Santander UK has today announced the launch of a new Home Energy Saving Tool, which will allow homeowners to review their home’s energy efficiency and receive a personalised action plan to identify what improvements can be made, and how they can help reduce their household bills in the long term.

The tool, launched in partnership with the Energy Saving Trust (EST), a leading independent voice on climate action, takes around six minutes to complete and uses details including a customer’s postcode to assess their property. It will then create a plan to help them identify:

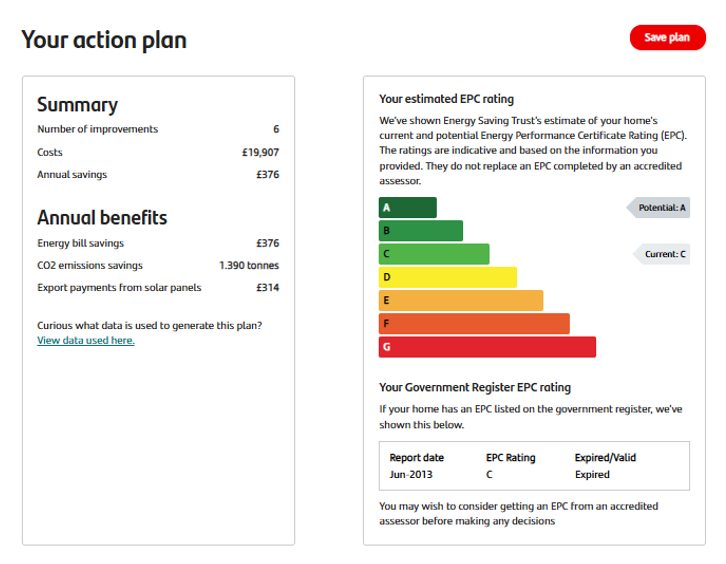

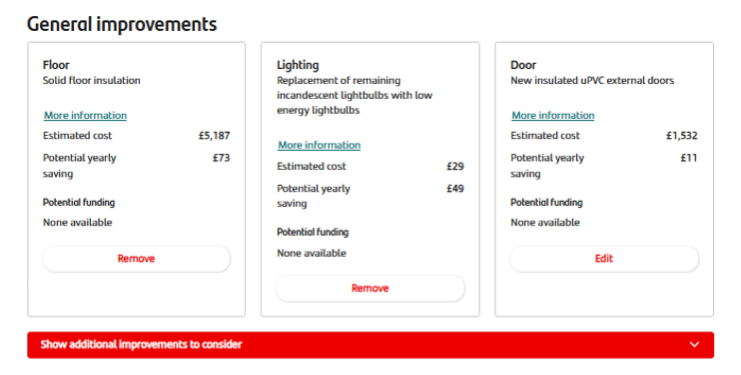

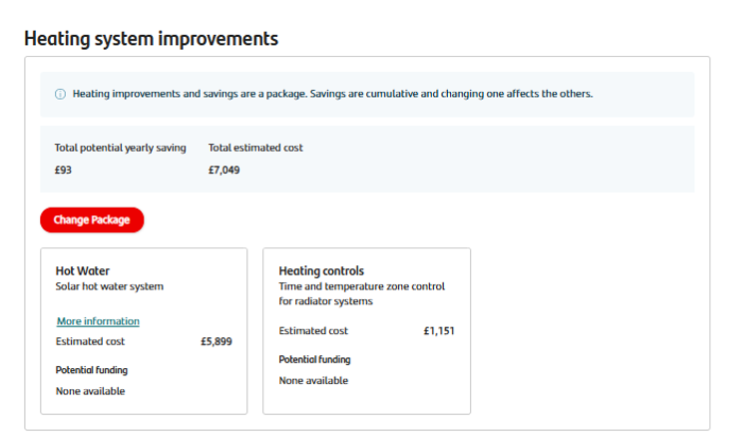

Suggested home improvements and their costs;

The estimated annual home energy bill savings;

An indication of the property’s current and estimated (after improvements) Energy Performance Certificate rating; and

The property’s current and estimated CO2 emissions.

Research from Santander1 found that more than half (53%) of homeowners would be more likely to make energy efficiency improvements if they knew it would save them money on other areas like their energy bills.

Speaking about the launch of the tool, Mick Taylor, Head of Green Finance, Homes at Santander said:

“We can all feel the change in the air as the autumn breeze starts to bite, coupled with the recent 2% rise in the energy price cap, it’s natural that homeowners are starting to think about ways to keep bills as low as possible, longer term. Our new tool quickly highlights where homeowners can invest their time and money to improve the energy efficiency of their property, as well as what the impact of those improvements would be in pounds and pence to their annual energy costs in future.”

- Ends -

The information contained in our press releases is intended solely for journalists and should not be used by consumers to make financial decisions.

Notes to editors

Research conducted among 1,050 UK homeowners in July and August 2025.

Examples of the personalised home improvement plan:

About Santander

Santander UK is a financial services provider in the UK that offers a wide range of personal and commercial financial products and services. The bank serves its customers via a nationwide branch network, telephone, mobile and online banking. Santander UK is subject to the full supervision of the FCA and the PRA in the UK. Santander UK plc customers’ eligible deposits are protected by the FSCS in the UK.

Banco Santander (SAN SM) is a leading commercial bank, founded in 1857 and headquartered in Spain and one of the largest banks in the world by market capitalization. The group’s activities are consolidated into five global businesses: Retail & Commercial Banking, Digital Consumer Bank, Corporate & Investment Banking (CIB), Wealth Management & Insurance and Payments (PagoNxt and Cards). This operating model allows the bank to better leverage its unique combination of global scale and local leadership. Santander aims to be the best open financial services platform providing services to individuals, SMEs, corporates, financial institutions and governments. The bank’s purpose is to help people and businesses prosper in a simple, personal and fair way. In the first half of 2025, Banco Santander had €1.3 trillion in total funds, 176 million customers, 7,700 branches and 204,000 employees.