It’s personal, secure, and easy to use

Transform the way you bank with our highly-rated mobile app.

Download our Mobile Banking app today.

We're making some changes to our Mobile Banking app. Until your app receives the update, some of the information and steps may be different. Check which version of the app you have

With Mobile Banking you can make payments on the move, manage your money, and create a budget.

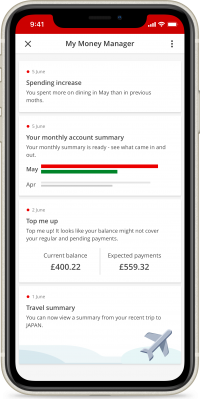

Our in-app feature My Money Manager helps you save money with free, helpful insights based on what you do in your Santander accounts. And the more you use your accounts, the more insights you’re likely to get. We’ll send messages straight to your phone or device when a new insight arrives.

Getting started

If you have Online Banking you can download our mobile banking app to your phone or device and log on with the same details.

If you aren’t yet registered for Mobile Banking, you can get started today. You’ll just need your phone and account details to hand.

Find out more

Need help?

If you’ve forgotten your Mobile Banking details or you’re locked out of your account, you can reset your details

Need help using the app? Contact us if you’ve downloaded the app and you’re having trouble signing in. Or Click on ‘Chat with Sandi’ on any of our web pages.

What you can do

Account management

You can manage your account with these handy in-app features.

- Stay on top of your spending with My Money Manager

- Enable Quick Balance to see your balance without logging on.

- Pay people you've paid before and set up new payees.

- View, cancel or set up standing orders

- View or cancel Direct Debits

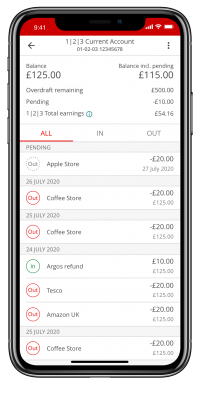

- Check your account balances and transactions, including your loan, investment and mortgage balance.

- Carry out a variety of transactions for your Santander mortgage.

- Manage your cookie settings

- Raise and track the status of your card transaction disputes

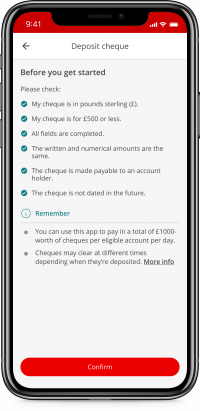

- Pay in a cheque using your mobile phone's camera

- Check out our financial support hub where you can manage an overdue amount, check out our financial health check tool and use our budget calculator

Digital features

Our tech-savvy app features are designed to help you bank with ease.

- Log on securely using Touch ID, Face ID, or Fingerprint (with compatible devices).

- Use your app to allow transactions made online and consent with third-party providers.

- Use Santander Boosts to enjoy cashback, vouchers, offers and prize draws.

- Get your questions about Mobile Banking answered using Chat with us

- You can use Chat with us whilst logged on to Mobile Banking to manage your money, such as activating a credit card or closing an account.

- Link external accounts with Open Banking in our mobile banking app.

- Get more from your home with My Home Manager.

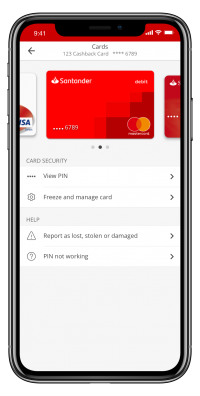

Card management

Keep on top of your cards in the app.

- Pay your Santander credit card

- Freeze and unfreeze your Mastercard to block card usage completely if it's temporarily lost.

- Block specific transaction types without freezing your Mastercard entirely. For example, you can block gambling, international, or online transactions. If you want to switch the block off once it’s on, it’ll take 48 hours to be removed.

- Report your card as lost, stolen or damaged

- View your card PIN by logging on, clicking ‘More’, then ‘Cards’ and ‘View PIN’.

- See pending transactions on your current account and credit card. These are transactions you’ve made but are yet to fully process.

- Amend your Mastercard contactless limit in chat.

- Close your credit card in chat.

Paying in cheques

Pay in cheques using your Mobile Banking app and your mobile phone's camera. Just take a photo of the cheque and submit it through your app.

How does Mobile Banking compare to Online Banking?

You have more options to take care of your cards and accounts in our mobile app. You can also sign up for My Money Manager, which looks at what you do in your Santander accounts and sends you helpful 'insights' to help you be smarter about your spend.

Take a look at our table below to see what you can do exclusively in Mobile Banking compared to Online Banking and what you can do in both.

| Features | Mobile Banking | Online Banking |

|---|---|---|

| Make payments and transfers | ||

| View, cancel or set up standing orders | ||

| View or cancel Direct Debit | ||

| View statements | ||

| Pay your credit card | ||

| Paying in a cheque | ||

| Link external accounts with Open Banking | ||

| Report your card as lost, stolen or damaged | ||

| View your PIN | ||

| Mastercard card controls (freeze/unfreeze, gambling, international, contactless and online blocks) | ||

| My Money Manager spending and insights tool | ||

| Get more from your home with My Home Manager | ||

| Update your personal details | ||

| Raise and track the status of your card transaction disputes | ||

| Check out our financial support hub where you can manage an overdue amount, check out our financial health check tool and use our budget calculator |

Get rewards to give you a little boost when you bank with us. All you need to do is sign up for Boosts through your Mobile Banking app or in Online Banking and then you’ll be able to choose the offers you like and earn rewards with your favourite retailers.

- Earn cashback when you shop online at a wide range of retailers

- Receive vouchers and coupons for discounts on a variety of products and services

- Get offers personalised to your individual interests and hobbies

- Enjoy free gifts and enter prize draws

Devices that have been jailbroken or rooted have had their security settings changed from the device standard, which can mean that they are more vulnerable to malware and fraudulent attacks. We block access to the app from these devices as an additional security measure, to help keep your details and your accounts safe.

If your device is jailbroken or rooted, you'll need to use Mobile Banking on a different device. If you don’t want to do this, you can still see your accounts by logging on to Online Banking.