Remove Brexit roadblocks to promote growth

Our latest Trade Barometer suggests British businesses are keen to maintain trading links with their neighbours in Europe. But they must be supported in overcoming the bureaucratic hurdles caused by Brexit, as well as other obstacles such as a lack of skilled staff.

Our Spring 2023 Trade Barometer reveals UK businesses increasingly view European markets as a key source of future growth. But the ongoing trading challenges created by Britain’s departure from the European Union (EU) and the customs rules introduced at the start of 2022 continue to represent a significant obstacle.

Our research shows that the EU is the global region most likely to drive international growth over the next 12 months. It’s cited by 46% of businesses compared with 40% that highlight North America. This is followed by 25% which point to the Middle East-North Africa (MENA) region. Similarly, 25% expect markets in Oceania to be a source of new business.

Brexit blockages

However, growth in the EU is threatened by ongoing issues relating to the UK’s post-Brexit arrangements with its nearest neighbours. Almost half (48%) of businesses that already operate internationally say the new regulatory framework has made trading with existing markets more time-consuming, while 42% report having to pay more in terms of tariffs and local taxes. Almost 4 in 10 businesses (38%) believe the present terms of trade are less favourable than before Brexit.

International operations and growth

British businesses are currently most likely to sell to the EU (84%) or North America (68%). In terms of specific countries, Germany is the most popular market at present, with 66% of international businesses active there. This is followed by the US (61%), France (58%), Spain (47%) and Ireland (46%). Two-fifths of businesses (40%) sell to Canada and Australia, and 32% to China.

With regard to the individual markets that businesses expect to drive their global growth over the next 12 months, the US is seen as the most promising economy (35%). This is followed by Germany (27%), France (22%) and Australia (20%). Interestingly, while 15% expected China to be a key source of growth in our last Trade Barometer (published in October 2022) this has fallen to 11% and has been overtaken by the United Arab Emirates and India (both 16%).

Although the Chinese Government’s recent lifting of Covid-19 restrictions could be expected to boost cross-border trade, British businesses may be concerned about the uncertainty surrounding ongoing infection levels in the country, as well as the overall health of the Chinese economy. They’re also unlikely to have been able to visit the country during the pandemic in order to strengthen existing relationships or forge new ones.

At the same time, while 40% of UK businesses rely on China for at least part of their supply chains, more than half (56%) say they plan to reduce this dependency either partly or entirely. This may be in response to the rises in transportation and production costs experienced in recent years.

Brakes on overseas expansion

Our Spring 2023 Trade Barometer also looked at the factors that prevent UK businesses from fulfilling their potential in overseas markets. For businesses that already operate in foreign territories, an inability to find the skilled workers needed to facilitate international trade is the biggest threat to growth (cited by 33% of businesses). This is followed by concerns about the global economy (32%) and uncertainty related to post-Brexit trading arrangements (31%).

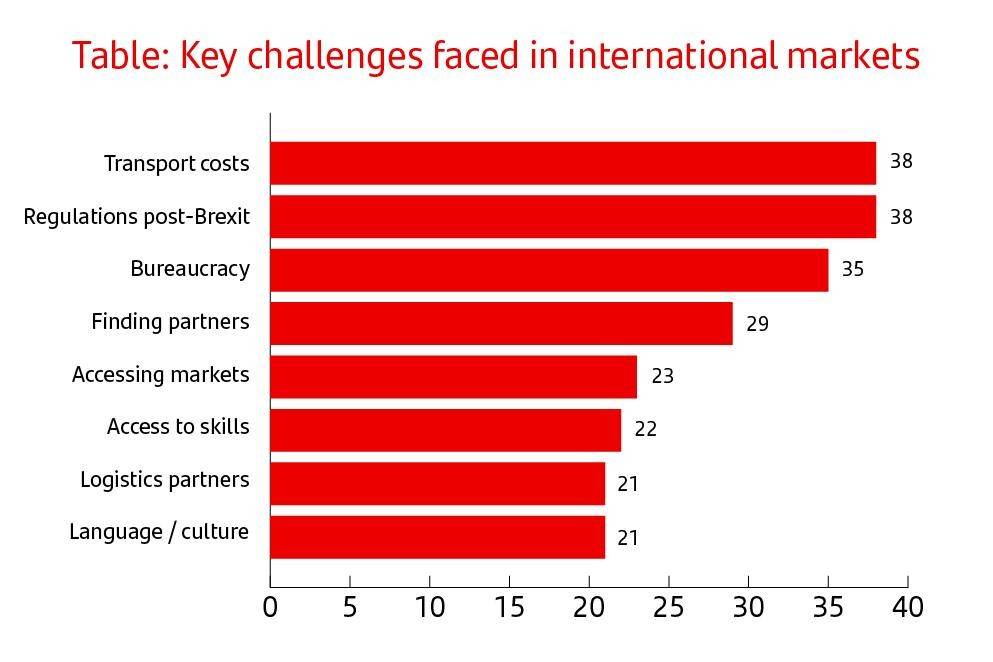

The most burdensome day-to-day challenges faced by such businesses when operating overseas is shown in the table below.

Among businesses which don’t yet operate overseas, high transport costs are the most significant barrier to beginning their international trade journey, cited by 41% of businesses. This is followed by a lack of managerial time (36%) and shortages of skilled labour (35%). Other obstacles include insufficient government assistance (34%), limited information about potential target markets (31%) and an inability to identify the right opportunities outside the UK (30%)

How we can help

We understand how important it is for businesses to be able to trade seamlessly across borders, as well as complying with all local laws and regulations. That's why we want to give you access to our new Brexit-specific resources on Santander Navigator.

Our compliance training will help you get up to speed on all of the new risks and challenges associated with Brexit so that you can tackle them head-on. We'll also provide our 'ready to trade' checklists so that you have all of the information you need at your fingertips. And best of all you'll be able to access these resources from anywhere.

Subscription fees may apply for some packages. For more information about Santander Navigator visit www.santandernavigator.co.uk or contact santandernavigator@santander.co.uk

And for additional support we created the Trade Club Alliance. The Trade Club Alliance is a group of global banks, covering 85% of global trade flows. It’s committed to linking its customers together to create commercial opportunities for everyone involved. If there's ever an issue with finding business relationships —from potential buyers through to payments processing—our Trade Club Alliance partners are there as a point of contact. For information on how we can help you access the solutions it provides here in the UK, please click ‘Get in touch’.