Our Business Current Account comes with

Free everyday banking for start-ups for 18 months (£7.50 standard monthly fee)

Standard day-to-day banking

Access online, on the move with our Mobile Banking app, at cash machines and Post Office branches

Eligibility

- All directors, owners (shareholders) or partners are aged 18 or over and UK resident

- Up to 2 directors, owners (shareholders) or partners

- You intend to use the account for business purposes only

- Your business is registered in the UK

- You're either a sole trader or your business is a partnership, limited liability partnership or a private limited company

Arranged overdraft

(subject to status)

- 10.00% EAR (variable)

- Short term borrowing for those unexpected costs

Annual fee 1% of the agreed overdraft (minimum fee £50)

Transfer your existing Santander account to a Business Current Account with a £7.50 monthly fee

You can transfer your Santander business current account online if you’re:

- a sole trader or current partner in a partnership

- a member of a limited liability partnership

- a director of a private limited company

And:

- only your signature is required to operate the existing account on behalf of the business

- the account you want to transfer is a Business Everyday Current Account, a Business Current Account or a 1|2|3 Business Current Account

What do I need to do

If you want to transfer you’ll need to:

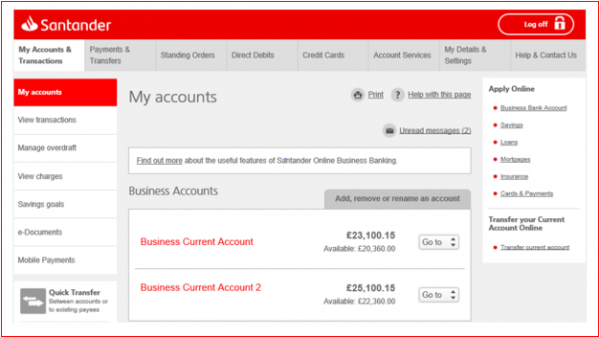

- Log on to Online Banking

- Go to ‘Apply online’ on the right hand side and click on ‘Transfer current account’

- Have your existing account details to hand

When you transfer your existing Santander business current account you’ll be able to keep your existing account number, card and PIN.

Please note: if you’re transferring from a product that is currently not on sale you will be unable to transfer back to this.

Not set up for Online Banking yet or don’t meet the eligibility criteria above?

You can transfer your account by calling us on 0330 678 2521.

Account fees and charges

Charges apply to non-standard transactions such as change-giving, CHAPS payments and foreign currency transactions. Please see the General Terms and Conditions in ‘Key documents and other account information’ for full details.

Overdraft (there are fees associated with your overdraft)

As part of your current account application, you can apply for a business overdraft from £500 to £25,000 (subject to acceptance) if:

- you have a good credit history

- you haven't been declared bankrupt

- you haven’t been a disqualified director or a director of a failed business within the last 6 years and

- neither you, nor any of the directors, owners (shareholders) or partners, have had an Individual Voluntary Arrangement.

Overdraft interest rates and fees

| Interest and charges | |

|---|---|

| Arranged overdraft annual fee | 1% of agreed overdraft (minimum fee £50) |

| Arranged overdraft interest rate | 10.00% EAR (variable) |

| Unarranged overdraft interest rate | No interest |

| Unpaid item fee | No fee |

| Paid item fee | No fee |

Overdrafts depend on your circumstances and you must repay any overdraft when we ask, in line with our General Terms and Conditions.

Other borrowing options are available.

We’ll let you know at least 30 days before we debit your annual renewal fee and at least 14 days before we debit your monthly charges and interest.

Please see our Overdraft page for full details.

Everything you need to know before you apply

We recommend reading the information in the documents below before you apply. You may want to save or print them so you can refer to them in the future.

Key documents

To view these documents you may need to download Adobe Reader

Ways to bank with us

24/7 banking on all your devices. You can set up paper free statements and set up personalised account alerts.

- Online Banking

- Mobile banking app

- Face-to-face banking at Post Office branches

- Telephone Banking

- Use our ATMs to withdraw cash, make cash and cheque deposits, check your balance and manage your PIN (all transactions subject to account limits)

Account alerts

You'll automatically receive text alerts when:

- your account makes or may make use of an unarranged overdraft

- you have regular payments due on your account for which you have insufficient funds to cover, we will ask you to pay into your account to ensure these payments are made

- where a payment is refused as you don’t have enough funds.

You can register to receive an alert when:

- your account makes use of an arranged overdraft.

If we don’t have a valid mobile number for you, we might not be able to reach you.

You can also register for other account alerts to help you to stay on top of your finances. For example, alerts to inform you when your balance has fallen below a set limit, or you have had a deposit into your account greater than a set amount. For more information visit Account alerts. You can manage your alerts settings at any time with Online Banking. Alternatively you can contact us

Checklist – what you’ll need to open an account

Participating providers of UK business bank accounts have agreed to a basic set of information that they'll need from you to set up your UK business current account. Find out what you'll need to provide using the simple business account checklist from UK Finance, the UK's leading trade association for financial services. This is only a standard checklist, so you may have to provide additional information while completing our application form.

Have you got everything you need?

To make your application journey as easy as possible we’ve created a checklist so you have all the information required to hand including your personal identity and existence of your business. Check you’ve got the right information you’ll need (143 KB)

Payment Service Providers

If you are or have applied to become a Payment Institution (API, SPI), E-money Institution (EMI, SEMI), Payment Initiation Service Provider (PISP), or Account Information Service Provider (AISP), please go to the Payment Service Provider page for information about accounts available.

Security

Keep your banking details private and secure.

For more information about our approach to security as well as more useful information to help you stop the threat of fraud visit our Security Centre

Business Banking Awards

This account also comes with

£500 cash withdrawal per day

Online and Mobile Banking with text and email alerts

Subject to availability and may be withdrawn without notice at any time.

Information is correct as of 29 February 2024.