The scam: Criminals pose as ‘sellers’ on online selling platforms or marketplaces and post fake adverts offering items for sale which are not as described or simply do not exist. The buyer is encouraged to send the money via a method that does not offer relevant protection e.g. bank transfer, meaning they end up with a fundamentally different item to that which they thought they were getting or nothing at all.

Santander and Gumtree are working together to warn customers what to look out for, as April and May see the highest volume of “for sale” listings on Gumtree.

The data: New data published today from Santander and online sales platform Gumtree shows:

- In 2023, Santander customers lost £7.3 million to purchase scams originating on online selling sites and marketplaces, as it reports claims have increased by 32% in the last year compared to 2022.

- The average claim was £500.

- Of the total number of purchase scams reported to Santander in 2023, 80% started on online selling platforms or marketplaces.

- Between February and April 2023, Gumtree reported an increase the volume of overall “for sale” listings of 24%, with similar growth expected for 2024.

- Last year, Gumtree removed a total of 1,177,292 listings from across their platform, for failing to meet their posting standards and policies. Of those, 42,725 ads were removed due to suspicions of fraud, a decrease of -31% YoY, owing to their improved safety infrastructure which has prevented scam listings being posted in the first place.

- According to Gumtree, the most popular items for criminals to create fake posts about include:

- Smart phones

- Games console

- Digital cameras

- Headphones

- Dogs

- Collectables

- Guitars

Chris Ainsley, Head of Fraud Risk Management at Santander said: “More than ever, scammers are homing in on our love of grabbing a bargain, whether it’s that ‘impossible’ to come by collectible or a new phone.

“It’s great to see online marketplaces like Gumtree taking strides towards not only removing scam posts from their site but also putting measures in place to stop them appearing in the first place. Customers should always be wary of an item for sale that seems too good to be true, but the more that can be done to stop criminals from creating these posts in the first place, the better.”

Joseph Rindsland, Head of Trust & Safety, Gumtree said:“We’ve invested heavily in recent years in technology to prevent scam posts making it to our site and thanks to this, the volume of suspicious listings we’re having to remove is falling month on month.

“But scammers are tenacious, and we still removed tens of thousands of posts in 2023. That’s tens of thousands of opportunities for criminals to take customer’s hard-earned cash, which is why we’re teaming up with Santander to advise our users how they can better protect themselves.”

Marketplace scams – how they work:

- Criminals advertise goods on social media and through listings on genuine selling sites.

- Once you enquire about the item, the apparent ‘seller’ will often be quite pushy to try and make the sale take place.

- The seller will usually come up with reasons why you are unable to view the item in person and create a sense of urgency that the item is in high demand to convince you to buy it now.

- The seller will then ask you to use a payment method that does not offer relevant protection, such as ‘PayPal Friends & Family’ service or through a bank transfer.

- Once you've paid, you lose contact with the seller and either receive nothing or your purchase arrives, but it is fundamentally different to that advertise.

Protection advice: These criminals are very clever, but sometimes warning signs could help you identify them:

- Too good to be true? – An item priced under the recommended selling value should always be a red flag. But it doesn’t need to be a high value purchase, criminals will post everything that’s in demand, from that impossible to find collectible figure to the latest sold-out toy.

- Shop local – Most selling sites, like Gumtree, can be filtered depending on postcode and location. Shop local, and make sure you see the item in person first. To help protect customers, Santander recently introduced a new fraud warning that won’t allow a customer to make a purchase from Facebook Marketplace, unless they confirm they have seen it in person first.

- Stay secure – Always use secure payment methods where you can. PayPal (buying goods) and debit and credit cards can offer more protection than a bank transfer. Any attempts to communicate outside of an official site like Gumtree should also be treated with suspicion.

- Slow down – To check whether a seller is genuine, take the time to look at how long the seller has been a member of the selling site for and check out the seller’s profile, including reviews from other buyers.

- Ends -

The information contained in our press releases is intended solely for journalists and should not be used by consumers to make financial decisions.

