Santander has taken the fight to the fraudsters, with its latest update to its OneApp banking app, available to download today[1], now including screen sharing detection technology. This technology will automatically blur a customer’s mobile screen and prevent them from carrying out any banking actions where screen sharing technology is being used on their device.

Data from Santander shows more than £1.8 million was stolen from customers in 2024, in scams which used screen sharing and remote access technology as a means to access money or personal information.

Often, customers are contacted out of the blue, by phone, email or text/Whatsapp with a range of messages either providing a new investment opportunity or warning of a technical problem with their phone. The scammer will persuade customers to download legitimate screen sharing software, such as AnyDesk or Teamviewer, giving scammers access to their mobile screen and personal information, including mobile banking credentials.

Chris Ainsley, Head of Fraud Strategy at Santander UK, said: “As technology advances, so do scammers. We have a range of specific warnings for customers, but these criminals are clever and will talk their way into accessing a customer’s personal information. Our latest development catches the social engineering in action, protecting customers who are often caught up in a moment of panic.”

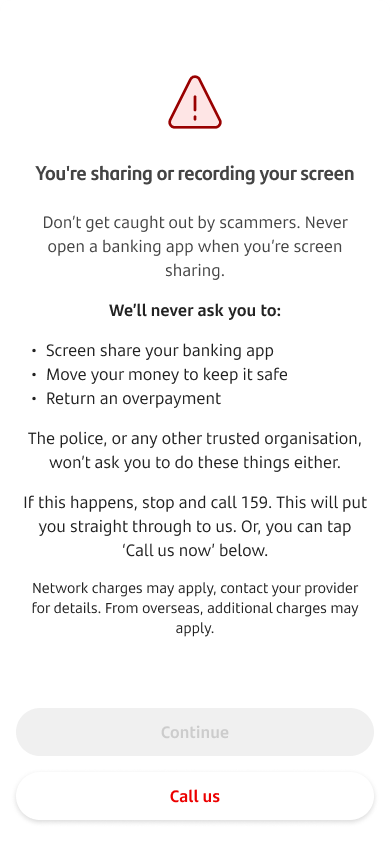

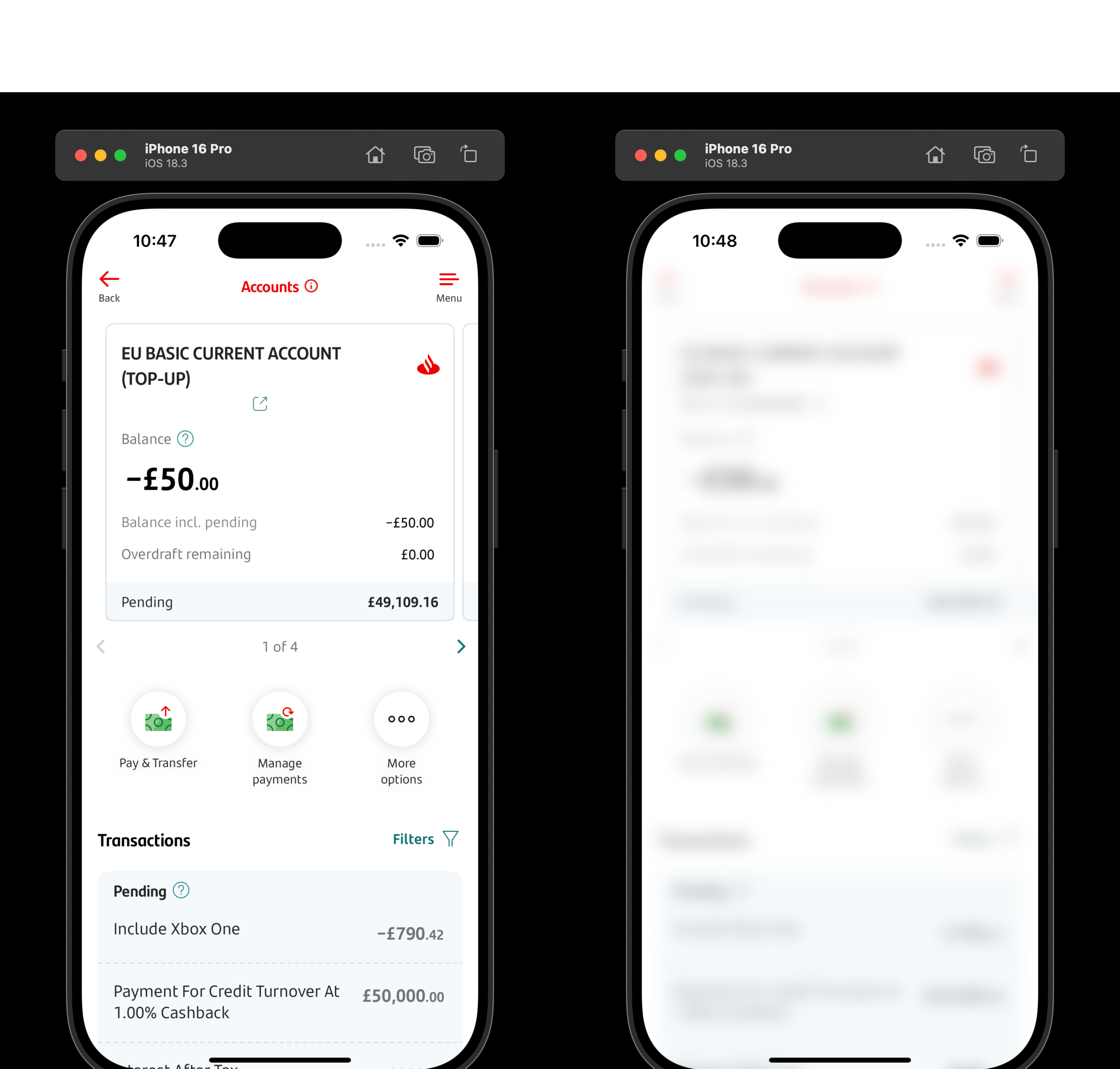

The bank previously introduced a specific warning that screen sharing technology had been detected on a customer’s device. The new technology will build on this making customers’ mobile banking app automatically blur, shielding their personal information as below.

Specific mobile warning:

App blurring:

- Ends -

The information contained in our press releases is intended solely for journalists and should not be used by consumers to make financial decisions.

Notes to Editors:

- The update is currently live to customers running version IOS18 and above. The release will be live to Android customers in the near future.

Santander UK is a financial services provider in the UK that offers a wide range of personal and commercial financial products and services. The bank serves its customers via a nationwide branch network, telephone, mobile and online banking. Santander UK is subject to the full supervision of the FCA and the PRA in the UK. Santander UK plc customers’ eligible deposits are protected by the FSCS in the UK.

Banco Santander (SAN SM) is a leading commercial bank, founded in 1857 and headquartered in Spain and one of the largest banks in the world by market capitalization. The group’s activities are consolidated into five global businesses: Retail & Commercial Banking, Digital Consumer Bank, Corporate & Investment Banking (CIB), Wealth Management & Insurance and Payments (PagoNxt and Cards). This operating model allows the bank to better leverage its unique combination of global scale and local leadership. Santander aims to be the best open financial services platform providing services to individuals, SMEs, corporates, financial institutions and governments. The bank’s purpose is to help people and businesses prosper in a simple, personal and fair way. Santander is building a more responsible bank and has made a number of commitments to support this objective, including raising €220 billion in green financing between 2019 and 2030. In the first quarter of 2025, Banco Santander had €1.4 trillion in total funds, 175 million customers, 7,900 branches and 207,000 employees.