• The ‘Santander Quarterly Scamtracker’ charts trends in Authorised Push Payment (APP) scam types reported each quarter, the types of customers impacted, and warns of emerging scams

• More than £16.7 million stolen by fraudsters1 in Q3, an increase of 7% on the amount previously reported in the Q2 tracker

• Advance fee scams saw £1,136,525 stolen from Santander customers between July and September, with the biggest increase from Q2 in the volume of claims

• Santander warns about latest scam trend involving messages from tech companies that ask you to provide personal or banking information

Santander UK is today launching its latest ‘Santander Quarterly Scamtracker’, which shows that a total of £16.7 million was stolen from customers between July and September 2025, a 7% increase on the figure reported by the bank in Q2.

The Scamtracker results for July to September 2025 show that scammers are increasingly finding success with advance fee scams, which saw £1,136,525 stolen and a 25% increase in the number of claims reported by Santander customers when compared to Q2. An advance fee scam typically sees a scammer requesting upfront payment for a service or product that is never delivered.

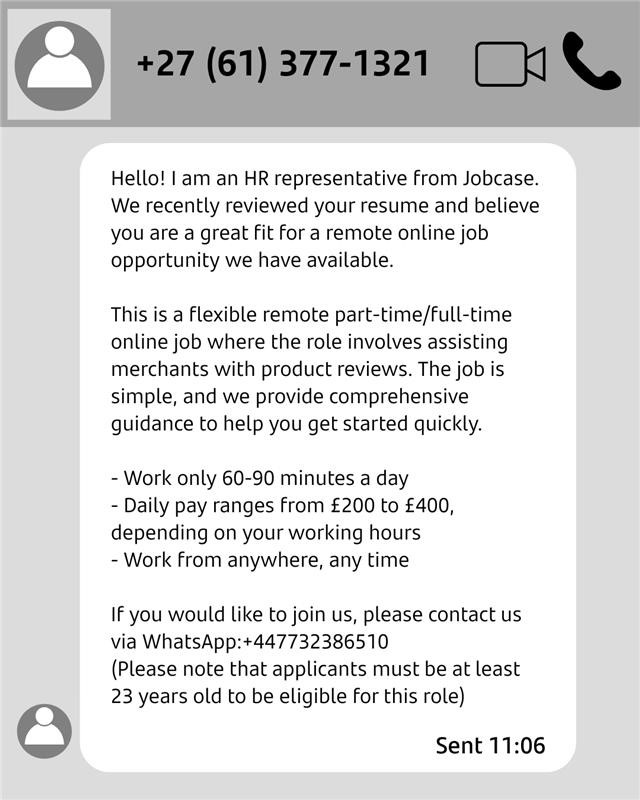

The data shows that the most common tactics used by criminals were online job scams, which accounted for £226,125 stolen. This scam sees customers enticed by the offer of a job, then asked for upfront payments for courses, or background checks to be completed. Insight from Santander shows that around one in five of these scams start via a WhatsApp message similar to the below.

Employer or job-related scams were also on the increase in the amounts stolen by impersonation scams, with a further £104,260 taken in Q3, an increase of 270% from the £28,163 stolen in Q2.

Chris Ainsley, Head of Fraud Risk Management at Santander UK said:

“Many jobseekers across industries will say that it is a tough market right now, with fewer positions and increased competition. Scammers are masters at exploiting these situations, creating messages, emails and fake website that mimic businesses or job recruiters. It’s a cruel tactic which has seen more than £200,000 stolen from Santander customers in the last three months as customers pay for checks and courses for jobs that don’t exist. Customers need to be wary of unsolicited messages about jobs, or any request for upfront payments or personal information.”

Santander’s Q3 Scamtracker showed that purchase scams related to gig tickets continue to be the most prevalent scam carried out on customers aged 18-44. Older age groups have seen a shift from impersonation scams to investment scams with the data showing that fake cryptocurrency offers accounted for 22% of the overall amount stolen from this age group.

One to watch

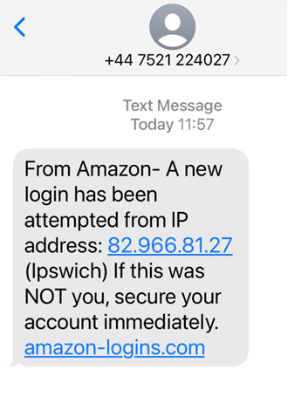

Data from Santander has highlighted a sharp spike in cases where criminals have impersonated tech companies. In Q3, around £5,000 was stolen from Santander customers, more than ten times the amount stolen in Q2 (around £450).

The bank is urging consumer to look out for message purporting to be from tech companies, like the example below, which then asks them to access their bank to resolve a problem. Never click on link in unexpected messages and never give out your banking or other personal information.

- Ends -

The information contained in our press releases is intended solely for journalists and should not be used by consumers to make financial decisions.

Notes to editors:

1) This is the total value of claims received from Santander customers between 1 July and 27 September 2025. This does not account for actual losses to customers or refunds given to customers during this period.

![]()

Santander UK is a financial services provider in the UK that offers a wide range of personal and commercial financial products and services. The bank serves its customers via a nationwide branch network, telephone, mobile and online banking. Santander UK is subject to the full supervision of the FCA and the PRA in the UK. Santander UK plc customers’ eligible deposits are protected by the FSCS in the UK.

Banco Santander (SAN SM, STD US, BNC.LN) is a leading commercial bank, founded in 1857 and headquartered in Spain and one of the largest banks in the world by market capitalization. The group’s activities are consolidated into five global businesses: Retail & Commercial Banking, Digital Consumer Bank, Corporate & Investment Banking (CIB), Wealth Management & Insurance and Payments (PagoNxt and Cards). This operating model allows the bank to better leverage its unique combination of global scale and local leadership. Banco Santander aims to be the best open financial services platform providing services to individuals, SMEs, corporates, financial institutions and governments. The bank’s purpose is to help people and businesses prosper in a simple, personal and fair way.