It’s for your business, secure, and easy to use

Our Mobile Business Banking app is evolving. Log on securely using Touch ID, Face ID, or Fingerprint (with compatible devices) and manage your business banking needs on the go.

Find out what it means for you and download our mobile banking app today.

If you already use Online Business Banking you can log on to Mobile Business Banking with your usual details.

You can download our app on your smartphone or device from the iOS App Store or the Google Play Store. Just click on one of the logos below to get started. We don’t ever recommend downloading apps from other third-party sites.

Check the app stores to see if your phone or device meets the minimum system requirements.

With Mobile Banking you can make payments on the move, manage your money, and authenticate transactions all in one place.

If you have Online Banking, you can download our Mobile Banking app to your phone or device and log on with the same details.

If you aren’t yet registered for Online Banking, you can get started today. You’ll just need your phone and account details to hand.

What you can do

- Log on securely using Touch ID, Face ID, or Fingerprint (with compatible devices).

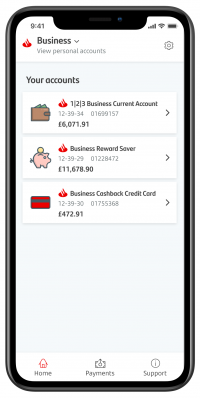

- Check your account balances and transactions.

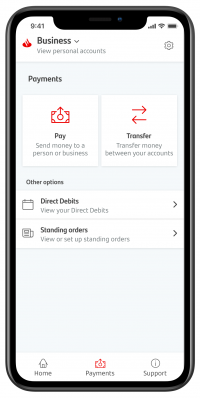

- Make payments and transfers.

- Pay in cheques.

- Pay people you've paid before and set up new payees.

- Authorise payments made in Online Banking or online card payments.

- View or set up standing orders.

- View Direct Debits.

- See and download statements.

- Set up future-dated payments.

- View your personal account balances and transactions.

- Access tools and resources to help you run and grow your business in the support hub.

- Share your account details easily.

Find out more

Need help

Visit our Trouble logging on page if you need more help

It's quick and easy to start using Mobile Business Banking

If you already use Online Business Banking you can log on to Mobile Business Banking with your usual details.

Before you start, you’ll need to make sure your current UK mobile number is up-to-date. This allows us to send you One Time Passcodes. Once that’s done, it takes just a few minutes to get started with our app.

- Log on to the app with your security details.

- Register your device following the on-screen instructions.

- Once you've registered your device you’ll be able to use our new app.

It’s important to know that each device can only be registered to one customer. This means that if you and another person use the same phone or tablet, only one of you will be able to use the app registered on it. The other person will need to use a different device for Mobile Banking.

You’ll need to make sure you have the latest operating system running on your device. Go to your app store and search for Santander Mobile Business Banking.

If you’ve never registered for Online Business Banking before please call us on 0330 123 9860 to register today. You should then receive your log on details in the post within 4 working days.

Can’t log on to your account? Visit our trouble logging on page for help and tips.

The Mobile Business Banking app lets you do the following, and so much more.

- Biometrics Log in

- Device registration

- Account information & transaction history

- Inter account transfers

- Payments to new & existing payees

- Confirmation of Payee

- Authorise payments made on online banking or online card payments

- View standing orders & Direct Debits

- Set up future dated payments

We’re continually improving Mobile and Online Business Banking and these changes, called Strong Customer Authentication (SCA), affect how we check it’s you when you use Mobile or Online Business Banking.

We may refer you to the mobile business banking app when you try to log on to Online Business Banking or to verify some transactions. Your Mobile Banking device is registered to you, so this helps us to check it’s you.

We make sure you’re protected when you use Mobile Business Banking

- You need your log on details every time you use Mobile Business Banking

- If you're logged on but don't use Mobile Business Banking for 5 minutes, we log you out automatically

- Anything sent to or from your phone using the app is encrypted so third parties can't read or understand it. If you lose signal in the middle of a transaction, there's no need to worry. Our system is set up to make sure that your accounts remain secure in these circumstances. If you didn't receive a confirmation that your transaction was successful then log back on when your signal returns and check. If it doesn't show on your recent transactions, simply make the transaction again.

Plus, as long as you take the proper precautions, for example by keeping your details safe and private, you can relax as you're completely covered by our Online and Mobile Banking Commitment