The Basic Current Account comes with

A contactless debit card

This debit card does not allow mobile payments

Basic banking

You can pay in your income, bills and set up Direct Debits and standing orders

Online and Mobile Banking

Use your mobile phone or computer for banking transactions like making payments or checking your balance.

Santander Boosts

Get cashback, vouchers, prize draws and personalised offers with our free rewards service

Travel benefits

No fees for using Santander cash machines when you travel

How it works

You’re 16 or over, You live in the UK

You don’t already have a Basic Current Account, or more than one other current account with Santander

If you don’t have a listed proof of ID or permanent UK address, we may still be able to help. Please come and talk to us in branch.

Before you apply, check this account is right for you

If you want a simple bank account which has no monthly fee, but also gives you more features such as a contactless debit card that allows mobile payments and the option to apply for an overdraft facility then have a look at our Everyday Current Account. Compare the two accounts

Account details

Account fee

There’s no monthly fee to maintain the account.

The Fee Information Document (PDF - 139 KB) details the main fees and charges on this account. For further explanation of our main terms and services take a look at our Glossary

Account alerts

There’s no overdraft facility available with this account.

This means we won't normally let you make a payment out of the account if there isn’t enough money in it. However, there may be times where you make a payment that we can't stop, which will take the account balance below zero. We won't charge you for this.

We'll send you free alerts when:

- you make a payment that takes your balance below zero

- we intend to refuse a future payment due to a lack of funds

- we refuse a payment due to lack of funds.

We’ll send these alerts by text, push notification, and/or email, so it’s important you tell us if your mobile number or email address changes.

You'll be automatically registered for these alerts. You can manage your alerts settings at any time by using Online Banking. For more information, visit our account alerts page.

Need more help? Please contact us or visit your local branch

If you need help managing your money or if you’re in debt, please visit our money worries page.

We won't charge you when you use your Basic Current Account debit card to make withdrawals at Santander cash machines abroad. You'll find our cash machines in Spain, Germany, Poland, Portugal, Argentina, Brazil, Chile, Mexico, Puerto Rico, Uruguay, and the USA. Make sure you choose to pay in the local currency to avoid being charged any other fees.

Key documents

- Basic Current Account Key Facts Document (PDF - 162 KB)

- Basic Current Account Fee Information Document (PDF - 139 KB)

- General Terms & Conditions (PDF - 958 KB)

To view these documents, you may need to download Adobe Reader

You can have your income paid into this account and set up Direct Debits and standing orders.

Fees may apply if you withdraw cash from outside the UK or make purchases in any currency other than pounds.

If you have a Basic Current Account with a top-up debit card that was opened or applied for before 2 February 2022 take a look at the documents for this account

You can apply if

- You’re 16 or over

- You live in the UK

- You don’t already have a Basic Current Account, or more than one other current account with Santander

- You’re not eligible for any of our other current accounts

Don’t think you have the right ID or documents?

If you don’t think you have the right ID or documents to apply for a Basic Current Account, contact us and we may be able to help.

Will applying for the Basic Current Account impact my credit file?

When you apply for a Basic Current Account, we complete a soft credit check. This lets us confirm your identity and look at some details on your credit file. This won’t affect your credit score or be visible to other lenders. Only you’ll be able to see the soft check on your credit report.

What you can’t do on your contactless debit card

You can’t use your contactless debit card for mobile payments. Mobile payments include Apple Pay, Google PayTM, Samsung PayTM and Garmin PayTM.

Santander Boosts

Get rewards to give you a little boost when you bank with us.

All you need to do is sign up for Santander Boosts through your Mobile Banking app or in Online Banking and then you’ll be able to choose the offers you like and earn rewards with your favourite retailers.

- Earn cashback when you shop online at a wide range of retailers

- Receive vouchers and coupons for discounts on a variety of products and services

- Get offers personalised to your individual interests and hobbies

- Enjoy free gifts and enter prize draws

Ways to bank with us

24/7 banking on all your accounts. You can amend your statement settings and set up personalised account alerts.

