We’re improving our Mobile Banking app so that we can bring you new features faster and provide a simpler, more secure and personal experience.

Over the next few months, we’ll be updating our Mobile Banking app. You’ll see a refreshed look and new things you can do in the app. You'll still be able to complete everyday tasks like checking balances and making payments.

If you’re using the existing Mobile Banking app, you’ll get the new version no matter what device or smartphone you have. We’ll let you know about the changes by email and other ways, such as in-app messages. Keep an eye out for these in case you need to do something.

Which version of the app am I on?

Using the app for the first time after the update

Can I do the same transactions in the app?

Our Mobile Banking App

We’ve had a makeover.

Personalise the app with your preferred name and welcome screen. You’ll also have shortcuts to the products you have with us.

Keep your balance private when you need to by double-tapping the Santander logo. You can also tap on your accounts to see them in more detail.

Manage your spending with your activity overview.

Move your money simply and securely with Pay and Transfer.

View your card details in the app by tapping ‘See card details’. You can see your card number, CVV number and PIN, and instantly freeze or unfreeze your cards.

Make budgeting a breeze with the Activity tracker.

Get support in the help centre by tapping ‘Help’ or jump on an instant chat with our digital assistant, Sandi.

Make the most of the new app. It starts here.

Get to know the Mobile Banking app

Watch this video to learn more about some new and coming soon features in the Mobile Banking app

Which version of the app am I on?

