How to expand your horizons

Businesses remain determined to expand into new overseas markets such as North America and Asia-Pacific. But they will need help to seize these opportunities

Britain’s businesses are increasingly global in their international aspirations, new research from the Santander Trade Barometer reveals, with many scouring far-flung markets for the most exciting opportunities to expand. Despite short-term headwinds such as Brexit and slowing global growth, the 2019 edition of the Trade Barometer suggests businesses still have highly ambitious export strategies.

Their attitudes are underlined by their views on where the UK government should now prioritise international trade co-operation. Some 33% of businesses that already have international activities say a trade agreement with the US should be a post-Brexit priority, but many are looking even further afield for expansion opportunities.

For example:

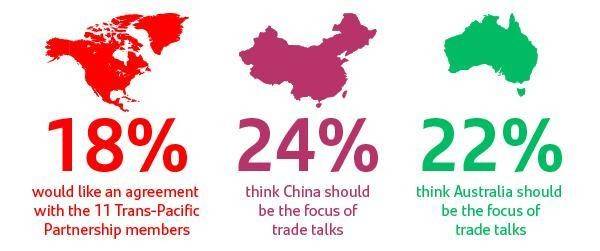

- 24% cite China as a priority for a trade deal

- 22% pick out Australia

- 18% are hoping for an agreement with the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which came into force earlier this year between 11 Pacific Rim countries.

To break into these new markets, businesses will often need tailored support. The difficulty of accessing markets in developed (20%) and emerging economies (18%) and finding the right contacts on the ground (31%) – such as customers, distributors, legal experts or trade bodies – are cited as barriers to international expansion by significant numbers of international businesses in the Trade Barometer. The ability of partners such as Santander, with our international network and local contacts, to provide tailored support in key markets will be a major competitive differentiator for international businesses as they seek to execute overseas expansion plans.

In addition, Santander and 13 other banks have come together to launch the Trade Club Alliance. Our common purpose is to make international trade simpler by offering an innovative digital platform, giving clients a wealth of relevant trade expertise and the opportunity to get with trusted partners in new markets.

New market ventures underway

Many businesses are not waiting for new trade agreements to implement their plans in key target markets. Already, 16% of businesses say they have begun trading with the US since the Brexit referendum in June 2016. China, Australia and India have become new markets for 12%, 11% and 10% of businesses respectively in that period. Many others have launched into Japan and Brazil for the first time.

Such growth indicates an increasing recognition of the scale of the opportunity in markets businesses might once have been reluctant to target. More than a quarter of the businesses in the Trade Barometer (28%) single out Asia-Pacific as the region likely to generate the highest levels of growth for their firms over the next three years, while 27% say North America.

Europe will continue to be an important market for UK businesses – 71% of international companies surveyed already trade with Europe and 15% believe the eurozone will generate most growth for their businesses – but growth prospects in other markets are proving especially attractive.

US and China head the target list

At a country level, 30% of businesses say they see growth potential in the US over the next 12 months while 19% say the same of China, Germany and France, by contrast, offer growth potential to 15% and 12% of businesses respectively – these are of course still very important markets, but these figures highlight the fact there are exciting opportunities further afield.

While optimism for international growth is vital, businesses will need to ensure they seek out the right partners to work with in each market to capitalise on these global opportunities. The Trade Barometer reveals that in almost every region of the world, red tape and bureaucracy are regarded as the biggest barriers to expansion. Businesses that can rely on a trusted partner with a global presence will have a clear advantage here.

At Santander, for example, our international network has helped clients to access the local expertise necessary to cut through legal, regulatory and compliance complications in a wide range of markets, enabling them not only to successfully identify opportunities but also to fulfil them.

To take just one example in an important growth market identified in the Trade Barometer, Santander is a partner of the London office of the China Certification & Inspection Corporation, which certifies food and drinks products to be sold in China. We’ve worked closely with British exporters to help them navigate through the process of securing certification, dealing with CCIC in the UK and ensuring they are prepared so that they save both time and money.