- Online Banking

- Mobile Banking

- Get personalised spend insights with My Money Manager

Face-to-face support in branch and UK-based telephone support

- In branch

- Telephone Banking

- ATM

- Post Office to make withdrawals, balance enquiries, cash deposits and cheque deposits

Security

Keep your banking details private and secure.

For more information about our approach to security as well as more useful information to help you stop the threat of fraud visit our Security Centre.

How we manage scam claims

We’ll support you if you’ve fallen victim to fraud. Find out more about our approach to fraud

Statements

We'll add your monthly statement to your mailbox in Mobile Banking. In Online Banking, you can find it in your 'Statements and documents’. You can update your paper-free preferences in Mobile and Online Banking.

You can ask for paper statements in branch, by phone or Chat. You can choose to get them every month or every 3 months. You can also ask for your statements in an alternative format, such as braille.

Before you apply for the Basic Current Account, compare it to the Everyday Current Account or see our full range of current accounts to make sure it’s the right account for you.

Basic Current Account

You can apply for this account if you’re 16 or older. This account is usually for people who don’t have a UK bank account or can't get one of our other current accounts. This may be due to a recent bankruptcy or if you’re new to the UK.

This account includes:

- No monthly account fee

- A contactless debit card that does not allow mobile payments. Mobile payments include Apple Pay, Google PayTM, Samsung PayTM and Garmin PayTM.

- No unarranged overdraft charges

With this account you won’t get

- A contactless debit card that allows mobile payments

- A chequebook

- An arranged overdraft

Everyday Current Account

A simple and straightforward current account, with no monthly fee

What you get

- No monthly account fee

- A contactless debit card

- No unarranged overdraft charges

- You can apply for an arranged overdraft facility, if required (subject to status)

Find out more about the Everyday Current Account

Or see our full range of current accounts

Fancy a change? You may be eligible to transfer your Basic Current Account to another account that works for you. To find out more, visit your local branch or get in touch with us.

If you have a Basic Current Account with a top-up debit card that was opened or applied for before 2 February 2022 - take a look at the documents for this account

Boost up your life

With cashback, discounts and special offers that match your interests. All you need to do is sign up for Boosts through your Mobile Banking app or in Online Banking and you’ll be able to choose the offers you like and earn rewards when spending at your favourite retailers

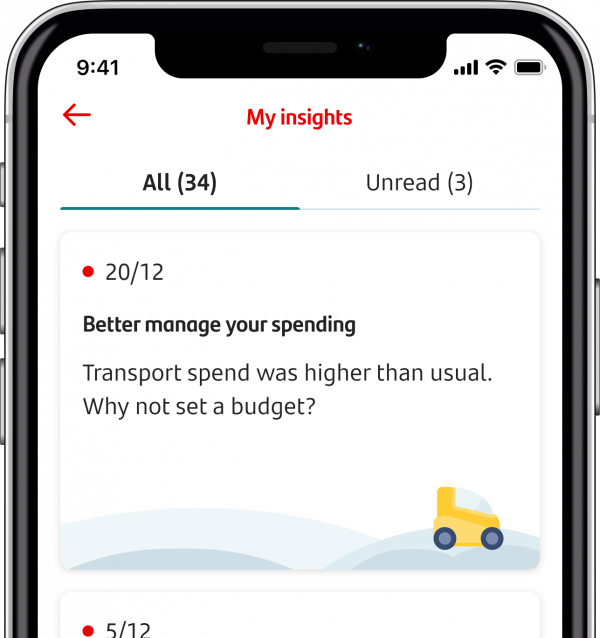

My Money Manager

If you’re trying to be better with your money, My Money Manager is designed with you in mind. Now, as well as banking on the go, our mobile banking app lets you get tailored insights into how you spend.

Digital banking with us

Whether that’s via Online Banking or our Mobile Banking app, we offer a secure way to access and manage your banking needs 24/7.

Switch quickly and easily

We offer a simple, reliable and stress-free way to switch your current account to a new or existing Santander account

Information correct as at 1 November 2025.