The scam: Fraudsters are preying on bargain hunters looking for deals in ‘closing down’ or ‘clearance’ sales. These sales are typically advertised on social media or through fake websites, and often draw on brands who have been in the news recently announcing store closures.

Volume (Santander data): In August alone, more than 5,000 disputes were raised involving merchants that had been set-up by fraudsters. This includes those imitating companies having closing-down sales or holding end of season clearances.

August saw a combination of a major retailer, Wilko, announcing they were closing down, alongside other outlets holding traditional end of summer season sales. The exploitation of this by scammers was evident and cases doubled from 869 in the w/c 14 August to around 1,700 in the w/c 21 August, as many customers realised that their hope to grab a deal, had actually been a scam.

Numbers remained high throughout August, with more than 2,200 cases reported in the final week of the month with a total value of almost £85,000.

On average, customers are losing £37 each in these scams – a total of more than £300,000 since the start of August 2023.

Chris Ainsley, Head of Fraud Risk Management at Santander said: “Fraudsters see the news of large retailers closing shops as an opportunity to try and turbocharge their own closing down or clearance sale scams. We often see a worrying spike of this type of scam, when an announcement like this is made public. If you see an advert for discounts which sound too good to be true, it probably is a scam. Even if the advert uses recognisable logos and brand names, people should be alert and ensure they are visiting genuine websites.”

Closing Down Sales Scams - how it works:

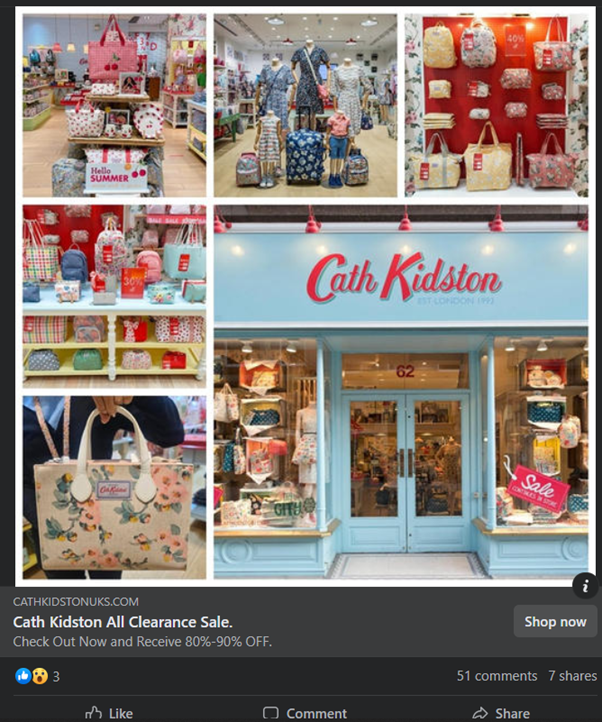

- Customers see an advertisement (examples below) which show heavily discounted products as part of a closing down or clearance sale.

- These are often advertised via social media platforms linking to fake websites. A customer clicks through on these websites and adds items to their basket.

- The website often only allows items to be in the basket for a restricted time period. This is frequently around five minutes – adding pressure to the sales process as customers rush to secure the bargains.

- The website harvests significant data from the customer as part of the check out process, including address and email address - this information could also be used in future scam attempts.

- Often an expensive ‘VIP’ or ‘Premium’ shipping service is added to basket – inflating costs with no option to remove. But with time running out to complete the purchase customers often rush and agree to this additional cost.

- While the payment screen may look legitimate and have the branding of a well know provider, the website is not secure or legitimate and the payment is not processed by the official provider.

- The customer makes the payment, and unfortunately the money has gone to the criminal and the goods never arrive.

How to keep yourself safe from closing down or clearance sale scams:

- If a price looks too good to be true, it probably is.

- Always check the website you are purchasing from – check it’s the legitimate web address, rather than a copy of a well-known brand’s address.

- When buying online, check the payment pages are secure by looking for the padlock symbol in the address bar. The website should start with ‘https’.

- It never hurts to stop and pause before sending your money. A quick chat with a friend or relative can sometimes be a great way to sense check what you’re doing.

Examples of fake closing down and clearance sales social media adverts:

- Ends -

The information contained in our press releases is intended solely for journalists and should not be used by consumers to make financial decisions.

Santander UK is a financial services provider in the UK that offers a wide range of personal and commercial financial products and services. At 30 June 2023, the bank had around 19,400 employees and serves around 14 million active customers, 7 million digital customers via a nationwide 445 branch network, telephone, mobile and online banking. Santander UK is subject to the full supervision of the FCA and the PRA in the UK. Santander UK plc customers’ eligible deposits are protected by the FSCS in the UK.

Banco Santander (SAN SM, STD US, BNC LN) is a leading commercial bank, founded in 1857 and headquartered in Spain. It has a meaningful presence in 10 core markets in the Europe, North America and South America regions, and is one of the largest banks in the world by market capitalization. Santander aims to be the best open financial services platform providing services to individuals, SMEs, corporates, financial institutions and governments. The bank’s purpose is to help people and businesses prosper in a simple, personal and fair way. Santander is building a more responsible bank and has made a number of commitments to support this objective, including raising €220 billion in green financing between 2019 and 2030. In the first half of 2023, Banco Santander had €1.25 trillion in total funds, 164 million customers, 9,000 branches and 212,000 employees.