How Santander UK is funded

Santander UK primarily generates its funding and liquidity through:

- UK retail and corporate deposits; and

- its own debt programmes and facilities in the wholesale markets.

As a Prudential Regulatory Authority (PRA) regulated group, the Santander UK group is expected to satisfy the PRA liquidity and capital requirements on a standalone basis. This means we have to prove to the PRA we can withstand liquidity and capital stress tests.

Sources and uses of wholesale funding

We have a strong wholesale funding investor base, diversified across product types and geographies. Through the wholesale markets we have active relationships in many sectors including banks, other financial institutions, corporates and investment funds.

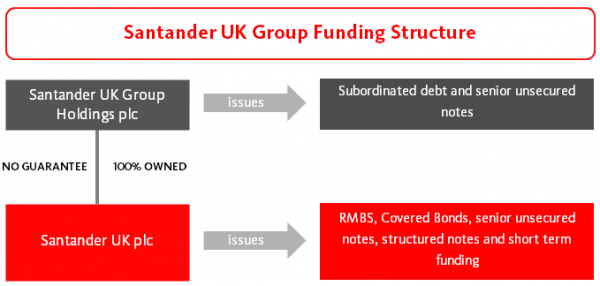

We access the wholesale funding markets through Santander UK Group Holdings plc for subordinated debt and longer dated senior unsecured debt, through Santander UK plc for shorter dated senior unsecured debt, structured notes, short term funding, Covered Bonds and through securitisations of certain assets of the Santander UK group’s operating subsidiaries.

Santander UK Group Holdings plc is the holding company of the Santander UK group. Santander UK plc is a wholly owned subsidiary of Santander UK Group Holdings plc.

Sources of short-term funding

We access short-term funding through Santander UK plc:

- GBP 20bn Certificate of Deposit Programme

- Wholesale Deposits

- commercial paper

- US$ 10bn ECP STEP Label

- US$ 20bn USCP

Santander UK plc acknowledges that the UK Money Market Code (‘the Code’) represents a set of principles generally recognised as good practice in the UK Money Markets. We confirm that we are a UK Market Participant as defined by the Code and have committed to conduct our UK Money Market activities in adherence with the principles of the Code. We have policies and procedures that accord with the Code (in so far as the content does not conflict with applicable law), they are reviewed regularly by senior management to ensure their continued relevance and effectiveness.

Contact us about short-term funding

Short-term Funding

Email ShortTermFundingFM&IR@santander.co.uk

Sources of medium to long-term funding

We access medium to long-term funding mainly through:

- Santander UK Group Holdings plc

- EMTN Programme

- US Registered Debt Shelf

- Subordinated debt - Santander UK plc

- EMTN Programme

- US Registered Debt Shelf

- Regulated Covered Bonds - Asset Securitisation

- Fosse

- Holmes

- Motor - Structured Products

- Santander UK Global Structured Solutions Programme

- Santander UK Notes and Certificates Programme

- Santander UK Structured Note and Certificate Programme

Contact us about Medium and long-term funding

Medium-term Funding

Email mtf@santander.co.uk

Structured Notes

Phone 0207 756 7002