Independent service quality survey results

Business current accounts – published February 2024

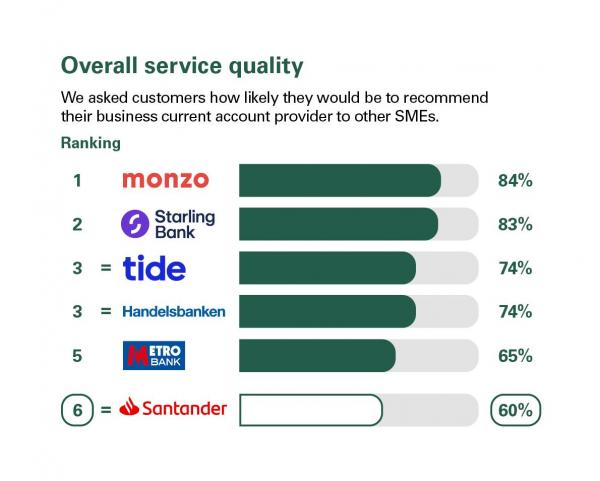

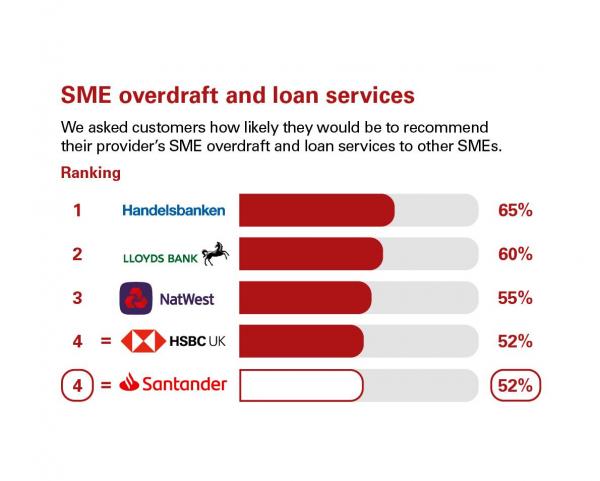

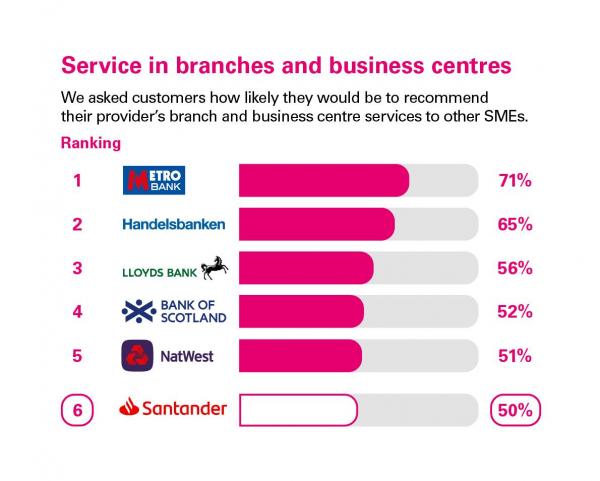

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 15 largest business current account providers if they would recommend their provider to other small and medium sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

These results are from an independent survey carried out between January 2023 and December 2023 by BVA BDRC as part of a regulatory requirement.

Santander has published this information at the request of the Competition and Markets Authority so you can compare the quality of service from business current account providers. In providing this information, we are not giving you any advice or making any recommendation to you and we can only give you information about our own products and services.

SME customers with business current accounts were asked how likely they would be to recommend their provider, their provider’s online and mobile banking services, services in branches and business centres, SME overdraft and loan services and relationship/account management services to other SMEs.

The results show the proportion of customers of each provider, among those who took part in the survey, who said they were ‘extremely likely’ or ‘very likely’ to recommend each service.

Participating providers: Bank of Scotland, Barclays, Handelsbanken, HSBC UK, Lloyds Bank, Metro Bank, Monzo, NatWest, Royal Bank of Scotland, Santander, Starling Bank, The Co-operative Bank, Tide, TSB, Virgin Money.

Approximately 1,200 customers a year are surveyed across Great Britain for each provider; results are only published where at least 100 customers have provided an eligible score for that service in the survey period.

18,000 people were surveyed in total.

Results are updated every six months, in August and February.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

Visit BVA BDRC's business banking service quality results page for more information.