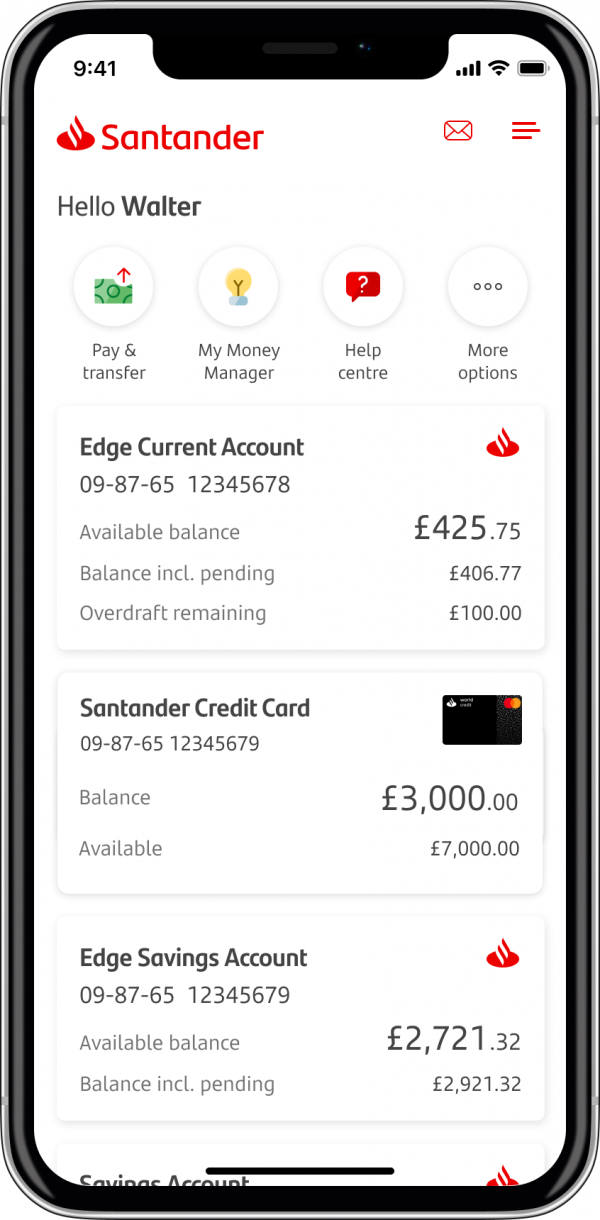

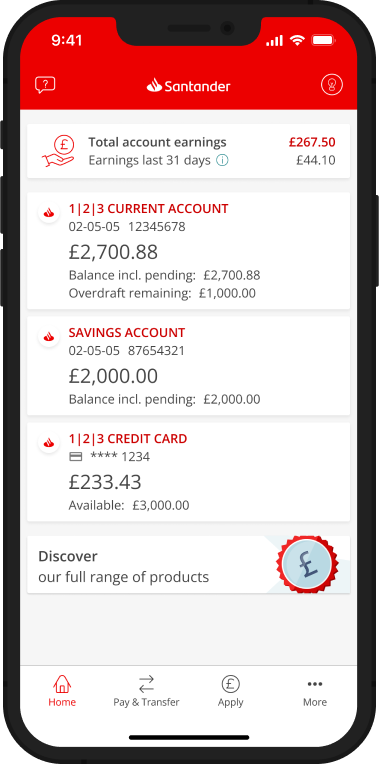

The updated app has a new welcome screen that you can customise.

When you log in, the previous version has a red banner at the top. In the updated version you’ll see a new look to the app. In the top left you’ll see the Santander logo.

You can also check which version of the app you’re on.

- Tap ‘Menu’ in the top-right corner.

- Choose ‘Important information’.

- Tap ‘About this app’.

New welcome screen

New home screen

Previous home screen

Using the app for the first time after the update

When you log on for the first time after the update, you'll need your 5-digit security number. You'll also need to have registered your mobile number for OTPs (One Time Passcodes). We recommend you check your registered email address and phone number are correct. Please have your security number ready before you update the app.

To learn how to update your OTP mobile number, please visit our One Time Passcodes page

If you don't know your security number, you can reset your details

Your Personal ID (PID) will be entered into the app for you after the update. If you need your PID to reset your details, here’s how to find your PID

Can I do the same transactions?

Yes, but not all of them right away.

What you can use right away

You can:

- check balances, and

- make payments and transfers as normal.

See our ‘Take a look at some of the features in the app’ section below to see what else you can do.

The app also has a simpler layout so you can find things easier.

Got something you need to do that you can’t do right now in this version of the app? You can still use Online Banking as normal.

What’s coming soon

Some features won’t be live in the app at the start. We’ll add more features over the next few months. This includes:

- raising and tracking disputes, and

- the ability to deposit cheques in the app for Android users.

Quick Balance feature no longer available

Instead of quick balance, you can set up alerts in Online Banking to let you know when your balance falls below an amount you choose.

If you exit the app without logging off, the app will log you out after two minutes. You can log off through the side menu at any time.

Here's some of the features in the app

Keep up to date with push notifications

Keep safe with improved fraud prevention features

Choose your preferred name and welcome screen

Add and see your accounts from other banks

Use your preferred text size

Securely view your PIN

Manage payments quickly and securely in Pay & Transfer

Verify payee details to keep your money safe

Pay your credit card quickly and easily

Do I need to do anything for the app update?

You’ll need to:

- check your mobile phone number and email address are correct

- make sure you know your security number.

Tell us what you think

We’d love to hear your thoughts about the updated app. Please give us feedback using the ‘Help us improve’ option in the app. You can find this by logging on and tapping ‘Menu’ on the home screen.

Your feedback will help us improve the app. Please let us know any thoughts you’d like to share about your Mobile Banking app experience.

Choose ‘Pay & Transfer’ in the app. This will take you to the payments hub.

- Use Pay to send money to a new person or existing payee.

- Use Transfer to move money between your own Santander accounts.

In Pay & Transfer, you can also manage your Direct Debits, standing orders, existing payees and future dated payments.

To pay money to someone:

- tap ‘Pay’

- tap on the account you want to pay money from

- tap on the payee you want to pay money to or tap ‘Add new payee’

- enter the details of the payment: amount, reference, date and payment reason, then

- check the payment details then tap ‘Authorise payment’ if everything’s correct, or ‘Change details’ if it’s not.

