Welcome to Santander Business Banking

Welcome to Santander business banking We’re here to help businesses grow and succeed. If you’re running a smaller business, with up to 2 directors, owners (shareholders) or partners, have a look at the accounts and services we offer. You might find just what you need to get started or take the next step.

Running a medium-to-large business with comprehensive banking needs? No problem. Head over to our Corporate & Commercial Banking website to see what we’ve got for you.

Support for businesses

Growing your business

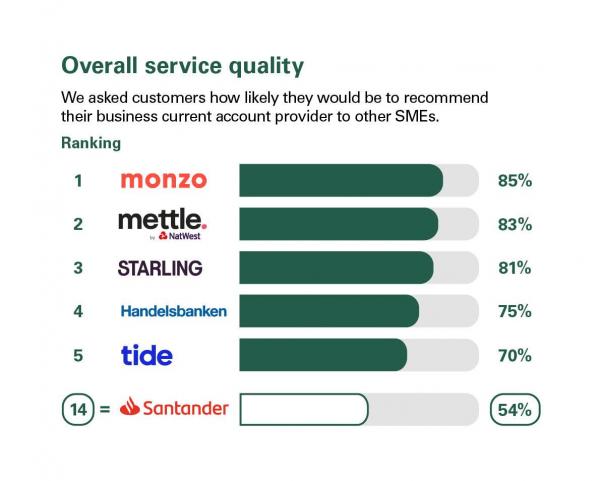

Independent service quality survey results

Business current accounts (GB)

Published February 2026

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 17 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). *SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

The results represent the view of customers who took part in the survey.

Take a look at the latest published results

Great Britain

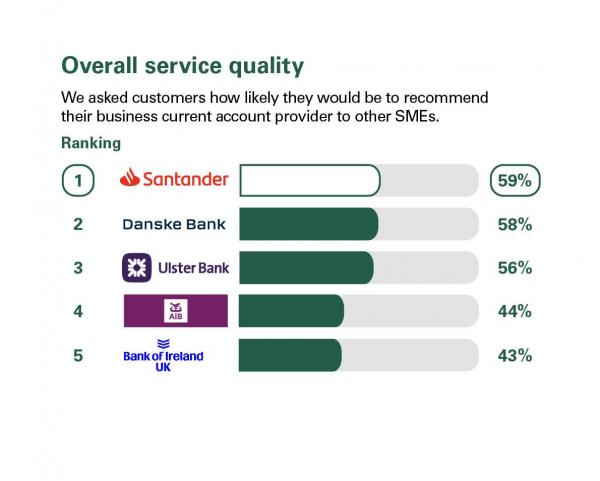

Business current accounts (NI)

Published February 2026

As part of a regulatory requirement, an independent survey was conducted to ask approximately 580 customers of each of the 5 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). *SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

The results represent the view of customers who took part in the survey.

Take a look at the latest published results

Northern Ireland

As part of a separate regulatory requirement, we have also published the Financial Conduct Authority service quality information for business current accounts.