Welcome to Santander Business Banking

We want to help your business prosper. If you’re a smaller business with up to 2 directors, owners (shareholders) or partners, please take a look at the accounts and services we offer to see how we might be able to help you.

If you’re a medium-to-large business with comprehensive banking needs, please take a look at our Corporate and Commercial Banking page.

Starting your business

Growing your business

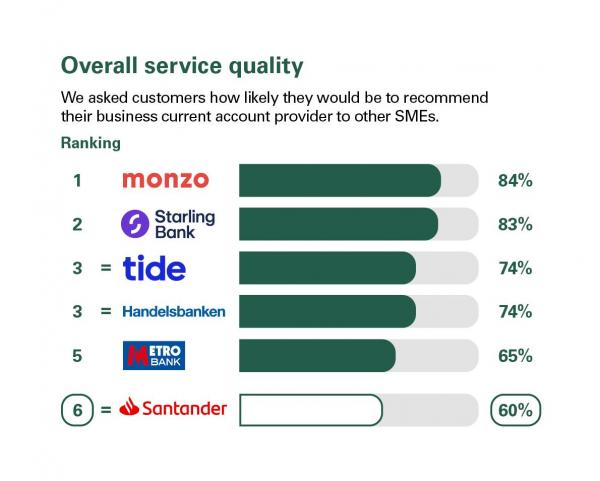

Independent service quality survey results

Business current accounts (GB)

Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 15 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*).

The results represent the view of customers who took part in the survey.

Take a look at the latest published results

Great Britain

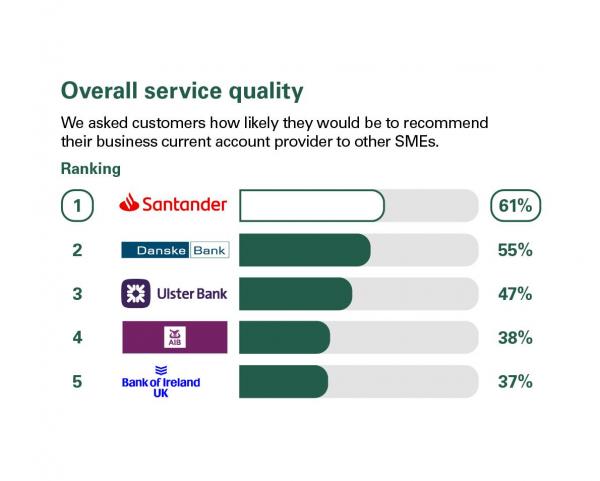

Business current accounts (NI)

Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask approximately 600 customers of each of the 5 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*).

The results represent the view of customers who took part in the survey.

Take a look at the latest published results

Northern Ireland

As part of a separate regulatory requirement, we have also published the Financial Conduct Authority service quality information for business current accounts.