Santander UK is today warning consumers to be wary of taking on a new online side hustle this January as scammers home in on those looking to make some extra cash to cover the costs of Christmas and bridge the gap until January payday.

Data from the bank shows that more than £95,000 was stolen from customers between October-December 2025 by criminals offering money for completing “tasks”, for example by liking or sharing social media influencer videos. Almost a third (£31,000) of the amounts stolen were from customers “recruited” to ‘like’ videos on TikTok, with scammers often offering small payments to begin with to hook consumers in.

Customers aged between 20-55 are most commonly targeted, and Santander has warned that criminals often l use legitimate company names such as Allianz, Starfish and Indeed to gain people’s trust.

Chris Ainsley, Head of Fraud Strategy at Santander UK said:

“January payday still feels a long way off for many, as the costs of Christmas start to roll in, others use this time to reevaluate their finances and start saving for the year ahead. Looking for ways to make some extra cash provides scammers with an opportunity to pounce. Be wary of any jobs that seem too good to be true, promising returns for simply ‘liking’ social media content. Start the new year alert - even if you’ve earned a couple of pounds from a few clicks before - any requests to pay an up-front fee to take on a job should be treated as a scam.”

How it works:

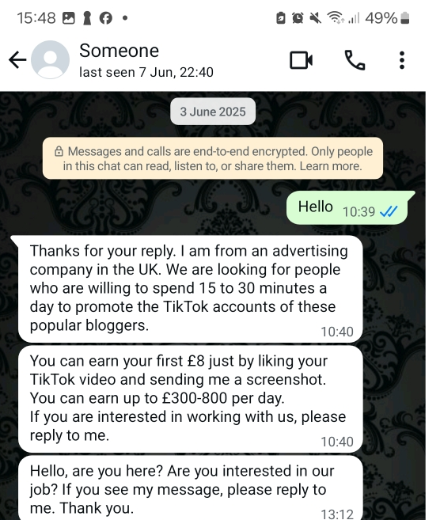

Fraudsters often target consumers directly on social media or through an automated call (or WhatsApp message) from a ‘recruitment agent’ with a job opportunity.

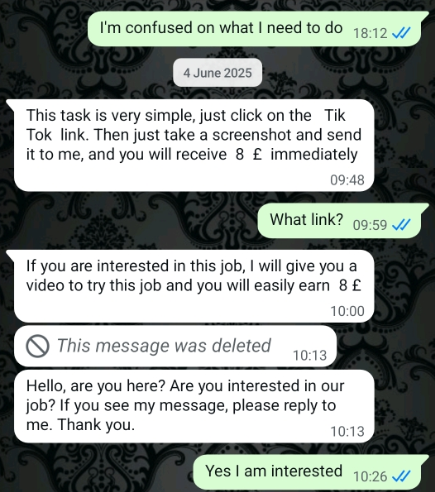

The criminals will either directly ask for upfront payment or hook their target in by messaging details of a job and asking them to complete their first ‘task’ to earn money.

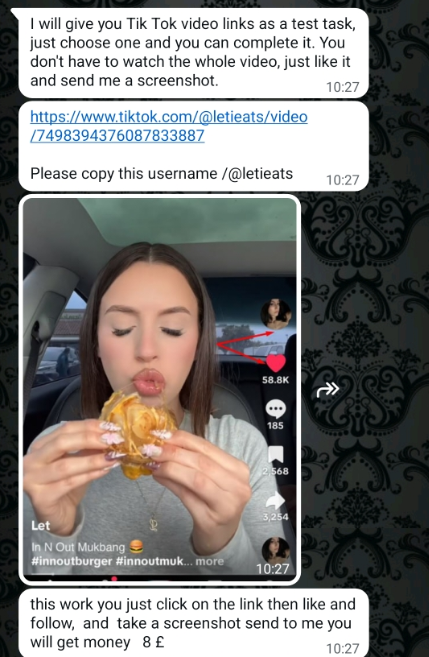

The task is typically to promote social media influencers/products.

Once finished, the consumer may receive payment for the task, usually a small sum - which is used to gain their trust. They’re then told to download another messaging app, such as Telegram to connect with other ‘members’, such as a ‘receptionist’ or ‘mentor’ and will be required to open an account on a crypto platform.

Next, they will be asked to complete tasks that they need to pre-pay to access, using their own money, on the promise of getting a higher return. The criminal will ask the consumer to deposit money into a mule account, or their newly opened Cryptoaccount – which will then be sent on to a wallet controlled by a fraudster.

Consumers will then be blocked from withdrawing their funds, often by being told their ‘Credit Score’ is below the threshold to withdraw and more money is needed to release it.

- Ends -

The information contained in our press releases is intended solely for journalists and should not be used by consumers to make financial decisions.

Example messages below: