Looking to make new global contacts?

Our experienced team can call on local expertise almost anywhere in the world. They can help you connect to the people you need to know, wherever you want to do business.

Santander Navigator

We'll help you to identify growth opportunities in new markets through our market deep dives and connect you to the experts you need. We can also support you to upskill your team with a range of insights and events. Plus, much more.

Build deeper relationships

Your relationship team will work with you to understand what dynamics are driving your business. They’ll help you explore future opportunities and realise your ambitions.

Support when your business needs it

Are you concerned about how rising costs could affect your business? We want to support you and your business. That’s why we’ve developed a range of tools, tips and best practice.

Take your next step with our sector specialists

We understand the complexity and evolving needs of businesses across a wide range of industries. Our team of experts are on-hand to help turn your dreams into reality.

Bank of England base rate change

On Thursday 3 August 2023 the Bank of England base rate increased from 5.00% to 5.25%.

Connecting Delta Global to a world of opportunity

Delta Global are specialists in luxury packaging. At their core, they're passionate about offering bespoke solutions to suit each client. They believe luxury packaging is about more than just the end use.

Making the most of Santander Navigator, Delta Global have access to pre-qualified, high-quality providers. We saved them time finding the right people to speak to in large and complex markets. They use this time to focus on their business and its future.

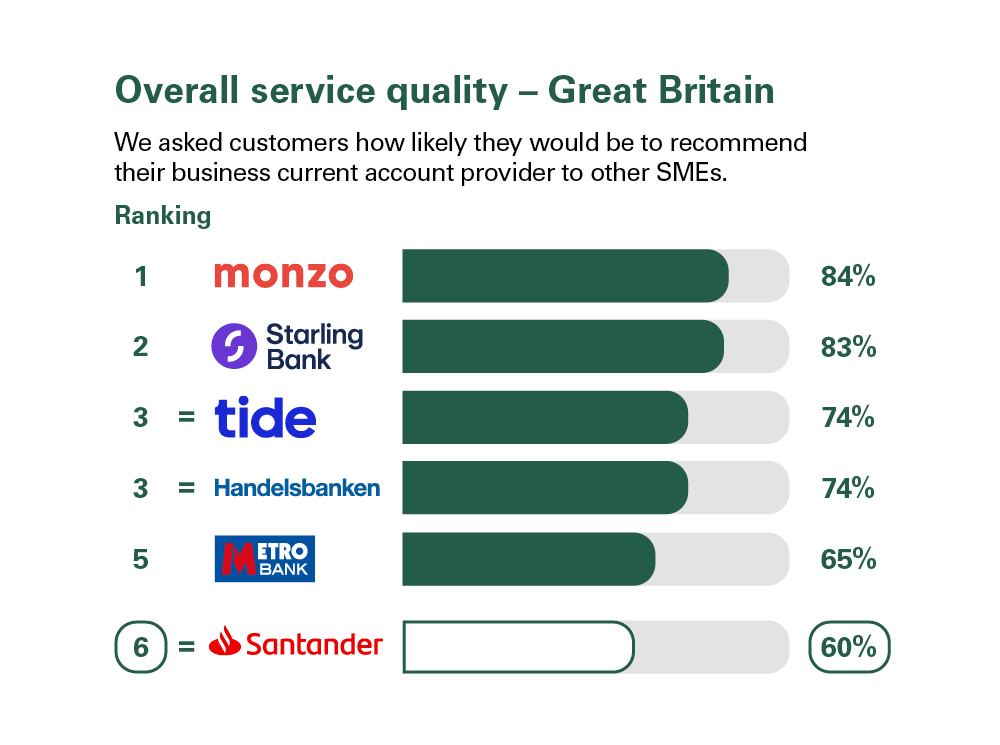

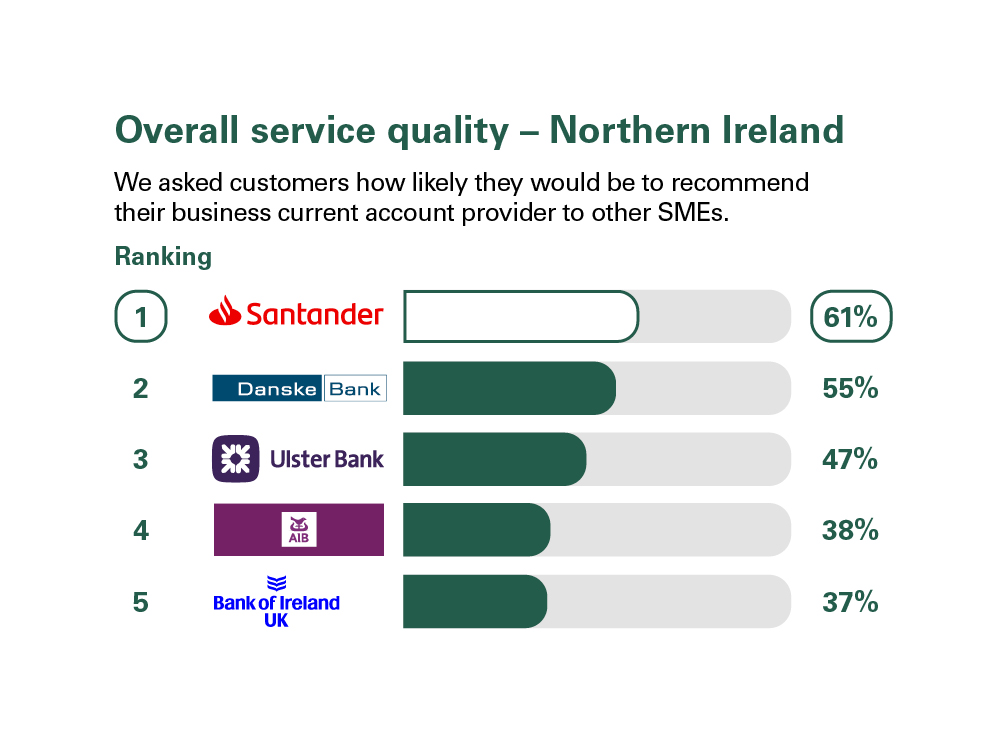

Independent service quality survey results

Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask customers (approximately 1,200 in Great Britain and approximately 600 in Northern Ireland of each of the largest business current account providers (15 in Great Britain and 5 in Northern Ireland) if they would recommend their provider to other small and medium-sized enterprises (SMEs).

The results represent the view of customers who took part in the survey.