To make a transfer to your own account:

- tap ‘Transfer’

- tap on the account you want to transfer money from

- tap on the account you want to transfer money to

- enter the amount and date, then

- check the transfer details and tap ‘Confirm transfer’ or ‘Change details’.

We’re releasing the app update gradually, so some customers will be on the new version earlier than others. All our Mobile Banking customers will get the app update over the next few months.

To use our app, you’ll need:

- an iPhone or iPad with a minimum operating system of iOS 13 (above iPhone 6s), or

- an Android device with an operating system of at least 8.0.

You can switch on automatic updates so the app will update when a new version is available.

For iPhone or iPad:

- go to ‘Settings’

- tap on ‘App Store’, then

- turn on ‘App Updates’.

For Android devices:

- open the Google Play app

- tap on the profile icon

- tap on ‘Manage apps and device’

- tap on ‘Manage’ and choose the app you want to update

- tap on ‘More’, then

- turn on ‘Enable auto update’.

You can also manually update the app.

- On your phone, open the App Store or Google Play.

- Search for ‘Santander Mobile Banking’.

- If the status says ‘Open’ then you’re up to date. If you see ‘Update’, tap this to download the latest version. If you see a cloud icon, then you used to have the app on your phone. Tap the cloud to re-download.

Now and then we update the version of Android or iOS operating system our Mobile Banking app runs on. We’ve included information on how this might affect you below.

If you’re running an out-of-date operating system, we’ll try to send you a message in the app about updating. You can use the information below to check your operating system version and update it.

On your iPhone or iPad

What operating system will the app work on?

- iOS 13 or higher.

When was this update active from?

- July 2022 onwards.

How do I know what version of the operating system I’m using?

- In your device go to your ‘Settings’ menu.

- Tap ‘General’ then ‘About’.

- The number you see next to the ‘Version’ heading is the version of operating system your device is running.

- If the number is less than 13.0.0 you will need to update it to use Mobile Banking.

How can I update my operating system?

- From your ‘Settings’ menu tap ‘General’.

- Then ‘Software update’.

On your Android phone or tablet

What operating system will the app work on?

- Android 8 (Oreo) or above.

When was this update active from?

- July 2022 onwards.

How do I know what version of the operating system I’m using?

In your device go to your ‘Settings’ menu

- Tap ‘About phone’.

- Scroll down and tap ‘Android version’.

- The number you see is the version of operating system your device is running.

- If the number is less than 8 you’ll need to update it to use Mobile Banking.

How can I update my operating system?

- From your ‘Settings’ menu tap ‘About phone’.

- Next, tap ‘Check for updates’.

- If an update is available an ‘Update’ button will appear.

- You might also find this under ‘System and updates’ or ‘Software updates’.

What if I can’t update my operating system?

- If you don’t use an operating system of iOS 13/Android 8 (Oreo) or higher, you won’t be able to log on to the app.

- If you’re using an older device and can’t update it, you may need to use or buy a newer model.

- You can use Online Banking with the same log in details. If you can’t remember your details, visit our trouble logging on page for help.

We make these changes for your safety and security. Android and Apple release fewer security updates to older operating systems. This makes those systems potentially riskier to use. Like many other apps, to keep you safe we stop running on devices using outdated operating systems.

These updates will only affect your Santander Mobile Banking app. For more information on the Business Banking app, please visit our Business Banking Mobile Banking page.

- You can get this in the existing Mobile Banking app. Tap on the three dots in the bottom-right corner, then ‘Help and contact us’, then ‘Need help? Chat with Sandi 24/7’ at type in ‘Forgotten Personal ID’.

- You can find your Personal ID in your statements in Mobile and Online Banking. In Mobile Banking, tap on the three dots in the bottom-right corner, then ‘My details and settings’ and ‘Statements and documents’.

- Or visit our Forgotten your Personal ID page. You may have known your Personal ID as Customer ID or Customer Number.