Independent service quality survey results

Business current accounts – published February 2024

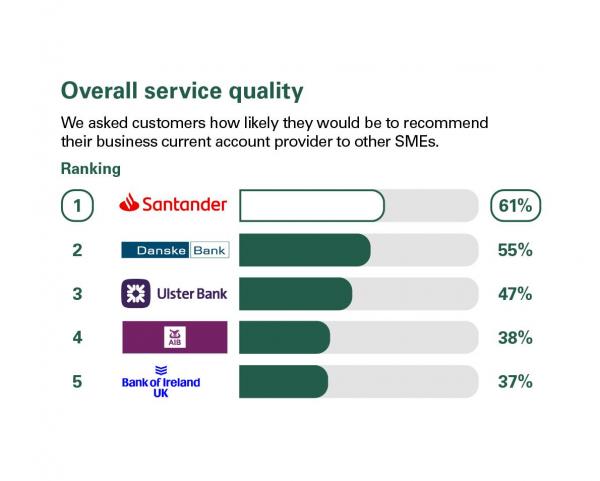

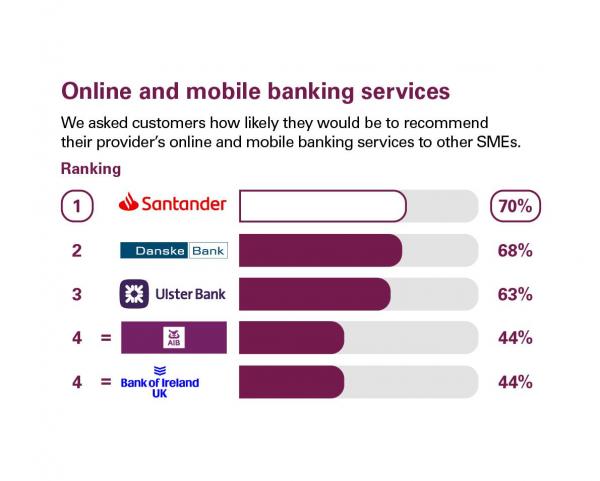

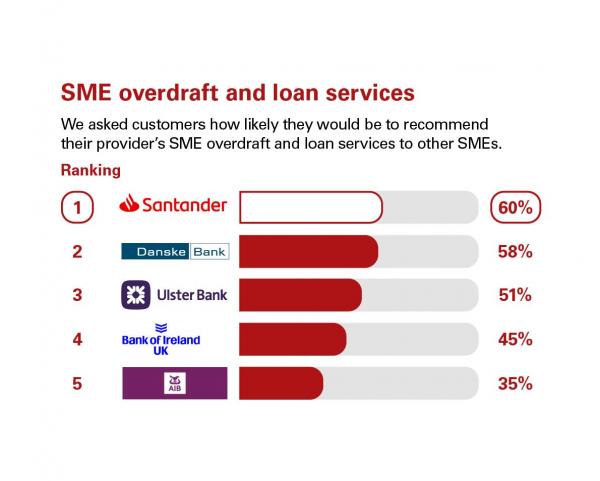

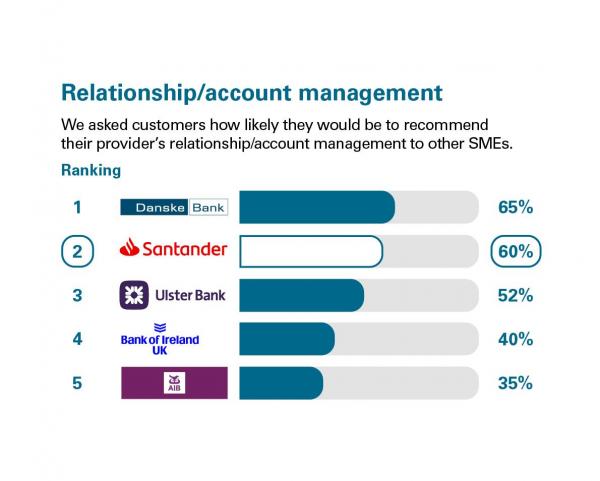

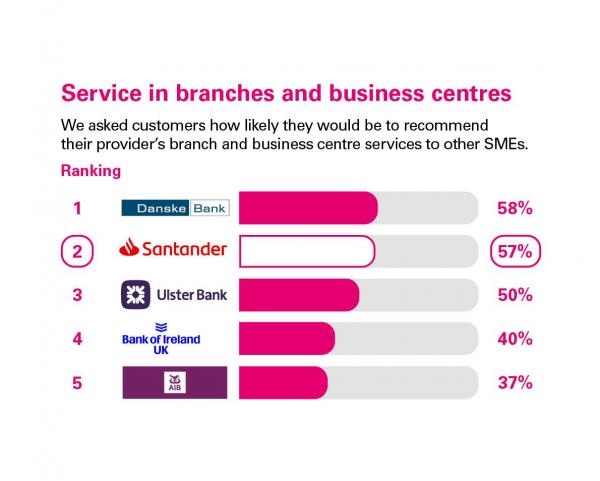

As part of a regulatory requirement, an independent survey was conducted to ask approximately 600 customers of each of the 5 largest business current account providers if they would recommend their provider to other small and medium sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

These results are from an independent survey carried out between January 2023 and December 2023 by BVA BDRC as part of a regulatory requirement.

Santander has published this information at the request of the Competition and Markets Authority so you can compare the quality of service from business current account providers. In providing this information, we are not giving you any advice or making any recommendation to you and we can only give you information about our own products and services.

SME customers with business current accounts were asked how likely they would be to recommend their provider, their provider’s online and mobile banking services, services in branches and business centres, SME overdraft and loan services and relationship/account management services to other SMEs.

The results show the proportion of customers of each provider, among those who took part in the survey, who said they were ‘extremely likely’ or ‘very likely’ to recommend each service.

Participating providers: AIB, Bank of Ireland UK, Danske Bank, Santander, Ulster Bank.

Approximately 600 customers a year are surveyed across Northern Ireland and the Republic of Ireland for each provider; results are only published where at least 100 customers have provided an eligible score for that service in the survey period.

3,000 people were surveyed in total.

Results are updated every six months, in August and February.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

Visit BVA BDRC's business banking service quality results page for more information.