What is equity?

Equity is the difference between the amount you owe on your mortgage and what your home is currently worth.

For example, if your home is worth £250,000 and you owe £200,000 on your mortgage, you have £50,000 in equity.

If you have a repayment mortgage where you pay off the amount you owe (capital) and interest, over time your equity can go up. This is because the amount you owe on your mortgage goes down. Your equity can also grow if the value of your home goes up.

What is negative equity?

Negative equity is when the value of your home is less than the amount you owe on your mortgage.

Could I be at risk of negative equity?

You could be at risk of negative equity if house prices fall. House prices can fall for reasons such as:

- cost of living going up could mean fewer people want to buy your home

- your home may need some repairs

- you bought your home on a lease and the term runs out soon.

If you have an interest only mortgage, you’re at more risk of negative equity than if you have a repayment mortgage. With an interest only mortgage, the amount you owe stays the same. If the value of your home does go down, you could find yourself in negative equity.

If your home is a new build, it might have cost more to buy. So, the value of your home might go down soon after you buy it and put you in negative equity.

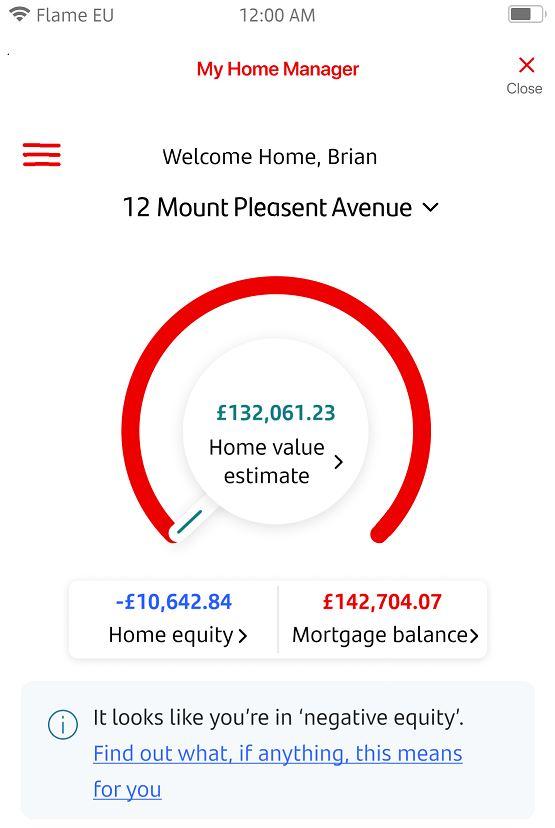

If you have a Santander mortgage, you can see if you’re likely to be in negative equity using My Home Manager.

You can also see:

- how your home’s price and mortgage amount can affect your equity

- how we work out how much your home is worth.

Where can I find My Home Manager?

My Home Manager is available to all customers using Mobile Banking. You’ll need to have the most

up-to-date version of the mobile app installed.

- Go to our mobile app.

- Tap ‘More’ in the bottom right corner of the screen or from your mortgage account screen.

If you aren’t yet registered for Mobile Banking, you can get started today. You’ll just need your phone and account details with you.

Other ways to check

Before you find out if you’re in negative equity, you’ll need to see how much of your mortgage you have left to pay.

There are a few ways to do this:

- go to Online Banking or our Mobile Banking app. Log on to your account. Choose your mortgage account. Click ‘Manage my mortgage’

- check your latest mortgage statement

- get in touch with our mortgage team.

You’ll then need to find out how much your home is worth.

You can do this by:

- asking a local estate agent

- using an online property valuation tool.

Here are a few things you can do to lower your risk of negative equity:

- Put down a bigger deposit, if you can - the more money you can put down, the more equity you’ll have in your home. This will lower your risk of going into negative equity.

- Avoid paying too much for your home – you might find this tricky depending on the market, so it helps to do some research. Have a look at similar properties in the area you’d like to buy. You might find you’re being asked to pay more than you need to. If you’re not in a chain or the seller wants a quick sale, you might be able to agree a lower price.

- Switch to a repayment mortgage – if you have an interest only mortgage, the amount you owe stays the same. This can increase your risk of falling into negative equity. Switching to a repayment mortgage means the amount left on your mortgage will go down each time you make a payment. This could lower your risk of negative equity. If you’re paying off your mortgage another way, make sure you’re on track to pay it off by the end of the term.

If you’re already in negative equity, there are some things you can do to help.

- Make overpayments – you’ll have more equity in your home if you pay off more of your mortgage. If you can afford to and you won’t be charged for doing so, you could make single or regular overpayments. If you’re on a fixed rate mortgage with us, you can overpay by up to 10% of the outstanding amount. You can do this each calendar year without paying an early repayment charge. If you’re not on a fixed rate, you can make as many overpayments as you like. Take a look at our ‘Mortgage overpayments’ page if you’re considering doing so.

- Wait and see if property prices go up – if you find yourself in negative equity, it might be best to wait. Over the long term, house prices might start to go up again. This can help to reduce your level of negative equity or bring you back to a point where you have equity again.

- Change your repayment method – if you have an interest only mortgage, changing to a repayment mortgage could help. Your monthly payment on a repayment mortgage covers both the amount you’ve borrowed and any interest. This means your mortgage balance goes down each time you make a payment. If you’re thinking about changing how you pay your mortgage, take a look at our ‘Manage your mortgage’ page.

We know that it can be worrying if you’re in negative equity. If you need to sell your home or change your deal, we’re here to help.

If you’re thinking about moving home, it’s always best to wait until you’re not in negative equity. If you move home when you’re in negative equity, you’ll need to pay back any balance that’s not covered by the money from the sale. If you’d like to talk to us about this, call us on 0800 068 6064.

We may be able to offer you a new deal if your current deal has ended or is coming to an end. If you’d like to look at changing your existing deal, take a look at our ‘Mortgage deals for existing customers’ page.

Need help?

We know that talking about your finances can be difficult, that’s why we’re here to help.

If you need support with day-to-day budgeting or you’re worried about money, we will be flexible in helping you get back on track. Look at our If finances are a struggle page if you need our support, now or in the future.