Notes to Editors:

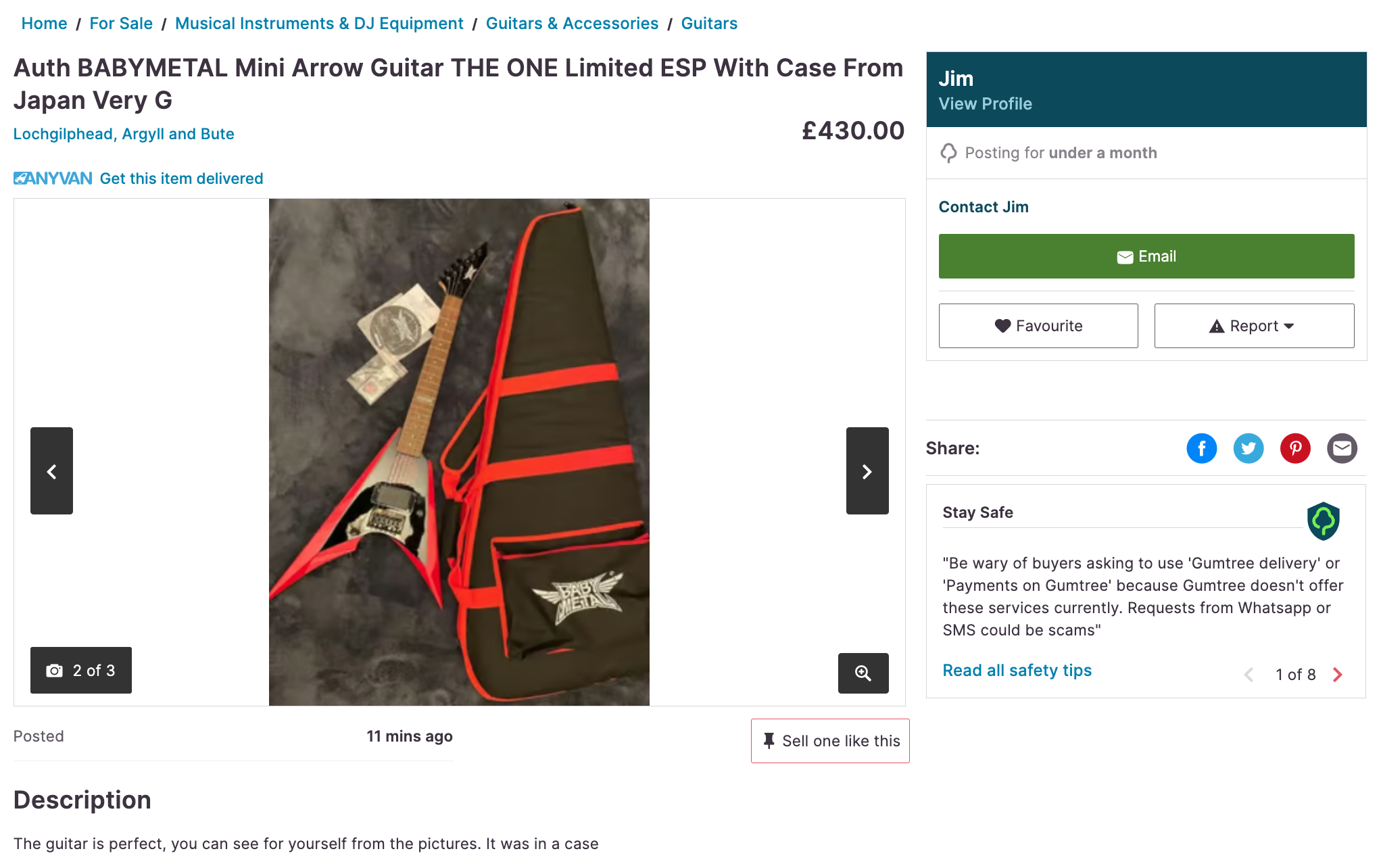

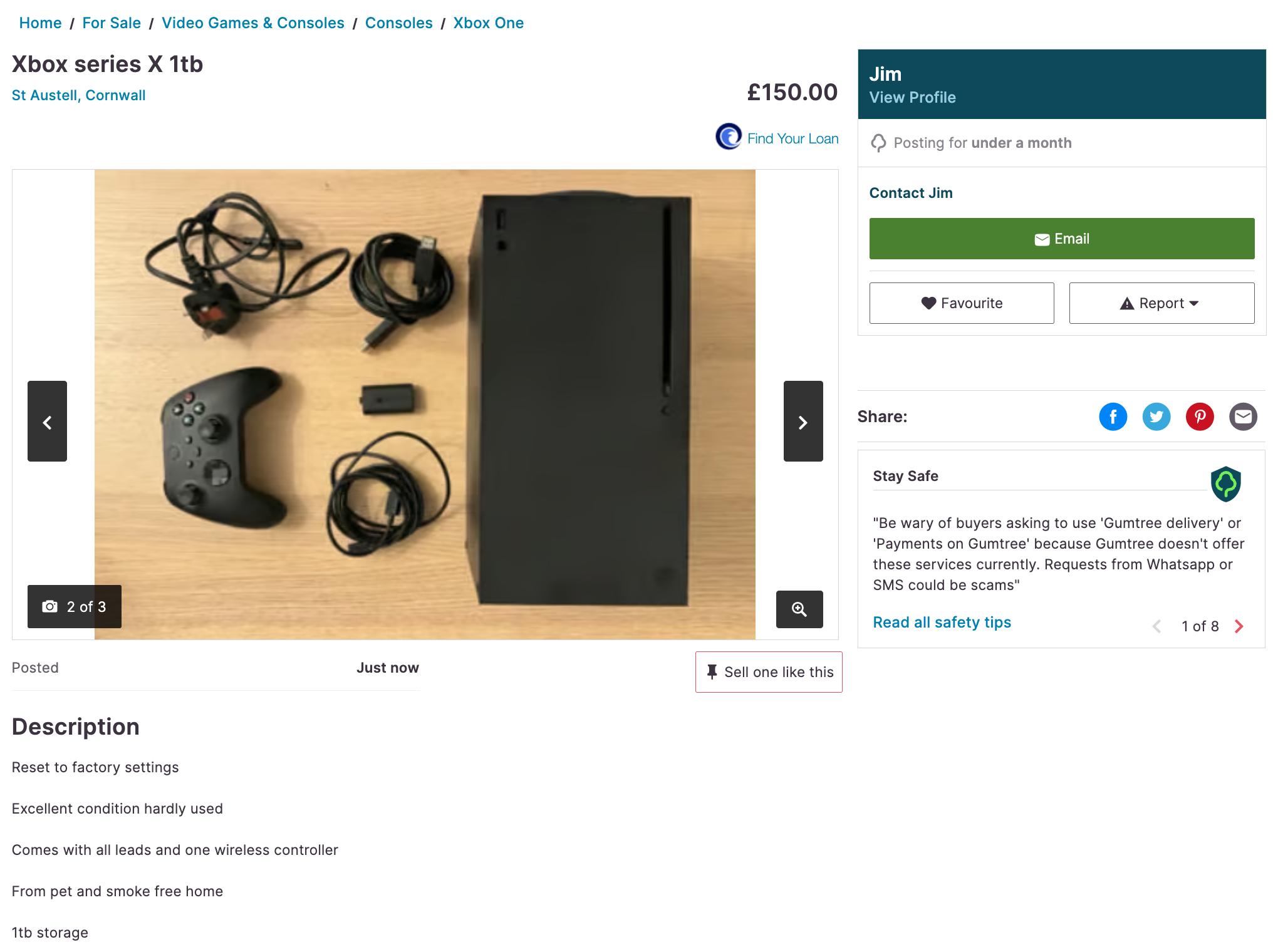

Images of typical scam posts below. Red flags include:

- New account – the profile has been posting for under a month.

- Posting from multiple locations – the same profile posted from Cornwall, Dorset and Argyll and Bute.

- Posting multiple listings within short time frame.

- Lack of info in description.

- The seller is willing to deliver the item.

- Non-specific images – which could have been taken from an internet search.

- Price is below market average.

Santander UK is a financial services provider in the UK that offers a wide range of personal and commercial financial products and services. At 31 December 2023, the bank had around 19,800 employees and serves around 14 million active customers, 7 million digital customers via a nationwide 444 branch network, telephone, mobile and online banking. Santander UK is subject to the full supervision of the FCA and the PRA in the UK. Santander UK plc customers’ eligible deposits are protected by the FSCS in the UK.

Banco Santander (SAN SM, STD US, BNC LN) is a leading commercial bank, founded in 1857 and headquartered in Spain. It has a meaningful presence in 10 core markets in the Europe, North America and South America regions, and is one of the largest banks in the world by market capitalization. Santander aims to be the best open financial services platform providing services to individuals, SMEs, corporates, financial institutions and governments. The bank’s purpose is to help people and businesses prosper in a simple, personal and fair way. Santander is building a more responsible bank and has made a number of commitments to support this objective, including raising €220 billion in green financing between 2019 and 2030. At the end of 2023, Banco Santander had €1.3 trillion in total funds, 165 million customers, 8,500 branches and over 212,000 employees.