weeks to resolve.

Similarly, on the demand side, some industries are more resilient than others. Aerospace manufacturers typically remain open, albeit producing lower volumes, with many benefitting from strong sales in January and February, the best start to the year for global aircraft orders in six years. An overall aircraft backlog of 14,094 units represents eight years of work-in-hand, worth £210bn to the UK, providing long-term confidence amid the short-term uncertainty. Still, deliveries have begun to slow and in the coming months the effect of Covid-19 will be felt in year-on-year comparisons of new orders. Some firms are also struggling with production. Airbus has shut its facilities in Spain until at least 9 April, with knock-on effects for its suppliers. Spirit Aerosystems in France also shut for a short period, though it has now reopened.

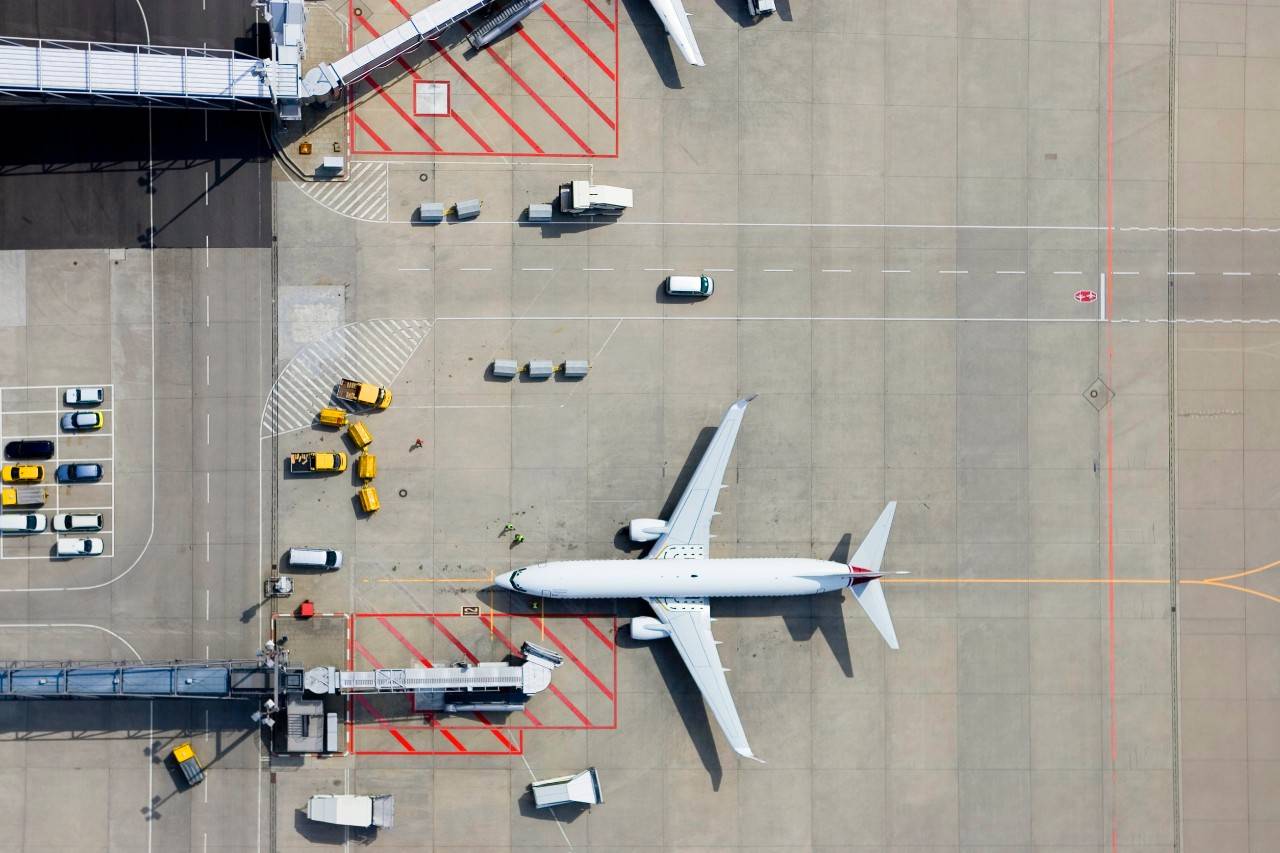

In aviation, by contrast, the demand picture is more worrying, with a third of the world’s aircraft now grounded. The future of many airlines is uncertain and this will inevitably impact on manufacturers in time. More broadly, airline nationalisation programmes, a possibility in this crisis, would have a significant impact on purchasing decisions, with governments keen to support their own industries. This has implications for UK manufacturing and supplied services.

The rail network remains open, with Network Rail pledging to keep the railways in operation so that key workers and vital supplies can continue to move around. That said, some non-essential work has stopped. Across Europe, most – but not all - Original Equipment Manufacturers (OEMs) remain open; UK suppliers will potentially be impacted as the situation evolves.

Manufacturing data begins to tumble

More broadly, the effects of the pandemic on manufacturing are now beginning to show up in sector data. The IHS/Markit Purchasing Managers Index, based on a survey of business leaders in the sector, fell to 47.8 in March, a three-month low and down from 51.7 in February. Any reading below 50 indicates a majority of respondents have experienced a contraction in activity.

Given that the UK government’s response to Covid-19 did not accelerate until the second half of the month, with the Prime Minister introducing lockdown measures on 23 March, April’s figures are likely to be significantly worse. Manufacturers across the UK are now focused on liquidity and very careful cash flow management. Several listed engineering companies have now announced they are cancelling planned dividends in order to conserve cash and we expect more to follow this example.

The experience of manufacturers in the UK mirrors that of their counterparts in other parts of the world. Factory activity contracted across most of Asia in March as the pandemic paralysed supply chains. Significant falls in activity in Japan and South Korea overshadowed a modest improvement in China where authorities have felt able to relax some of the restrictions as Covid-19 cases have slowed. With the number of countries around the world imposing their own lockdown regimes, we now expect the impact of the pandemic on global supply chains to be more enduring than many originally expected.

- To discuss how we can help your business during the Covid-19 pandemic, please contact issinsight@santander.co.uk